Interest on fixed deposits dropped to an eight-year low on bankers’ reduced appetite for savings following a slowdown in demand for loans.

The Central Bank of Kenya (CBK) data shows that the deposit rate dropped to 6.3 per cent last December from 7.1 per cent in December 2019.

This is the lowest level since February 2013

The fall is linked to a rise in deposits from wealthy investors and firms in a year when restrictions imposed to curb the spread of Covid-19 reduced investments opportunities that also cut demand for loans.

The falling returns on savings is a blow to high net worth investors and cash-rich firms who last year opted to hold onto cash, leading to a pile-up in bank accounts.

“Generally a decrease in the rate shows decreased appetite for the banks to mobilise funding for onward lending,” said Habil Olaka, the chief executive officer of Kenya Bankers Association.

“When demand for loans is not high, banks prefer not to keep deposits that they are not going to lend, but when loan uptake improves, the ripple effect is that banks will offer more returns for savings.”

The bulk of savings accounts do not earn interest because most banks have set a threshold below which they take the deposits for free.

Interest rate on the savings dropped to a five-year low in December to 2.7 percent from 4.25 percent in January last year. This is a sharp contrast to 2018 when interest on savings accounts averaged 6.37 percent.

Banks have been taking a cautious approach to extending fresh credit in an environment where companies and individuals sought moratorium on their loans in the wake of the public health crisis.

Businesses cut down on their activities in response to the infectious disease, leading to job cuts and unpaid leave for retained staff as profitable firms move into losses.

This has seen workers who had tapped mortgages and unsecured loans for purchase of goods such as furniture and cars and expenses like school fees default.

Unsecured loans are given on the strength of one’s salary. Firms that had borrowed based on the forecast of cash flows have also been struggling to repay their bank loans.

As result, banks have gone slow on lending, reducing the scramble for deposits that put pressure on interest they paid on savings.

This came as rich individuals and big companies, seeking a safe haven for their wealth, last year stockpiled billions of shillings.

CBK data shows that deposits increased by Sh467.5 billion last year while net lending rose Sh223.4 billion.

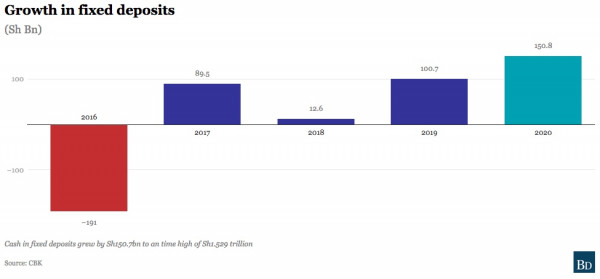

Fixed deposits rose by Sh150 billion to a record Sh1.53 trillion, the highest jump since 1995 when data on savings are available.

This is an indication that the wealthy are protecting their value rather than seeking new areas in which to invest their fortunes.

The jump in deposits emerged after Kenya announced its first Covid-19 cases and imposed tough restrictions, including a dusk-to-dawn curfew.

Demand at home and in export markets slumped as consumers stayed indoors to avoid catching the virus and because of government containment measures, forcing firms and the rich to freeze investments plans.

Low returns from a bearish stock market and a slump in real estate have also seen the rich opt to keep cash in banks and tap the interest returns, which hit a peak of 8.26 percent in January 2018.

“Most business are still operating at around 40 percent of their pre-Covid-19 levels. If the hospitality and transport industries get their vibe back, the demand for loans will increase and the ripple effect is an increase in the deposits and the savings rate offered by banks to entice the public for onward lending,” says Ken Gichinga, the chief economist at Mentoria Economics.