Newmont, other big gold miners missing out on bullion’s record run

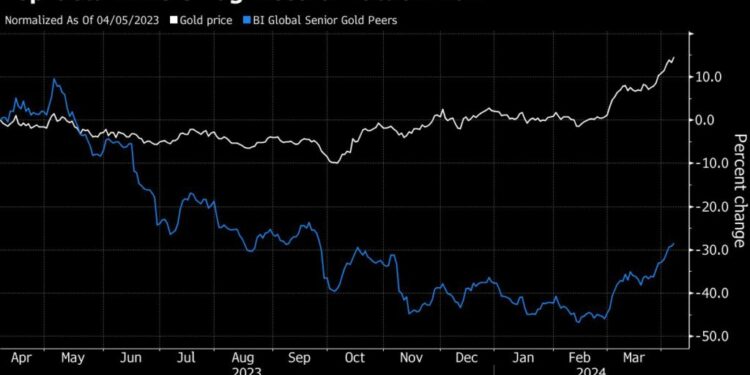

The world’s biggest gold miners are at risk of missing out on the metal’s record run after spending billions of dollars to become the obvious home for bullion-focused investors.

Despite gold hitting all-time highs almost daily, Newmont Corp. shares were down about 6% this year to Thursday’s market close, while rival Barrick Gold Corp.’s stock had fallen about 2%. Shares of both companies gained Friday as gold set a fresh record high, with Newmont rising the most since February.

“I’ve never seen it dislocate quite like this,” said Peter Grosskopf, chairman of SCP Resources Finance LP and former chief executive officer of Sprott Inc.

Gold is up about 13% this year and set another record Friday at $2,330.50 per ounce. It has rallied sharply since mid-February as tensions escalate in the Middle East and Ukraine, and uncertainties linger about China’s economy and US Federal Reserve policy.

Producers’ stocks soared at the outset of the Covid-19 pandemic as bullion skyrocketed amid widespread fears of economic calamity.

Newmont and Barrick went on deal-making sprees in recent years, snapping up smaller companies and eclipsing rivals in terms of scale. The logic behind this was clear: With investors increasingly wary about the sector, the companies wanted to give the gold-miner curious a place to invest.

Barrick chief executive officer Mark Bristow even secured the GOLD ticker in New York.

Since then, though, miners have seen margins shrink as inflationary pressures persist, with most companies spending more on labor, equipment and processing than expected.

Barrick, Newmont and Agnico Eagle Mines Ltd. have struggled especially in North America, where worker pay and other cost items have spiked in recent years.

“Things like cement, lime, explosives, steel — there’s still a little bit of inflationary pressure in those areas, which we’re working on to bring down,” Barrick chief financial officer Graham Shuttleworth said in the company’s latest earnings call.

At Newmont, total operating expenses were 43% higher than analysts expected in 2023, according to data compiled by Bloomberg.

The Denver-based company also faces skepticism from shareholders about its $15 billion acquisition of Newcrest Mining Ltd., which is poised to deliver less gold production than anticipated this year and involves selling several mines that Newmont acquired during its 2019 takeover of Goldcorp Inc.

“They’re selling all those Goldcorp assets, and now they’re buying a new suite of assets,” Grosskopf said. “So investors are really taking them to task and asking, ‘How do we know this isn’t going to happen all over again?’”

Yet a turnaround may be in the works. Shares of the largest gold producers increased 26% since March 1. Newmont and Barrick have closed at higher prices for more than a week straight.

If the companies can demonstrate improved costs in upcoming earnings, they may realign with the spot gold market.

The rally is a sign that “a lot of these inflationary pressures are now starting to ease,” said Robert Crayfourd, who co-manages the CQS Natural Resources Growth & Income fund as well as the Golden Prospect Precious Metals fund.

“It’s starting to move from headwind to tailwind.”