Kenya’s Ruto caught between street protests and the IMF

The anti-tax protests that roiled Kenya this week had an unexpected enemy: the International Monetary Fund.

“Kenya is not IMF’s lab rat,” read one sign in Nairobi’s central business district. Another used an unprintable epithet.

Kenyan President William Ruto has spent his first two years in office ramming through a slew of unpopular taxes — on everything from gasoline to wheelchair tires, bread to sanitary pads — thrilling international investors and the IMF, which has long urged Kenya to double its revenue collections to address its heavy debt burden. But this week, the low rumbling of discontent among Kenyans squeezed by a cost of living crisis and Ruto’s levies exploded onto the streets, with thousands of mostly young people protesting in a dozen cities across the country.

There’s a widespread feeling that “the administration has surrendered to the IMF and World Bank and ignored the feelings of the people,” said Macharia Munene, a professor of history and international relations at the United States International University in Nairobi. “They need to go back to the drawing board.”

Kenya isn’t the only country to witness such demonstrations. Last year, Pakistan saw protests triggered by IMF-recommended austerity measures, while decades ago Indonesia was wracked by street violence and looting as the government pushed through the lender’s plan.

A spokesperson for the IMF didn’t respond to a request for comment.

On Tuesday, lawmakers will hold a final vote on Ruto’s 2024 Finance Bill, which includes the kind of ambitious revenue targets that has won the president plaudits from the likes of Kristalina Georgieva, managing director of the IMF, which has put the government under pressure to enact painful fiscal reforms to unlock funding beyond a 2021 bailout. Markets have rewarded tough decisions such as the government’s refinancing of dollar bonds at high rates.

But now he will face a choice — between the IMF and the streets. He has so far repeatedly chosen the fiscal fixes the IMF says are essential to right a struggling economy but his administration seems rattled by Kenya’s majority young population — which has nicknamed the president “Zakayo,” Swahili for the biblical chief tax-collector Zacchaeus — finding their voice this week.

Young & Fearless

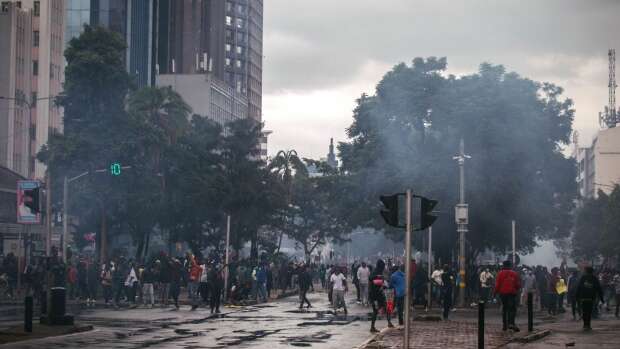

Anti-government protesters — mostly young, many jobless — poured onto the streets last Tuesday and Thursday carrying pocket-sized copies of the nation’s constitution, waving placards and live streaming on their phones as police waged a brutal crackdown involving water cannons, tear gas and firing live bullets.

The first protest on Tuesday caught most of the country by surprise, and the government reacted quickly by pledging to withdraw the taxes on locally made sanitary pads and other items. Two days later, as larger demonstrations spread and police sealed off the national assembly, Kenya’s National Treasury warned that not approving the taxes risks creating a 200 billion shilling ($1.6 billion) hole in the budget and Ruto’s ruling party lawmakers overwhelmingly voted to keep the controversial levies in the bill.

“We should not subject ourselves to the pressures that are being implemented by the IMF on funding conditions that they are giving to this country,” opposition lawmaker Nyakerario Mayaka said in the national assembly on Thursday.

In exchange for a bailout program agreed with the IMF in 2021, Kenya committed to economic reforms that included increasing revenue collection to 25% of gross domestic product, slashing debt and cutting wastage. When he took office in September 2022, Ruto set about implementing the kind of painful reforms that the IMF and his government say will set the country’s economy on a better course.

Looking at macroeconomic trends and global sentiments, Ruto seems to be doing something right. The Kenyan shilling is the best performing currency in the world this year, having gained 21.4% against the US dollar since the beginning of the year.

The benchmark index of the Nairobi Stock Exchange has the best returns so far this year in dollar terms after Argentina among 92 primary gauges tracked by Bloomberg. The NSE All Share index has a return of 49.6%.

Kenya in February tapped international debt markets after years of being priced out of them. It repurchased $1.44 billion of its $2 billion eurobonds due Monday, via issuance of new dollar bonds priced at a coupon of 9.75%, easing investor concerns on how it would settle the bullet maturity.

Kenyan local currency bonds are also offering high returns to investors, with a two-year bond yielding 17.12%, according to the central bank.

The economy is forecast to grow 5.7% this year despite deadly floods that killed almost 300 people, according to the central bank. That compares to 1.3% for South Africa and 3.2% for Nigeria, according to the African development Bank.

“The macros look good but this hasn’t translated in people’s pockets,” said Joy Kiiru, a lecturer at the University of Nairobi’s School of Economics. “The young people who are a majority still don’t have jobs, incomes are very low and there’s no welfare state.”