Informal Economy Distrust, Complexity Undermining Ghana’s Tax Revenue Efforts – BudgIT Ghana Report Reveals

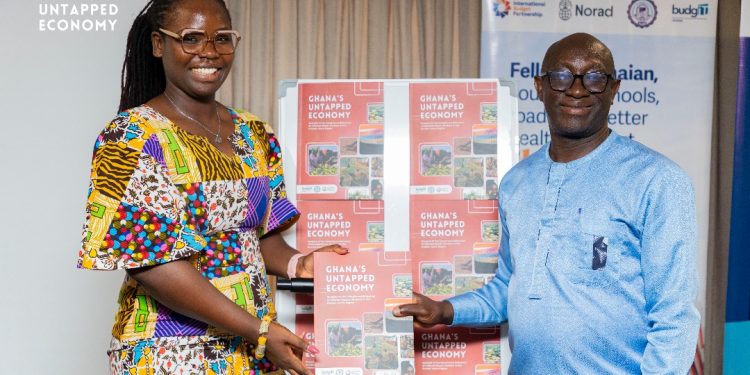

BudgIT Ghana, in partnership with the Society for Women in Taxation Ghana (SWIT) and the International Budget Partnership (IBP), has noted in a new report that, efforts by the government to expand Ghana’s tax base are being undermined by persistent structural, governance, and gender-based challenges within the informal sector.

Titled “Ghana’s Untapped Economy: Analysis of Tax Compliance Behaviour of Informal Sector Workers in the Greater Accra Region”, the study highlights a paradox in tax compliance behaviour: while many informal workers are willing to meet their tax obligations, they are held back by systemic barriers that limit voluntary compliance and, in turn, revenue mobilisation.

A core finding of the report is the entrenched public distrust in government institutions, driven by perceptions of corruption and fiscal mismanagement. Informal sector actors say their lack of confidence in how tax revenues are used has eroded any civic motivation to comply with tax laws.

“There is a real disconnect between what taxpayers expect from government and what they experience on the ground,” the report noted, adding that the absence of tangible benefits such as improved infrastructure or social amenities has deepened scepticism and disengagement.

The report further identifies income instability, opaque tax processes, and excessive bureaucracy as key structural impediments to compliance. Many informal workers operate without consistent income and lack the financial predictability required for regular tax payments. Others, especially those with limited formal education, find the tax registration process difficult to navigate.

Women in the informal economy who constitute a significant portion of the sector, face even greater hurdles. The study reveals that female entrepreneurs are disproportionately affected by indirect taxes, more frequent enforcement, and institutional harassment. Many also grapple with reduced financial flexibility and the dual pressure of running businesses while managing household responsibilities.

Despite the challenges, the report finds a strong undercurrent of willingness to pay taxes if the system is made simpler, fairer, and more transparent.

To this end, BudgIT Ghana and its partners are advocating a series of reforms aimed at improving compliance and equity within the system. These include simplifying tax registration and payment procedures, deploying mobile and decentralised platforms, and expanding mobile money and USSD-based tax payment options.

Crucially, the report recommends gender-sensitive tax administration such as flexible payment arrangements and anti-harassment protocols to ease the compliance burden on women.

The findings underscore the need for a shift in the government’s approach to informal sector taxation, with emphasis on trust-building, simplification, and inclusive policymaking as critical levers to unlocking the much-needed domestic revenue.