Aramco sale set to raise at least $11.2 billion for Saudi Arabia

Saudi Aramco’s mega stock offering is set to raise at least $11.2 billion, the biggest such deal globally in three years that will help fund the government’s multitrillion-dollar push to transform the kingdom’s economy.

The government is expected to sell almost 1.55 billion shares for 27.25 Saudi riyals ($7.27) apiece, people familiar with the matter said, asking not to be identified because the information wasn’t public yet. That’s a 6% discount to the stock’s last close before the deal was announced of 29 riyals.

Saudi Arabia had demand for all shares in a few hours after the books opened Sunday and the deal attracted significant interest from foreign investors, Bloomberg News reported Thursday. It wasn’t immediately clear exactly how much demand came from overseas, but those investors put in enough bids to more than fully cover the offering, people familiar with the matter said.

A representative for Aramco didn’t immediately respond to a request for comment on the price, which was reported earlier by the Wall Street Journal.

It’s a turnaround from the firm’s initial public offering in 2019, when global funds had largely stayed away and left the government reliant on local investors. That had put the spotlight on foreign participation in the current sale, even as the oil market outlook darkens amid strong supply and demand concerns in China.

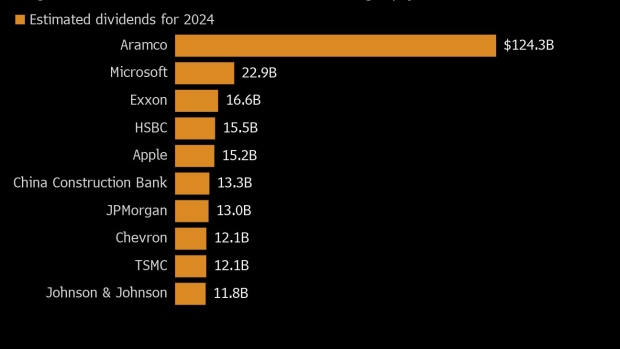

A top selling point this time around is Aramco’s $124 billion annual dividend, the world’s biggest. The company’s stock, however, is expensive compared with major Western oil companies.

Aramco’s shares closed at 28.30 riyals on Thursday, down 2.4% for the week. They fell to the lowest in over a year in the days leading up to the offer, which is set to be the biggest since Rivian Automotive Inc’s 2021 listing.

Secondary offerings are relatively rare in the region. Prior deals in the kingdom include Saudi Telecom Co. and Tadawul Group Holding, which operates Riyadh’s stock exchange. Both sales priced at a roughly 10% discount.

The Saudi government is selling stock in the state oil behemoth to raise funds for ambitious plans by Crown Prince Mohammed bin Salman to revamp the country’s economy. The massive spending plans mean the government needs oil at near $100 a barrel, according to the International Monetary Fund.

Oil prices, which haven’t been near those levels since late 2022, slid in recent days to below $80. The Organization of Petroleum Exporting Countries and its allies earlier this month agreed to extend some of their supply cuts into 2025, but also laid out a framework to gradually return some of the voluntary cutbacks starting in October.

The Saudi government owns about 82% of Aramco, while the Public Investment Fund holds a further 16% stake. The kingdom will continue to be the main shareholder after the offering.

SNB Capital is lead manager of the share sale, according to a previous statement. It is also serving as a joint global coordinator along with Citigroup Inc., Goldman Sachs Group Inc., HSBC Holdings Plc, JPMorgan Chase & Co., Bank of America Corp. and Morgan Stanley. M. Klein & Co. and Moelis & Co. are independent financial advisers on the offering, according to the statement.