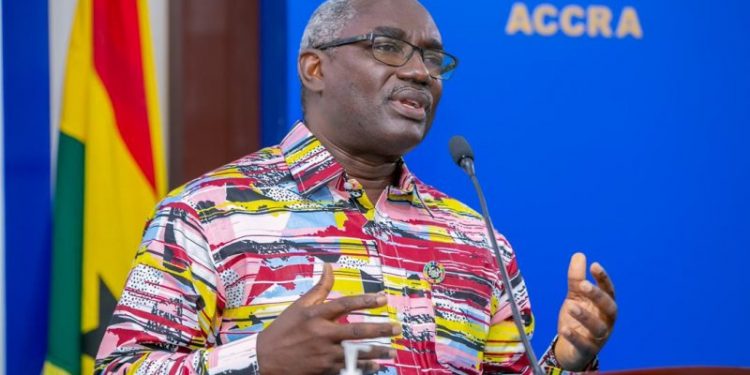

NDPC boss backs government’s decision to introduce E-levy

Director-General of the National Development Planning Commission (NDPC), Kodjo Esseim Mensah-Abrampa, has backed government’s decision to introduce the E-Levy in the 2022 budget.

According to him, the E-Levy will help rake in more revenue for government.

Speaking on Accra-based Asaase Radio, Mr Mensah-Abrampa allayed concerns that the implementation E-Levy will derail government’s digitization drive and ultimately affect its financial inclusion agenda.

“So we have to look at it in terms of if you come up with any policy, will it affect another policy negatively, neutrally or positively. Yes, it might affect digitization but that is for a very brief moment.”

“Yes we understand the payment of E-cost is not inelastic, so immediately you bring it there will be a reaction but the cost of cash payment we have looked at that, so the cost of cash payment is very heavy such that a rationale individual will look at the value of the electronic transfer of cash and then come back.”

”So we do not expect that once you bring it people will accept , yes there will be a reaction but we know in the analysis that it will be a brief moment and people will come back to it because the cost of maintaining cash payment is very very high in our situation and it is one of the ways that we can bring it,” the NDPC boss said.

Dr Mensah-Abrampa also added that, studies have shown that countries that initially resisted such levies have now embraced them.

Read: Golden Star receives award for good ESG practices

Meanwhile, economic analysts are of the view that the introduction of the E-Levy will not significantly expand government’s revenue tax base and could possibly affect the Bank of Ghana’s plans to roll out the digital cedi – E-cedi.

Mobile money charges to go up January 1 2022

Charges on mobile money (MoMo) on the back of the implementation of the E-Levy is expected to go up starting January next year.

If not reviewed downwards as demanded by the Minority Caucus in Parliament, CSOs, economic analysts and the general public, charges on MoMo transactions will amount to 2.75 percent on the value of money transfers made – already the telcos charge 1 percent on mobile money transactions.

As of January 2021, 38.9% of the population aged 15 years and more had a mobile money account in Ghana.

The share of mobile money users increased over the previous three years but decreased slightly in 2021 from 39% in 2020.