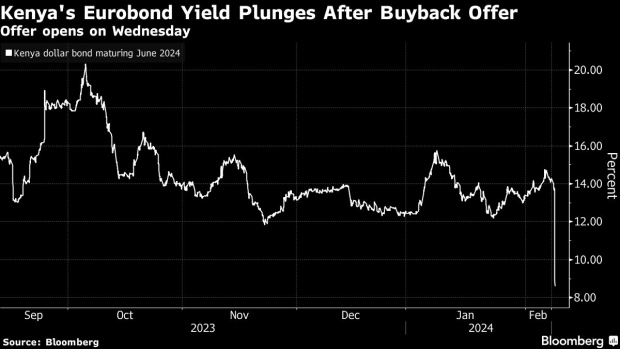

Kenya opens tender offer for maturing Eurobonds; yields plummet

Kenya’s eurobonds maturing in June surged after the East African nation offered to buy back its $2 billion of debt and announced plans to sell new securities.

The maximum amount that the government will repurchase will be determined by how much it raises in an offering of new securities that will be priced on Feb. 12, according to a statement issued by the government. The buyback offer — which is at par value and includes payment of accrued interest — closes on Feb. 14, it said.

The yield on the 2024 debt plunged to 10.34% by 4:30 p.m. in London from 15.79% on Tuesday.

Kenya’s efforts to raise funding for the looming eurobond maturity have been a focal point for investors concerned that elevated food- and energy-import bills and limited foreign-exchange reserves will restrict its ability to repay the debt. The East African nation’s buyback offer follows announcements by Ivory Coast last month and Benin this week of new eurobond offerings, after sub-Saharan African nations were largely shut out of international capital markets last year.

“Clearly US treasuries dropping from 5% to 4% is the biggest factor,” while the International Monetary Fund deserves credit too, said Charlie Robertson, head of macro strategy at FIM Partners UK Ltd. in London. “They have backstopped countries ranging from Argentina to Kenya and Pakistan and that has given the market the reassurance it needed that the problems in Ethiopia, Ghana, Sri Lanka and Zambia won’t spread.”

Kenya’s government mandated Citigroup Global Markets and Standard Bank of South Africa as joint bookrunners to arrange a series of investor calls, following which a seven-year dollar-bond will be issued subject to market conditions, according to a person familiar with the matter. Kenyan National Treasury Principal Secretary Chris Kiptoo declined to comment.

Ivory Coast last month sold $2.6 billion through two bonds, after receiving more than $8 billion in combined demand. Benin raised $750 million in its debut dollar-bond offering after attracting $5 billion of demand.

“The market has demonstrated strong demand for emerging-market issuance in recent days, with Benin’s successful issuance demonstrating strong appetite for single B names,” said Yvette Babb, currency portfolio manager at William Blair. “It seems timely for Kenya to seek to issue given the market conditions. The tender offer shown by Kenya offers generous terms, which is likely to encourage participation.”

Kenya has been exploring a range of options to handle the eurobond bullet payment due on June 24, raising funding from the International Monetary Fund, the World Bank and syndicated loans. Kenyan President William Ruto signaled last month that his government was considering tapping capital markets to help fund the repayment of the eurobond.

The nation’s reserves stood at about $7.1 billion dollar on Feb. 1, sufficient to cover 3.81 months of imports.

“It’s good to get some market financing as part of the mix, as it shows that the market is there for them,” said Kieran Curtis, director of investment at Abrdn.