Nickel is year’s biggest metals loser, copper manages small gain

In a mostly lackluster year for metals trading, nickel emerged as the worst performer and might not see a reprieve anytime soon.![]()

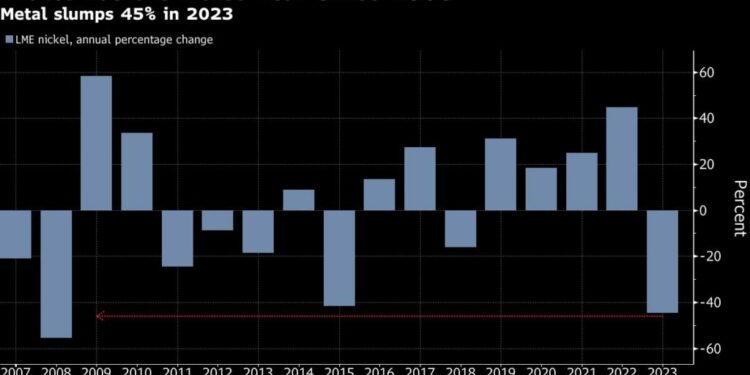

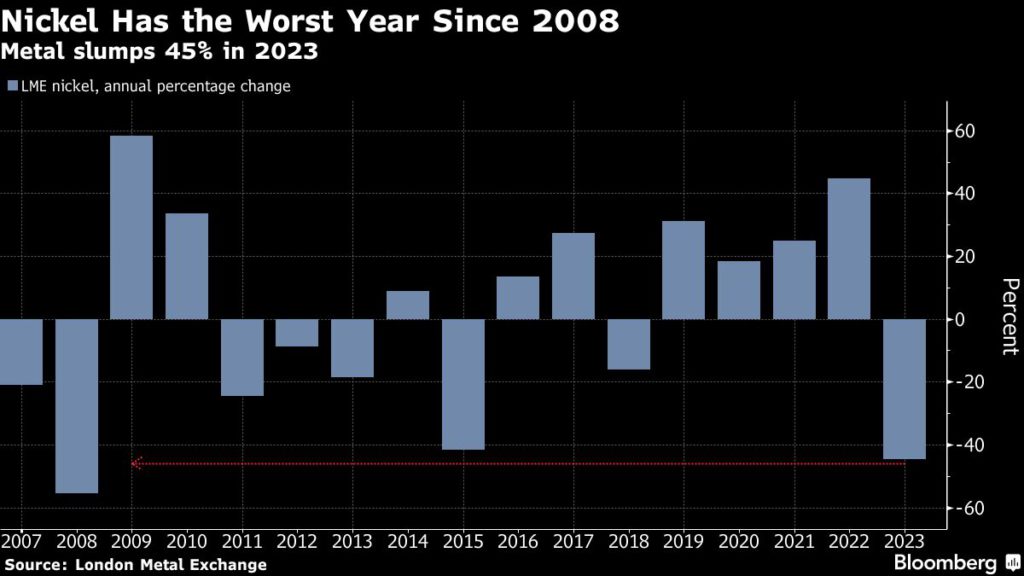

The metal used in stainless steel and electric vehicle batteries posted an annual drop of 45% on the London Metal Exchange, the biggest decline since 2008. That’s by far the worst outcome among industrial metals, and contrasts with a 2.2% gain for copper or with iron ore’s advance of about 20% in Singapore.

Metals have been pressured this year by global economic headwinds and uncertainty over China’s growth outlook. The LME’s all-in gauge of six metals is down 5.6% for the year, a second annual decline.

In most cases, concerns over tightening supply or even shortages have proved unfounded or perhaps premature. But those worries were particularly true for nickel, a market that’s been flooded with a wave of new material from top producer Indonesia. Demand growth has also faded.

“Nickel supply continues to grow, but consumption is showing no sign of improvement,” Huatai Futures analysts wrote in a note posted on its website.

Investors continue to bet against nickel. Net-short positions on the metal among the top 20 brokers on the Shanghai Futures Exchange are currently the biggest in at least six months.

Copper’s annual gain comes after a fourth-quarter rebound, helped by optimism that the Federal Reserve will start cutting interest rates next year. Prices will hit $10,000 a metric ton within 12 months, Goldman Sachs Group Inc. said in a Dec. 18 note.

On the final trading day of 2023, copper dropped 0.8% to settle at $8,559 a ton and nickel fell 0.8% to close at $16,603 a ton.