Ghana to struggle with debt service burden in 2023

Ghana, along with six other African countries will struggle with debt service burden in 2023, says the Economist Intelligence Unit (EIU).

According to the EIU, debt service payments burden will consume a substantial share of tax revenue in 2023.

Per the report, Tunisia, Egypt, Congo-Brazzaville, Zambia, Zimbabwe and Mozambique are the other six countries anticipated to struggle with debt service burden next year.

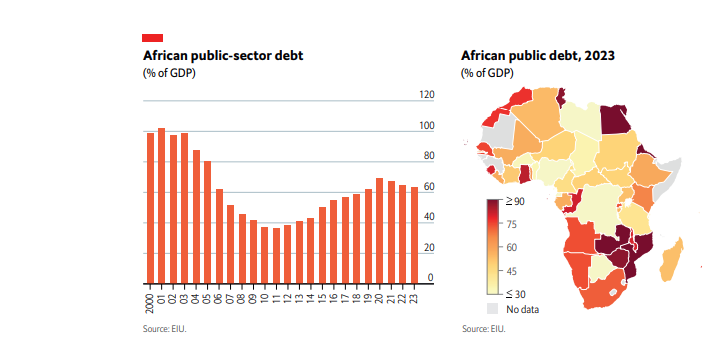

In its Africa Outlook 2023 Report, the EIU said the public-sector debt/GDP ratio will remain above 60% for Africa in 2022 and 2023 and some African countries will far exceed this level.

“The need to service and roll over large amounts of debt at a time when domestic and international borrowing costs are on the rise will weigh heavily on some countries in 2023 and things could get even more painful in 2024 when more capital repayments fall due”, it mentioned.

“African governments have ramped up their borrowing—domestically and internationally — and public sector debt ratios (relative to GDP) have pushed back towards the highs, last seen in the early 2000s just before the enormous debt restructuring of 2005, implemented under the umbrella of the heavily indebted poor countries (HIPC) initiative”, it added.

The EIU also said more African states will head towards external debt distress in 2023 and 2024.

“African states are required to repay about US$75bn of external borrowing (medium- and long-term capital repayments that fall due) in 2023 and a similar amount in 2024. Foreign creditors have offered pandemic-related debt relief and relatively low—by historical standards—interest rates in recent years, but these lines of international financial support have come to an end”.

It further said the debt-servicing burden will become more painful because of higher interest rates, weaker currencies against the US dollar and softer capital inflows, while rolling over existing debt or accruing new debt will become much more of a challenge.

Already, it added many African states have found it difficult to issue new Eurobonds in 2022 and yields in secondary markets—which indicate where future refinancing costs are headed—have risen sharply.

“A widespread external debt crisis across the continent seems unlikely, but some highly leveraged states will face acute financing difficulties and a very uncertain period”, it noted.

Government suspends payments of external debts

Meanwhile, Ghana’s Finance Chief Ken Ofori-Atta, has announced the suspension of payment on selected external debts including payment on Ghana’s Eurobonds, commercial term loans, and bilateral debt.

The decision by the Finance Ministry to suspend payments of the country’s external debts, it notes in a statement issued on Monday, December 1, 2022, forms part of “additional emergency measures necessary to prevent a further deterioration in the economic, financial, and social situation in Ghana.”

“This suspension will include the payments on: our Eurobonds; our commercial term loans; and on most of our bilateral debt. This suspension will not include the payments of our multilateral debt, new debts (whether multilateral or otherwise) contracted after 19 December 2022 or debts related to certain short term trade facilities.

“We are also evaluating certain specific debts related to projects with the highest socio-economic impact for Ghana which may have to be excluded. This suspension is an interim emergency measure pending future agreements with all relevant creditors,” read parts of the statement.

“As it stands, our financial resources, including the Bank of Ghana’s international reserves, are limited and need to be preserved at this critical juncture,” it added.