Libya’s Political Feud Threatens Oil Supply Disruption

Libya’s political crisis is threatening to return the OPEC member’s oil production to the chaos that plagued it for years after the toppling of dictator Moammar Al Qaddafi.

The North African nation’s crude output was slashed in half this week as authorities in the east shuttered more than 500,000 barrels a day amid a fight with the Tripoli-based government for control of the central bank. All the nation’s eastern export terminals closed on Thursday.

The disruption could swell to 1 million barrels a day, according to consultants Rapidan Energy Group. That would amount to roughly 1% of global supply, and marks the ending of a 2021 arrangement brokered by the United Nations to try and reconcile the two rival camps.

“Even if a compromise is reached on control of the central bank, it seems like the fragile deal that has provided relative stability to Libya’s oil sector for the last few years is breaking down,” said Richard Bronze, head of geopolitics at consultant Energy Aspects Ltd. “Output is likely to be more volatile and prone to outages heading into 2025.”

Eastern authorities froze oil exports after the UN-recognized government in Tripoli led by Prime Minister Abdul Hamid Dbeibah replaced Sadiq Al-Kabir, governor of the central bank. The institution manages billions of dollars of oil revenues on behalf of the two opposed governments.

Global oil prices are starting to flicker, with Brent futures climbing above $80 a barrel on Thursday. With traders focused on faltering demand growth in China and plentiful supplies from across the Americas, the benchmark remains down 2.5% from early July. Should Libya’s losses persist, the price response may intensify.

This week’s crisis follows the halt earlier this month of Libya’s biggest oilfield, Sharara, which deprived markets of 300,000 barrels a day. The country had been producing 1.27 million barrels a day of oil on Aug. 1, according to figures from the state oil firm National Oil Corp.

“Altogether, we expect production disruptions will total 900,000 to 1 million barrels a day and last for several weeks,” said Fernando Ferreira, director of geopolitical risk service at Rapidan, which is based in Washington.

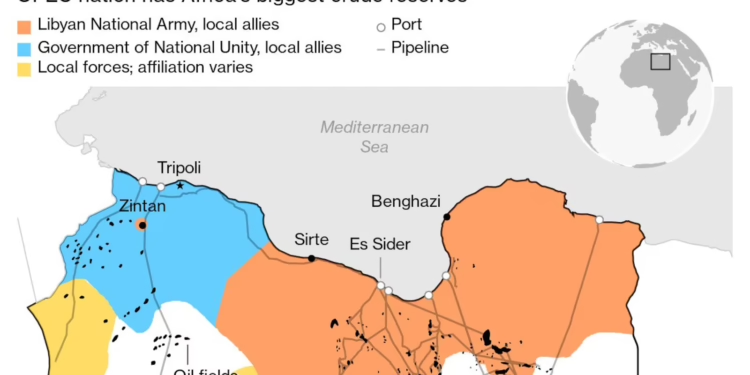

It’s the worst outage since an eight-month blockade in 2020 orchestrated by Khalifa Haftar, leader of the self-styled Libyan National Army, the powerful combat force that controls swathes of the east and south.

Haftar’s bloc, which opposed Al-Kabir throughout his 13-year tenure at the central bank, now supports him.

The nation’s state institutions crumbled during Qaddafi’s 42-year rule, and his overthrow left a vacuum that was filled by myriad militias, many based on tribal affiliations.

It has been wracked by unrest since his ouster in 2011, and its energy resources have been a key battleground for factions vying for political advantage and access to petrodollars, bringing frequent stoppages.

In 2014, the country essentially split in two, with a wealthier western half at loggerheads with an eastern side that’s home to most of its oil production and export terminals. While a ceasefire backed by UN in 2020 promised new elections, they haven’t yet taken place, causing the country to fracture anew.

The latest spat could be alleviated if international governments signal that the new central bank won’t be allowed to move dollars around, according to Jalel Harchaoui, an associate fellow at the London-based Royal United Services Institute. But “this level of clarity isn’t there yet,” he warned.

“Without firm, consistent, and swift US action, without strong help from other influential countries such as Turkey, the crisis may get much worse,” Harchaoui added. “There is no room for complacency or optimism at this juncture.”

Libya’s crisis nevertheless comes at an opportune moment for the producer nation’s counterparts in the Organization of Petroleum Exporting Countries, who have hesitated over plans to start restoring their production.

Led by Saudi Arabia and Russia, the alliance has been withholding millions of barrels of output since 2022 in a bid to shore up prices. It has a tentative plan to revive 543,000 barrels a day during the fourth quarter, and is set to take a decision on that approach in the coming days.

Analysts have warned that adding supplies could tip global markets into surplus, but a protracted stoppage in Libya could change the calculus.

“It might just be the perfect excuse for the producer alliance to go ahead,” said Tamas Varga, an analyst at brokers PVM Oil Associates Ltd.