A widening current-account deficit and potential liquidity constraints, which Tanzania often experiences at the start of the year, are putting pressure on the shilling in the short term, said Shani Smit-Lengton, a senior economist at Oxford Economics Africa. Still, the infrastructure spending will pay off in the long run, she said.

“As long as the government ensures efficient implementation of the projects and keeps debt at a sustainable level, these projects should yield positive results and strengthen the shilling,” Smit-Lengton said. “We expect these investments to deliver long-term returns.”

Tanzania is ramping up spending on projects including a deep-water container port at Bagamoyo, near Dar es Salaam. India’s Adani Ports and Special Economic Zone Ltd. won the concession to operate the harbor.

Other projects include the 1,443-kilometer (897-mile), $5 billion East African Crude Oil Pipeline that will transport crude from fields in landlocked Uganda to Tanzania’s port of Tanga. The Export-Import Bank of China, which lined up a number of lenders from the Asian nation, is backing the pipeline, set to start operating next year.

Tanzania already produces natural gas, which it uses to generate electricity, and plans a $42 billion liquefied natural gas facility to be built by a consortium comprising Shell Plc, Equinor ASA and Exxon Mobil Corp.

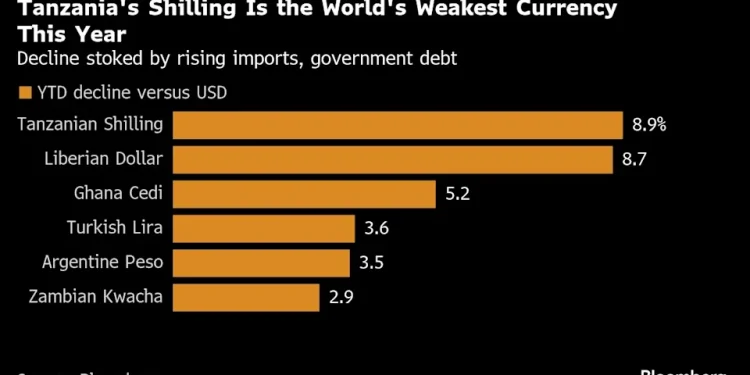

While those investments and others are expected to boost economic growth in the long term, they’re fueling the import and debt boom that’s weighing on the shilling.

Imports of goods and services rose 5% in the year through January to $16.9 billion, according to the Bank of Tanzania. That was driven by increases in purchases of industrial supplies and transport equipment, reflecting higher activity in the manufacturing, construction, and transportation sectors, the central bank said in its monthly economic review.

The country’s national debt stock, including government and private-sector debt was “broadly stable” at $47.6 billion, the bank said. External debt climbed 11.5% to $33.9 billion in the year through January, according to central bank data.

“We expect government debt to continue to rise in the coming years, although it is likely to remain below the International Monetary Fund’s 50% of GDP threshold until at least 2028,” said Smit-Lengton.

The Tanzanian currency was little changed on Wednesday at 2,641.23 per dollar, the weakest level on a closing basis since Nov. 28.

There is demand for dollars coming from oil and gas, manufacturing, mobile network operators, construction and trade sectors, said Nelson Kishanda, head of treasury at Exim Bank Tanzania Ltd.

“These sectors have grown year-on-year and hence increased demand for dollars,” Kishanda said. “The medium-term outlook is that we expect the shilling to trade in the 2,620 to 2,650 range.”