Kenya stock bulls still rare as investors resist low valuations

Kenyan stocks are finding it hard to shake off their unwanted status as the world’s worst performers this year.

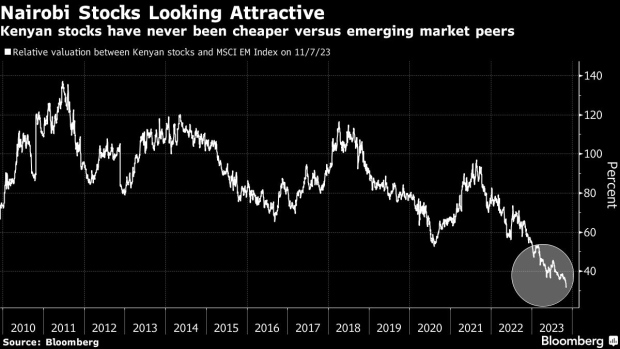

Nairobi’s all-share index has slumped 32% in 2023, the most among 92 global benchmarks Bloomberg tracks. That’s made the stocks the cheapest they’ve ever been compared with broader emerging markets. Yet, there are few takers.

Fund managers cite a list of concerns keeping them from increasing equity holdings. Foreigners are discouraged by the local shilling’s 19% decline this year amid concerns over how Kenya will fund the repayment of a $2 billion bond due in June. That’s been accompanied by delays in obtaining dollars to repatriate capital. Instead, investors are keeping their money in local Treasury bills paying the highest returns in eight years.

“The valuations are good, the only thing is that — at least for the short-term — we’re seeing competing assets,” said Barack Obatsa, chief executive officer at Nairobi-based Britam Asset Managers.

He’s referring to yields on 364-day and 182-day government debt above 15%, near the highest since November 2015. The rate on 91-day paper is similar, the most since Bloomberg started tracking it in 2012. Rates have been driven up by inflation — at a three-month high of 6.9% in October — and by investors demanding higher yields as the government seeks to cover rising debt obligations.

The equity market’s concentration in a few big names is another drawback. Telecoms giant Safaricom Plc accounts for 41% of the index, but has lost almost half its value this year.

Safaricom “was previously the darling of offshore investors due to its success with mobile money,” said Cavan Osborne, Cape Town-based manager of the $240 million Old Mutual African Frontiers Fund. That has changed largely because of declining revenue from mobile money and voice services along with the risks associated with Safaricom’s push into Ethiopia, he said.

The fund doesn’t currently plan to add to its main Kenya holdings of Safaricom and Equity Group Holdings Plc, Osborne said.

Stocks in Nairobi trade at about 3.6 times estimated earnings for 2024. That compares with 7.3 times for Nigeria’s benchmark gauge, 9.4 times for Johannesburg stocks and 8.8 times for MSCI Inc.’s index of frontier emerging markets.

Given those enticing valuations, the market’s miserable performance is a source of frustration for those in charge at the bourse. Nairobi Securities Exchange Plc Chief Executive Officer Geoffrey Odundo says investors are missing an “incredibly attractive” opportunity.

“When I look at this market — and I am talking from my experience as a fund manager — these are extremely good entry points,” Odundo said in an interview. “These are historical low prices.”

Foreign net outflows from Kenyan stocks have at least slowed, to 1.18 billion shillings ($7.76 million) in the third quarter from 1.48 billion shillings in the previous three months, figures from the markets regulator show. Foreigners accounted for 47% of trading, up from 45%.

In a rapidly evolving cryptocurrency landscape, Bitcoin’s price is surging toward the $49,000 level as analysts predict that the U.S. Securities and Exchange Commission (SEC) may soon approve spot Bitcoin exchange-traded funds