Kenya set to keep rates on hold as inflation cools, shilling rallies

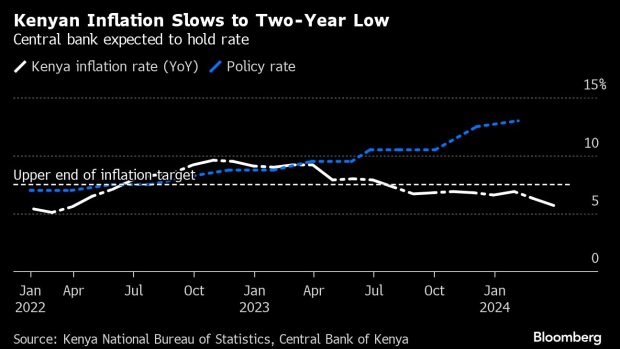

Kenya is likely to leave the benchmark interest rate unchanged at a 12-year high on Wednesday, giving more time for inflationary pressures to ease before it loosens up on its steepest tightening cycle in more than a decade.

Economists expect the monetary policy committee to hold the key rate at 13% and signal the way for cuts if inflation continues to soften.

Governor Kamau Thugge has said he wants price growth to cool to the 5% midpoint of the bank’s target range and that the MPC “will be keenly looking at the performance of inflation and the exchange rate” to guide them on “whether we relax monetary policy.” Last month inflation slowed to 5.7% from 6.3% in February, helped by a rally in the Kenyan shilling.

The currency has gained about 24% against the dollar since the MPC’s Feb. 6 meeting, making it the best performing currency in the world of those tracked by Bloomberg, The surge has been driven by a mix of factors, including the partial roll over of a $2 billion eurobond maturing in June and two successive interest-rate hikes in December and February of a combined 250 basis points.

The stronger currency and improved weather conditions will assist in cooling inflation further over the year to 4.4% by end December, which Absa Group Ltd. economists led by Ridle Markus expect will convince the MPC to maintain the key rate.

The central bank will probably only start lowering rates in the fourth quarter “when we expect a 150 basis point rate cut,” said Sthembiso Nkalanga at JPMorgan Chase & Co.

The MPC will also be cautious about decreasing rates as foreign-exchange reserves stood at $7.09 billion as at end-March and have been below the critical level of four months’ import cover since August last year.

Also, Kenya still needs to settle the balance of $557 million on the June 2024 eurobond.