Naira street price steadies as Central Bank makes itself felt

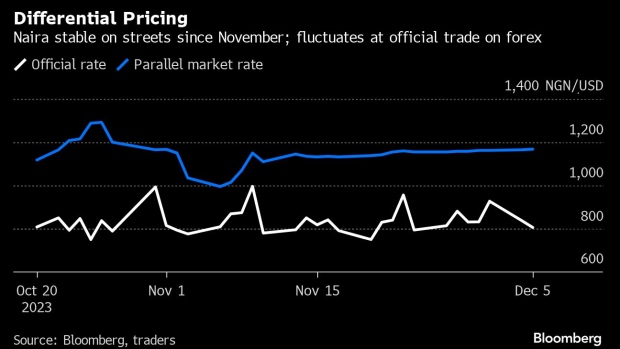

Nigeria’s currency has stabilized on the country’s unofficial foreign-exchange market following central bank efforts to improve dollar liquidity, while remaining volatile on the official market.

The naira was unchanged at 1,168 naira a dollar on Wednesday in the so-called parallel market, said Umar Salisu, a trader who compiles the data in the commercial hub, Lagos.

Its street value has swung between 1,135 and 1,168 naira per dollar in the last three weeks. That’s a notable pause in the volatility the currency has endured since the government eased exchange-rate controls in June, sparking a swift 40% slide.

Nigerian Central Bank Governor Olayemi Cardoso last month pledged to curb inflation and steady the West African nation’s battered currency, declaring that policymakers will clear forward foreign-exchange contracts that have weighed on the naria.

Since Cardoso “said he was clearing all the backlogs, those who kept the dollar are bringing them out for sale,” Salisu said. “Many people speculating on the currency have lost money since the past three weeks and don’t want to lose again.”

In contrast, the official market continues to witness sharp swings amid still-tight dollar liquidity. The unit gained 3.7% to 806.7 naira per dollar at Tuesday’s close compared to previous day, according to FMDQ Group, which tracks the data.

The gain followed a doubling of foreign-currency liquidity to $143 million, investment bank Chapel Hill Denham said in a client note on Wednesday.

The unit has swung between 750 and 927 naira per dollar on the official market since mid-November, as the local availability of dollars has shifted.

Rates in the parallel market have stabilized because traders are able to access dollars to meet customer demand, said Adetilewa Adebajo, chief executive of Lagos-based CFG Advisory, whereas the reverse was true in the official market.

“Once you can’t meet the demand, volatility will be there,” he said.