Middle East conflict risks reshaping the region’s economies

The conflict in Gaza and Israel is causing immense human suffering. In addition to the direct impact, the conflict will also have consequences for the broader Middle East and North Africa region, with impacts on both people and economies. This comes at a time when economic activity in the region was already expected to slow, falling from 5.6 percent in 2022 to 2 percent in 2023.

The extent of the impact on the region remains highly uncertain and will depend on the conflict’s duration, intensity, and spread. A large-scale conflict would constitute a major economic challenge for the region. Its containment hinges on the success of international efforts to prevent further escalation to the broader region. What is certain is that forecasts for the most directly exposed economies will be downgraded and that policies to buffer economies against shocks and preserve stability will be critical.

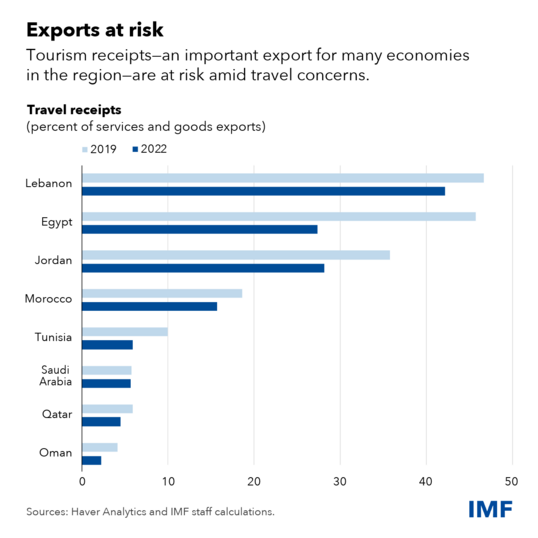

No doubt, Israel and the West Bank and Gaza are hardest hit. But the economic impact extends far beyond the area of fighting. The neighboring countries of Egypt, Jordan, and Lebanon are already enduring economic reverberations. Amid concerns about the threat of escalation, visitors have been canceling travel to the region, hitting hard at the very lifeline of these economies. Tourism, which accounted for 35 percent to almost 50 percent of goods and services exports in these economies in 2019, is a critical source of foreign exchange and employment. Tourism-dependent economies like Lebanon, where hotel occupancy rates fell by 45 percentage points in October compared to a year ago, will see knock-on effects for growth.

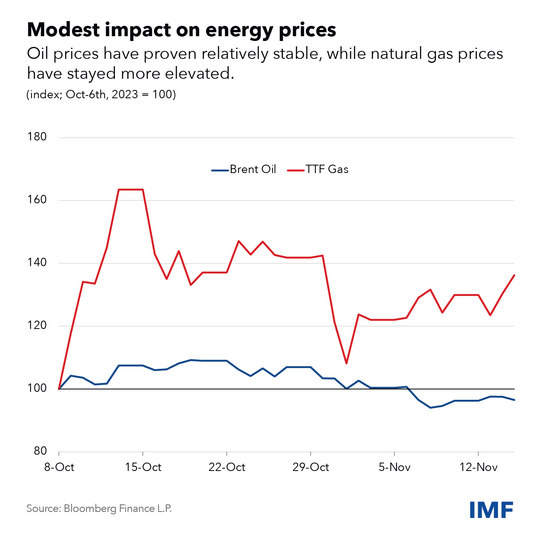

The impact on energy and financial markets has been limited and temporary. After an initial surge, oil prices retreated and are now below pre-conflict levels, reflecting changes in global demand conditions (as there was no disruption to oil production). Natural gas prices have also come down after a large spike but are still about 25 percent above pre-conflict levels.

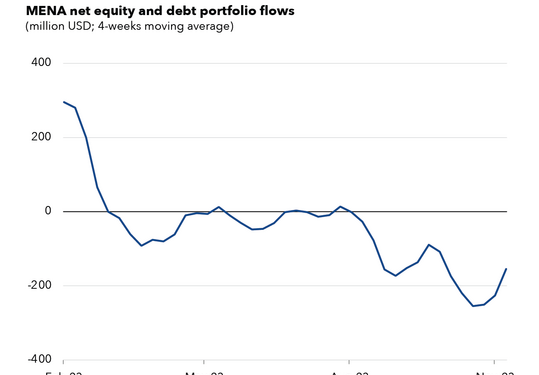

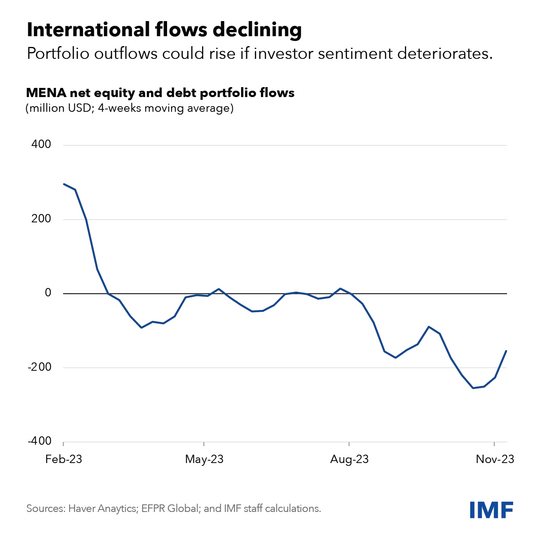

Government bond yields have climbed for some economies, but the broader impact has so far been minimal. Net portfolio flows to the region—a sign of investment sentiment—were on a downward trend that accelerated with the crisis but have since reverted to pre-conflict levels.

Despite these factors, elevated uncertainty about the trajectory of the conflict is eroding consumer and firm confidence, which could drive a drop in spending and investment. Absent a lasting ceasefire, and even if the conflict remains contained, uncertainty could impact the broader Middle East and North Africa region. Thus, where the impact has been limited so far, growth could deteriorate if hesitancy begins weighing on investment decisions.

And crises can also expose underlying vulnerabilities, exacerbating downside risks to the outlook. Rising risk premia could push up borrowing costs, which could quickly impact highly indebted economies. Moreover, fragile and conflict-affected states in the region, such as Somalia, Sudan, and Yemen, could experience a decline in critical aid flows if the focus of donors shifts away and the envelope of international aid does not expand to meet rising global needs.

Risk of escalation persists

Against this background, an escalation of the conflict could be a tipping point for the region. The ramifications would be far-reaching, quickly spreading beyond immediate neighbors to economies such as Iraq, Iran, Syria, and Yemen. The more prolonged the conflict, the more impacted the tourism, trade, investment, and other financial channels would become. Refugee flows could increase significantly, adding to social and fiscal pressures in the countries that receive them and potentially causing more protracted weakness.

In a region that produces 35 percent of the world’s oil exports and 14 percent of gas exports, the impact of a potential production disruption looms large. However, unlike in past episodes, even if prices were to spike in response to events, oil producers, particularly those in the region, can tap into ample spare capacity to quickly boost production, helping to mitigate the impact.

Prepare now

Undoubtedly, this crisis will reshape the region’s future. Where the economic impact is acute, or risks are elevated, prudent crisis management and precautionary policies will be critical in the near term. This crisis could inaugurate an era of high uncertainty for many countries if not properly addressed.

For others bracing themselves for the potential shock waves to come, it is key to not lose sight of the important reform and resilience agenda, especially considering existing structural challenges and a more shock-prone global environment. Countries must prepare by fortifying policy buffers where needed and ensuring fiscal and external sustainability. As highlighted in our latest Regional Economic Outlook, appropriately designed and sequenced structural reforms can help support both near-term growth and longer-term growth prospects. Stronger and more resilient economies are also more likely to withstand sudden shocks.

The IMF is closely engaged with the region to help countries mitigate the impact of adverse spillovers. Countries with IMF-supported program engagements (Egypt, Jordan, Mauritania, Morocco) can use these programs to anchor good policies. In Egypt, staff is engaged with the authorities to move forward with the program reviews. The recent staff-level agreement on a Fund-supported program for Jordan—in train since mid-2023—sets the path for continued shelter against the storm. Morocco’s Flexible Credit Line arrangement, which reflects its very strong fundamentals and policy settings, also serves as a buffer against adverse shocks.

More broadly, addressing these challenges provides an opportunity to reset. The IMF is revising the economic outlook for the Middle East and North Africa in close collaboration with its members and stands ready to step up needed support through policy advice, technical assistance, and financing to countries in the region.