Nigeria’s naira finds path to stability after wild week

Even by the standards of Nigeria’s byzantine foreign-exchange market, it’s been a crazy week for the naira. But as the dust settles, new measures are in place that could prove decisive for the fortunes of the world’s worst-performing currency.

The naira plunged 36% this week after the central bank allowed a change in the method for setting its rate in the official foreign exchange market, and cracked down on misleading price reporting by traders and speculation against the currency by banks. It also eased rules on international money transfers to net billions of dollars sent home by Nigerians living abroad.

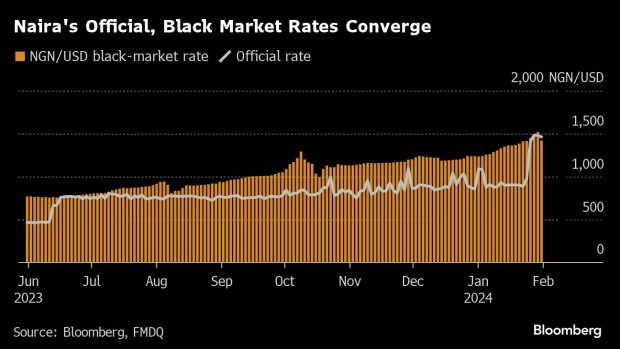

As a result, the naira’s close-of-day rate as calculated by the exchange, FMDQ, is now closer to a market-related value for the currency – as evidenced by the fact that it traded at a weaker level through the official channels this week than on the street. The latest measures from the central bank are part of a push to step away from managing the currency, unify the official and unofficial markets and attract investor inflows.

“Conditions for naira stability are gradually coming together,” Barclays Plc analysts including Michael Kafe said in a note. The currency weakness witnessed since President Bola Tinubu came to power in May “could be approaching its end,” they said.

The naira slumped almost 50% in 2023, including a one-off devaluation of about 30% in June as the central bank removed its peg against the greenback. But a scarcity of dollar supply through official channels meant the black-market rate weakened even more. By offering a more competitive rate, the central bank hopes to attract flows from exporters and remittances — the latter estimated to be as high as $20 billion in 2022 — back to the official market.

If the reforms are sustained into the long term, Nigeria will be on track to restore confidence in its currency, said Mosope Arubayi, an economist at IC Group in Ghana. “This could bring back on board two of the country’s key sources of foreign exchange: remittances and foreign portfolio investments,” she said.

But maintaining the naira at a stable level hinges on clearing a backlog of foreign-currency demand that’s estimated to be as high as $10 billion. Even after the central bank cleared about $2.5 billion of overdue obligations, the jury remains out on whether it will be able to satisfy foreign-exchange needs.

“The longer they’re unable to clear it, the more jittery the market gets and inflows won’t come in as expected,” said Imokha Ayebae, executive director and head of finance and accounts at Fidson Healthcare Plc, Nigeria’s biggest drugmaker. “As I speak, we have letter of credit obligations that have not been closed. We are not able to source everything.”

The naira’s official rate closed below the street value for s second day on Thursday, at 1,478.12 per dollar compared to 1,420 in the parallel market. The spot rate is also higher than its one- and two-month forward rates and only slightly below the six-month forward rate, an indication that the currency maybe now be undervalued. Barclays see the naira regaining some ground to average 1,100 this year and 1,150 in 2025.

“After the latest devaluation, Nigeria’s real effective exchange rate stands 40% below its 10-year average and 35% below its 20-year average,” said Patrick Curran, a senior economist at Tellimer Ltd. However, the need to rebuild reserves, lingering forex imbalances and excess naira liquidity means that “even if the naira is competitive it will need to overshoot in the near term to clear the market,” he said.

All eyes are now on the central bank policy meeting on Feb. 26-27. Barclays said the central bank will need to deliver large rate hikes in February and March, complemented by other policy measures such as tweaking the amounts that banks must keep as cash and as investments in government securities, to ensure the naira’s new-found stability is sustained.

“We need to see a comprehensive response from the CBN that will give the market the sense they are serious about a move back to orthodoxy and take the appropriate measures to arrest the decline in the naira’s value,” said Mohamed Abu Basha, managing director and head of macroeconomic analysis at EFG Hermes Holding.