Mystery trader’s debt-ceiling windfall sparks insider concerns

The US government’s move to greenlight a 300-mile natural gas pipeline as part of legislation to stave off a Treasury default shocked just about everyone, except for a mystery trader who somehow appears to have seen it coming.

On Wall Street, analysts had mostly expected vague promises on energy permits to be included in a bill to raise the US debt ceiling. Yet, options trading suggests something bigger may have been in the offing.

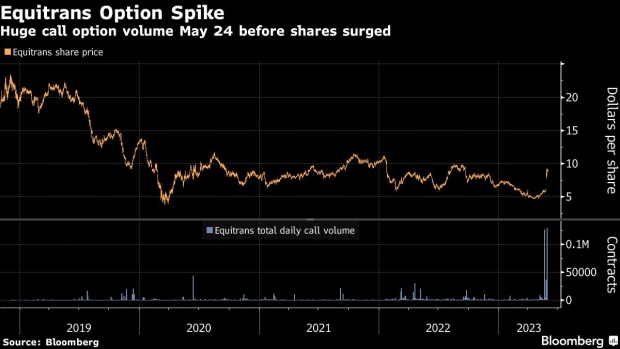

On May 24 — several days before an agreement was announced — a huge bullish bet was made on Equitrans Midstream Corp., data compiled by Bloomberg show. The company is deeply involved in the long-delayed Mountain Valley Pipeline. The wager involved snapping up 100,000 call options on the firm’s stock.

It proved prescient and wildly profitable within just a few days.

On May 27, White House and Republican lawmakers reached a deal that would give the long-delayed Mountain Valley Pipeline the final approvals needed to complete the project.

Throughout April and much of May, negotiators from the White House and Congress went back and forth on broad-stroke parameters of an agreement. Almost until the very end, the details were closely held and in flux. Doubts lingered over whether a deal would be reached before the US was scheduled to run out of money in early June.

Bill Signed

The legislation, which was signed into law by President Joe Biden on Saturday, forced action on permits for the project. On paper, the bet appears to have earned $7.5 million through Friday. It has some asking whether more than skill and luck played a role.

“My questions are: Who’s the trader? How sophisticated are they? And what are their connections to the government?” said Donald Sherman, chief counsel at the ethics watchdog Citizens for Responsibility and Ethics in Washington. He added the bet raises the specter of whether the parameters of the debt deal had somehow leaked out ahead of time.

Digging into whether a trade is improperly based on confidential information is notoriously difficult, especially when it involves market-moving news from inside the government. The rules are also rife with gray areas and ambiguities.

Confidential Information

Officials, including members of Congress, are barred from trading on confidential information they learned in their position. But if, for example, someone overhears a Congressional staffer loudly mention a piece of information on the train, they’re likely in the clear.

“The challenge for investigators isn’t just to learn if information was shared, but to uncover the intent in sharing it,” Philip Khinda, head of the SEC enforcement practice at Cadwalader, said. “These are very difficult cases to bring, because of both the legal and investigative complications they pose.”

No one has been accused of any wrongdoing with the options trade. A representative for the Securities and Exchange Commission, which would be responsible for overseeing any probe, declined to comment on whether it was looking into the matter.

Still, the call options are attracting a lot of attention for their timing — immediately before the debt-ceiling agreement was reached. The $8 strike price also equates roughly to how some Wall Street analysts have valued the Mountain Valley Pipeline for Equitrans.

Long Delay

Before the debt deal, the outlook for the Mountain Valley pipeline project had been bleak. Legal fights with environmentalists raged for years. Shares in Equitrans fell 35% last year.

After the surprise announcement that the pipeline would get a kickstart, Equitrans roared back. Shares soared 49% last week, a record.

“These trades are highly concerning,” said Dan Taylor, a professor at The Wharton School who studies insider trading, said. “It starts to beg the question of whether it, in fact, is a coincidence.”

Equitrans said neither the company nor any of its executives were involved in the transaction. In a statement, the firm also lauded the pipeline as “essential energy infrastructure that will ensure American families have reliable, affordable access to domestic energy” that will actually help reduce carbon emissions and bolster energy security.

To be sure, the project has powerful champions. Senator Joe Manchin, a Democrat who represents West Virginia where the pipeline will traverse, has long been a backer. He celebrated the project on Friday, saying on Twitter that it was “truly America’s ‘MVP,” an apparent reference to the project’s initials.

Asked about the options trade, Manchin said, “I have no idea about that.” He added, “The only thing I know is that people need power.”

Growing Windfall

Trading aside, the inclusion of the pipeline in the debt ceiling law has been a political lightning rod.

Democratic Senator Tim Kaine of Virginia, whose state the pipeline also crosses, offered an amendment to remove it from the debt deal. That effort failed Thursday.

Representatives for the White House and Kevin McCarthy, who spearheaded negotiations for the GOP as Speaker of the House, didn’t respond Saturday to requests for comment on the trade.

“The surprise was that it actually made it into the debt ceiling bill itself and was not part of a separate vote or a promise to pass another bill,” said Citi analyst Spiro Dounis, who covers Equitrans.

The options underlying the trade appear to be outstanding. That indicates no one has yet cashed in the bet, and the windfall could grow if the rally continues.