Mauritius’ Economy Depends on Sustainable Public Finances

The island of Mauritius was once the native habitat of the dodo—striking, flightless bird that went extinct in the face of unsustainable hunting by sailors. Today, the dodo is a national symbol for the country, representing the importance of conservation and sustainability efforts.

Economies are also shaped by human action, including fiscal policy. Mauritius has a strong policy track record that has engendered a transition from an agricultural economy to a diversified upper-middle-income country.

However, Mauritius now faces challenges from high public debt, significant public investment needs, low productivity, and an ageing society. To address them, fiscal policy would need to be recalibrated to preserve today’s dodo: inclusive economic prosperity.

Fiscal sustainability measures

The Mauritian authorities recently announced their 2025-26 budget, which prioritizes reforms to support sustainable fiscal policy. These reforms aim to increase tax revenue by over two percent of GDP in 2025-26, while reducing government spending by over one percent of GDP in the same period. Overall, the authorities expect to reduce government debt from 87 percent of GDP in 2024 to 75 percent in 2030.

Our recent annual economic health check of the island nation—our Article IV Staff Report and Selected Issues Papers—offers policy options to achieve sustainable fiscal policy in Mauritius, including (i) strengthening revenue mobilization, (ii) reforming the pension system, and (iii) increasing spending efficiency. The announced budget is in line with many of our proposed policy options.

Increasing fiscal revenue

Given that tax exemptions are high—they accounted for 4.6 percent of GDP in 2024-25—the new budget aims to discontinue selected exemptions from VAT and excise duties, such as those for construction, real estate, and electric vehicles. The budget also lowers tax payment thresholds and raises new taxes. The implementation and sequencing of these reforms would need to limit any potential adverse impact on economic growth, while also protecting the most vulnerable.

Reforming pensions

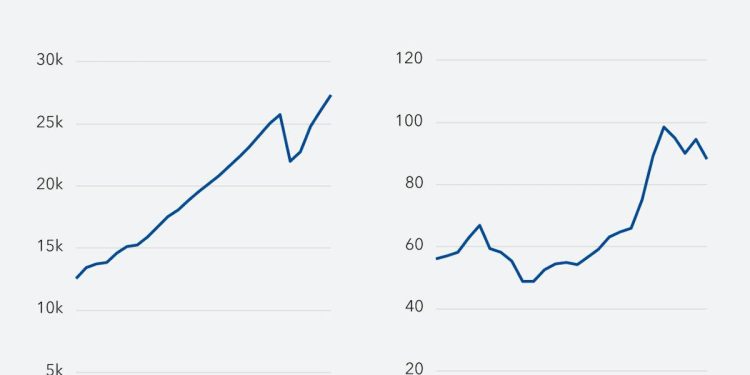

On the expenditure side, there is room to make pension spending more sustainable. Benefits paid to individuals through the Basic Retirement Pension program (BRP)—received by all Mauritians aged 60 and older—have more than doubled since 2019. On top of higher benefits, fiscal pressures are mounting from a relative increase in the number of pensioners. As society ages, Mauritius is expected to face a doubling in the old-age dependency ratio over the next thirty years, resulting in a fast-growing pension bill.

Maintaining the present system would imply significant intergenerational redistribution from younger to older generations, as the (relatively small) younger cohort would likely face higher taxes to finance pensions for the (larger) older one. An option to help contain the growing cost of the BRP is a gradual alignment of the eligibility age from 60 to the official retirement age of 65. Given demographic trends, the alignment in the BRP eligibility age would help make the pension system more sustainable, while containing intergenerational inequalities and protecting the most vulnerable. The announced budget is a step in this direction.

Spending efficiently

There is also scope for streamlining broadly targeted and regressive fiscal transfers. Social subsidies in Mauritius, in many cases, reach relatively few poor individuals. For example, only 11 percent of beneficiaries of the social aid program are defined as poor. The announced budget proposes savings by gradually unwinding some broadly targeted subsidies. The resulting savings will help create fiscal space to finance targeted schemes for the most vulnerable, while making fiscal policy more sustainable.

Unlike the dodo, now extinct, Mauritius’ economy will continue to thrive so long as fiscal sustainability is secured.