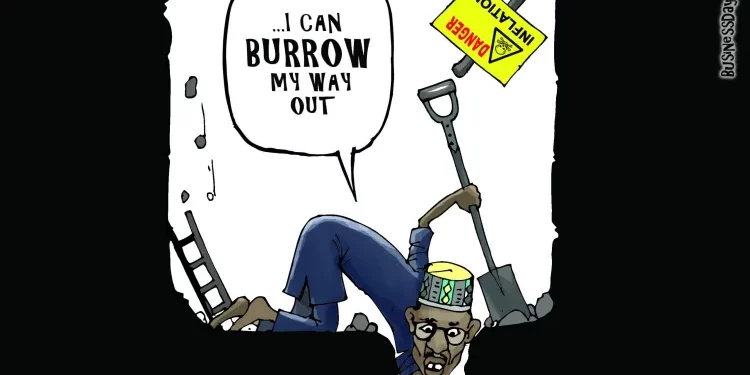

Nigeria borrows $16.7bn to finance 2021 budget

Nigeria’s financial status deteriorated in 2021 as the nation’s expenditure surpassed revenue resulting in a fiscal deficit of N7.3 trillion instead of N6.44 trillion approved in the 2021 Appropriation Act, a new report by Afrinvest has shown. The extra borrowings came from the domestic creditors, foreign creditors and the Central Bank of Nigeria’s Ways and Means.

The breakdown of the fiscal deficit showed that in 2021, the Nigerian government borrowed N3.218 trillion from the domestic market, which surpassed the N2.744 trillion approved in the last year’s appropriation act by NN474.30 billion. The government also borrowed N3.14 trillion from foreign creditors as against N2.74 trillion approved in the budget of last year.

In addition, the federal government sourced N932.6 billion from the Central Bank of Nigeria (CBN) when there was no such provision in the approved budget of 2021, the report indicated.

The Afrinvest’s report captioned “Deeper into the Rabbit Hole: The Nigerian Economic & Financial Market Review H1 2022 and H2 2022 Outlook”, identified the areas where the Nigerian government missed its targets in 2021 with respect to revenue and expenditure targets resulting in the huge deficit financing seen last year.

“While global crude oil demand and prices recovered, Nigeria struggled to boost production to pre-pandemic levels. Consequently, production declined to 1.61mbpd in Q2:2021 (Q1-2021: 1.72mbpd) and has continued the downtrend – declining to its lowest level in over 8 years (Q1-2022: 1.49mbpd) even as the Russia-Ukraine war boosted prices. The repeated underperformance of Nigeria’s oil production has kept the oil sector in contraction since Q2:2020, depriving the nation of fully realising the benefit of the oil market rally”, the Afrinvest’s report stated.

According to the budgetary assumptions in the approved budget of 2021, Nigeria planned to produce 1.86 million barrels of crude oil per day but ended up with 1.6 million barrels per day, underperforming the 2021 approved budget by 14 percent.

In the foreign exchange market, the average exchange rate approved for 2021 was N410.50/$ whereas the exchange depreciated by 1 percent to N414.5/$ by year end.

The report further stated that the oil and gas revenue was expected to hit N2.22 trillion in 2021, but due to underproduction wherein the country persistently missed its quota, Nigeria realised just N1.83 trillion, thus missing the target by 17.4 percent. Non-oil revenue had a variance of 58.8 percent from the approved budget, implying that the country realised N2.45 trillion instead of N5.9 trillion targeted in the 2021 approved budget.

With both oil and non-oil revenues far off from the amounts in the approved budget of 2021, Nigeria ended 2021 generating N4.39 trillion as total revenue in contrast to N8.12 trillion targeted in the 2021 appropriation act., representing a decline of 45.9 percent in total revenue generation.

The above raised Nigeria’s debt service to revenue ratio to 96 percent in full year 2021, compared with 38.5 percent approved in the budget.

“The apex bank needs to ensure compliance with its guidelines on ways and means, which limit the amount available to the government to 5% of the previous year’s fiscal revenues. Lastly, Nigeria’s oil production is at 1.24 million barrels per day on average according to OPEC, which is far below OPEC quota. Raising oil production and preventing oil theft is important in improving FX inflows into the country”, Wilsom Erumebor, an economist with the Nigerian Economic Summit Group (NESG), said.

The positives the country recorded in 2021 included a higher growth of 3.4 percent as against 3 percent in the approved budget of 2021 just as crude oil prices rose by 77.4 percent to $70.94 per barrel in contrast to $40 percent which was the budget benchmark.

It should be recalled that in the first four months of 2022, Zainab Ahmed, Nigeria’s minister of finance, budget and national planning stated that the country recorded a budget deficit of N3.09 trillion.

“In the second half of 2022, we are not optimistic about the potency of the CBN’s hawkish tilt to solve the FX crisis meaningfully. Confidence in the FX-generating ability of the economy is weakened by the disconnect between accretion to FX reserves and strong oil prices. Furthermore, tight global financing conditions should dissuade Eurobonds sales for the remainder of 2022 (7-year 1.25bn was raised at 8.5% per annum in Q1:2022), thus limiting options for a quick fix of dollar illiquidity.

“Therefore, it is unlikely that under prevailing circumstances FX reserves would improve significantly in H2:2022 given average monthly import bills of c.$4.5bn (implying roughly 8 months import cover as of June:22) and other FX obligations. stated that there is not much optimism for the second half of the 2022 as the problems of insecurity, crude oil theft, and hawkish stance of central banks across the world have high likelihood to affect Nigeria’s fiscal position by year end”, Afrinvest stated.