- LemFi Acquires fintech Pillar, to Launch Credit Cards for Immigrants

LemFi, an international payment services startup based in London, has acquired Pillar, a UK-based fintech focused on credit access for immigrants, in a strategic move that will transform financial services for immigrants. This acquisition paves the way for LemFi to launch specialised credit cards designed especially for immigrant communities, addressing one of their most persistent barriers to financial inclusion in the UK.

In 2022, Pillar raised £13M ($16.9M) in pre-seed to develop a platform for immigrants to access credit products when they move to a new country. LemFi will inherit this tech as part of the acquisition, becoming the first major remittance platform to offer credit as a core product. The deal, already approved by the FCA, also sees Pillar’s co-founders and Revolut alumni Ashutosh Bhatt and Adam Lewis join the LemFi team.

Breaking Down Financial Barriers

The acquisition comes at a time when immigrants in the UK face significant challenges in building credit histories and accessing financial services. According to research, only 1 in 10 immigrants believes access to credit has not become harder in the current economic climate. At the same time, banking exclusion reports estimate 13% for migrants versus just 3% for the general UK population.

LemFi’s vision is captured by this statement on its website: “We are reshaping the future of how immigrants move their money globally.” In the UK alone, net migration exceeded 700,000 people in 2022. The statement highlights the company’s mission to serve the world’s growing immigrant population.

The Credit Invisibility Problem

A familiar feeling for many immigrants, moving into a new country, is being “Credit Invisible”. Regardless of their previous or prospective financial profile, their credit history does not follow them into their new country.

In the UK, approximately 5 million “credit invisible” individuals struggle to access mainstream financial services. Immigrants, especially from the world’s emerging markets, pay the cost of inequitable access as a result of the unique challenges they face:

- Lack of UK credit history upon arrival.

- Limited recognition of credit histories from their home countries.

- Documentation issues related to immigration status.

- Language barriers and a lack of information about the UK banking system

Ashutosh’s experience, moving to the UK, mirrors this. “I couldn’t access any of the everyday [financial] products I had in India. Despite arriving and earning a good salary at Barclays, I couldn’t even get an iPhone!” While there have been slight improvements, the problem’s core remains. “Immigrants are always dealt a bad hand, especially if they’re coming from emerging markets – we need equitable access to credit for everyone. When the world is busy building an interplanetary life, we still can’t offer a bank account or credit card to someone from another country! He concludes, “With Pillar, LemFi will increase its reach by 10X and build truly global access to credit.”

A Full-Stack Financial Services Future

The acquisition is a natural progression in LemFi’s growth strategy. Ridwan Olalere, LemFi co-founder and CEO, says, “We have long stated our vision of building a full-stack financial service for immigrants everywhere.

Credit marks the next frontier for us in this journey. Rian and I are particularly pleased that Adam and Ash have agreed to join us in building it.”

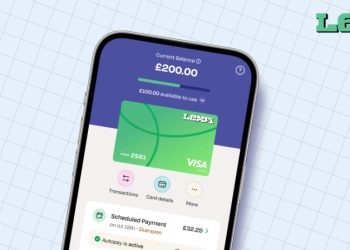

“Through LemFi Credit, we already provide our existing customers with the ability to grow their credit right within the LemFi app”, Ridwan continues “With this acquisition, we plan to offer Credit Cards to customers, starting with the United Kingdom.”

Within six weeks of launching, the Lemfi Credit service had over 8,000 users in private beta testing. It has maintained an 18% average week-on-week growth. Customers can get up to £300, £700, or £1000 based on their credit profile. They get a Virtual Card to spend online; customers can add the card to their Apple Pay or Google Pay wallets for ease of use.

“LemFi is already the go-to remittance service for customers sending money to over 30 countries in Asia, Africa and Latin America. We invite our customers and partners to grow with us as we build on our existing financial service offerings to scale LemFi into a fintech giant. ” Ridwan concludes.

How LemFi’s Credit Cards Could Change the Game

The market opportunity for immigrant-focused financial services in the UK is substantial, as Net migration continues to grow Post-Pandemic. Industry analysts estimate that addressing the financial inclusion gap for immigrants could unlock billions in economic value for the individuals gaining access to fair credit and the broader UK economy.

The anticipated LemFi credit cards for immigrants will leverage Pillar’s technology to:

- Recognise international credit histories: Allowing immigrants to “import” their credit standing from their home countries.

- Provide alternative credit assessment: Using non-traditional data points to evaluate creditworthiness.

- Offer graduated credit building: Starting with secured or limited-line products that grow with the customer.

- Integrate with remittance services: Combining Lemfi’s core cross-border payment capabilities with credit building.

For the millions of immigrants in the UK struggling to build credit histories, the development could represent a significant step toward equitable access to quality financial services and opportunities.

Since its founding, LemFi has supported over 2 million customers in the United States, the United Kingdom, Canada, and Europe. In January 2025, LemFi secured $53 million in Series B funding, bringing its total funding to over US$86M, involving some leading investors, including Highland Europe, LeftLane Capital, Endeavor Capital, and Y-Combinator.

Visit www.lemfi.com to learn more about LemFi.