Nigeria bonds dumped at fastest pace in 3 months after downgrade

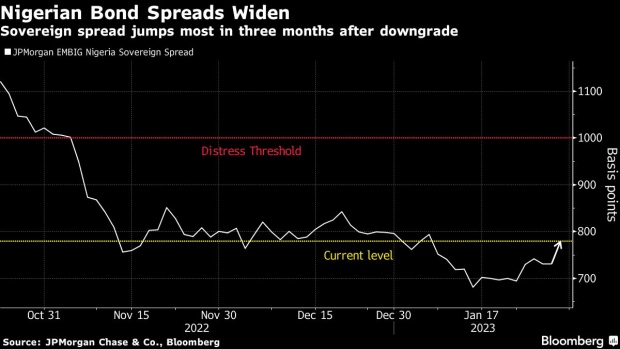

Nigeria’s sovereign-risk premium jumped the most in three months on Monday after Moody’s Investors Service downgraded the country deeper into junk.

The extra yield investors demand to own the West African country’s dollar debt rather than Treasuries widened 49 basis points to 780, according to JPMorgan Chase & Co. data. The rate on the nation’s 2032 bonds jumped 56 basis points to 12%, also the most since October. Forward contracts on the currency traded 28% weaker than the official rate on the one-year tenor.

The latest moves threaten to send Nigeria’s credit spreads back to distressed territory — widely described as 1,000 basis points above Treasury yields — as the country battles slow growth, fiscal strain and a dollar squeeze. While elections on Feb. 25 may provide a catalyst for economic reforms, implementation could take time amid social constraints, Moody’s said over the weekend while lowering the country’s long-term foreign-debt rating to Caa1 from B3.

“Nigeria faces significant structural challenges and we do not take it as a given that the mild improvements following the elections will be sufficient to counter them,” said Kaan Nazli, a senior economist and money manager at Neuberger Berman Asset Management. “There would also be concern of a spillover into the broader region given it is one of the largest sub-Saharan economies alongside South Africa.”

The nation isn’t a debt-default candidate in the near term, but that risk could increase the next year if fiscal consolidation doesn’t take place, Nazli said. The sovereign spread had traded above 1,000 basis points until early November, when expectations for China’s reopening boosted Nigeria’s bonds, pulling them out of distressed territory.

The country’s repayment burdens are mounting even as the government comes under pressure to boost social spending to help families cope with the aftermath of Covid. Interest payments are expected to rise to half of general government revenue over the medium term from about 35% in 2022, while debt as a proportion of gross domestic product will rise to 45% from 34%, according to Moody’s assessment.

Nigeria’s currency also came under pressure on Monday, with non-deliverable forward contracts plunging to record lows versus the current official rate of 461.36 naira per dollar.

Meanwhile, Standard Chartered Bank says Monday’s selloff may ease and offer opportunities for bottom-fishing.

“The external bonds have sold off this morning after the unexpected downgrade,” said Samir Gadio, the London-based head of Africa Strategy at Standard Chartered. “Some investors appear to be wondering whether this is a buy-on-the dip opportunity.”