- Ghana Cedi Defies Gloom, Emerges Among World’s Best-Performing Currencies

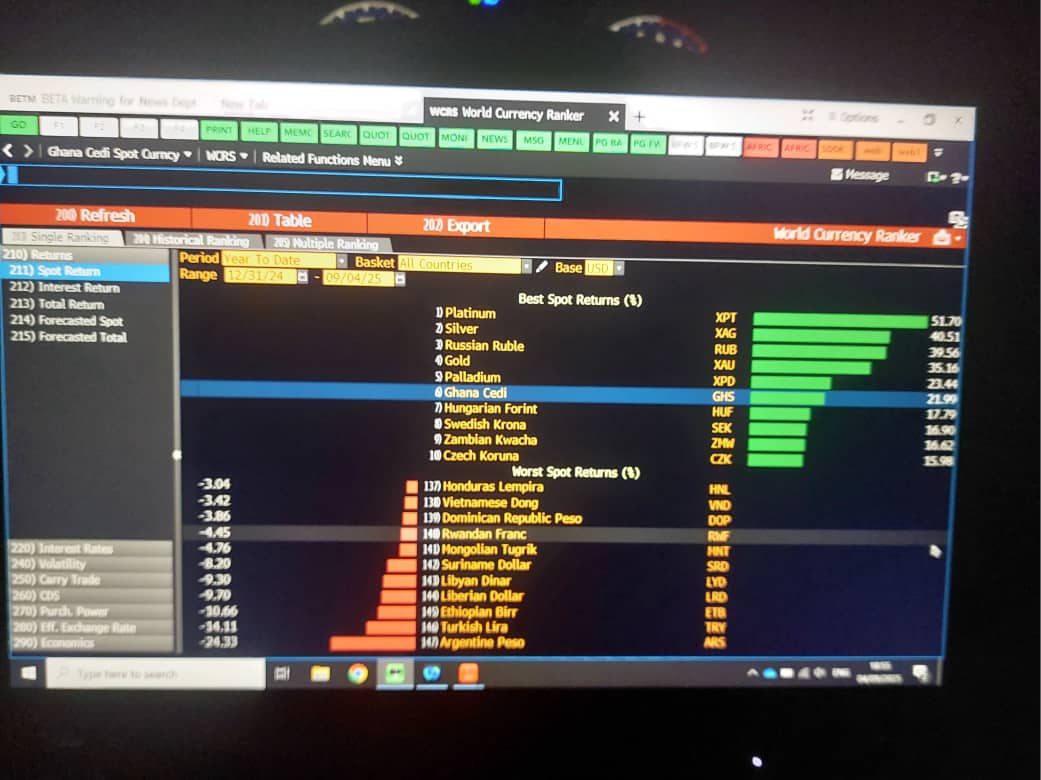

In a year dominated by volatile capital flows, fiscal tightening, and currency turbulence across emerging and frontier markets, Ghana’s cedi has staged an unexpected comeback, emerging as the world’s sixth best-performing currency according to Bloomberg data.

As of September 4, 2025, the cedi had gained 21.99% against the US dollar year-to-date, outpacing heavyweight currencies such as the Hungarian forint, Swedish krona, and Zambian kwacha. Only platinum, silver, the Russian rouble, gold, and palladium posted stronger spot returns over the same period.

The figures stand in stark contrast to prevailing narratives of economic fragility and currency weakness in Ghana. A recent report by the Daily Graphic Online suggesting that the cedi was among the world’s laggards has been undermined by the Bloomberg World Currency Ranker, which places Ghana firmly in the top tier of global currency performance.

The cedi’s resurgence reflects a complex interplay of factors. Fiscal consolidation under the government’s IMF programme, aggressive monetary tightening by the Bank of Ghana, and a recovery in cocoa and gold export receipts have buoyed investor confidence. Foreign exchange inflows from remittances and increased portfolio investments into government securities have added further support.

But analysts caution against reading too much into the rally. “The cedi’s appreciation is as much about global risk sentiment and commodity tailwinds as it is about Ghana’s fundamentals,” said one Accra-based economist. “Sustaining this trajectory requires structural reforms that go beyond short-term liquidity injections.”

The cedi’s surge has brought relief to importers and consumers weary of years of depreciation and inflationary pass-through. For households, a stronger cedi tempers the cost of imported goods, fuels, and pharmaceuticals. For businesses, it lowers dollar-denominated debt burdens and improves planning horizons.

Yet exporters, particularly in non-traditional sectors, now face thinner margins, with competitiveness dented on global markets. “We welcome stability, but if the cedi becomes too strong, it can hurt our ability to compete,” noted a senior executive in Ghana’s horticultural export sector.

The dissonance between Bloomberg’s ranking and local reportage underlines a broader challenge in Ghana’s political economy: the battle over perceptions. Markets tend to react as much to narrative as to data. In this instance, international investors and analysts will place more weight on Bloomberg’s independent metrics than on conflicting domestic headlines.

The episode also raises questions about media responsibility in times of economic stress. Misreporting currency performance risks fuelling panic, undermining policy credibility, and eroding the fragile confidence needed to anchor stability.

For now, however, the numbers speak for themselves. The Ghana cedi is not the beleaguered laggard some have claimed. It is, remarkably, among the world’s best-performing currencies in 2025 a fact that both reassures investors and complicates the prevailing narrative of fragility.