Nigeria: CBN bars further monetary policy tightening despite global inflation concerns

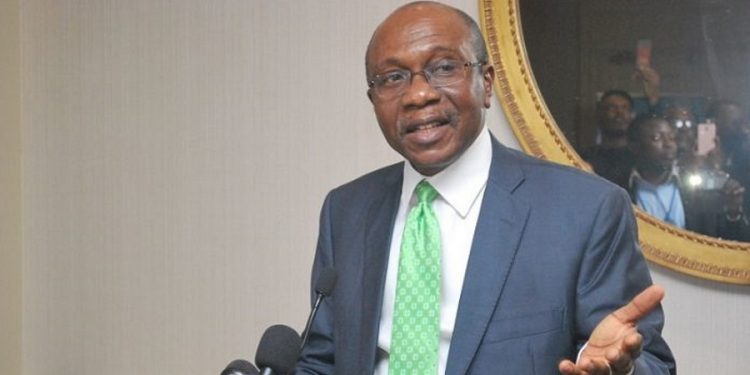

Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele on Thursday dismissed the likelihood of an additional monetary policy tightening anytime soon, despite global concerns on surging inflation.

Concerns around rising inflation – pushed by food and fuel prices as Russia continues to invade Ukraine – is dominating discussions at the ongoing spring meetings of the International Monetary Fund (IMF) and World Bank which began since Monday.

“We are tightening generally, the banks can confirm this, but at the same time, we are adopting some of accommodation to support growth through some priority sectors of the economy,” Emefiele told Businessday on the sidelines of the spring meetings.

Inflation has become a clear and present danger for many countries. Even prior to the Russia-Ukraine war, inflation surged on the back of soaring commodity prices and supply-demand imbalances. Many central banks, such as the Federal Reserve, had already moved toward tightening monetary policy.

But War-related disruptions amplify those pressures, and the IMF now projects inflation will remain elevated for much longer. In the United States and some European countries, it has reached its highest level in more than 40 years, in the context of tight labor markets.

After few months of downward trend, Nigeria’s inflation – which the CBN continues to monitor closely, though conscious of growth expectations – rose for the second straight time in March 2022 to 15.92% as prices of food and non-food thickened.

Read: Sanctions threaten to cripple Russia’s multibillion-dollar crypto industry

On Tuesday, the IMF, urged the Central banks to act decisively to prevent inflationary pressures from becoming entrenched, meaning to avoid a situation where inflation expectations become “unmoored”.

But responding to BusinessDay’s question on whether the CBN would thinker with its tight monetary policy stance further in response to the unfolding situation, Emefiele explained that, such position may not be necessary at the moment considering Nigeria’s peculiar situation of an additional growth concern.

His words: “I must say that in the last two years, the CBN has adopted a monetary policy of price stability but that is conducive to growth.

“This means that generally, we have been tightening, but again in some priority sectors of the economy like agriculture and manufacturing, we have adopted a somewhat of accommodative monetary policy stance. This is why you see that people can raise 10-year loan with 2 years moratorium at singe interest rate for agriculture and manufacturing.

“What we have sought to achieve with that is to see how we can adopt a more accommodative monetary policy to support those sectors so that they can grow, and and at the same time do everything possible to tighten and rein in inflation.

“That is why you can see that where as inflation is coming down gradually, the output, which is growth is increasing at the same time, which is a good result for Nigeria.”

Also speaking the World Bank’s position against Nigeria’s multiple exchange rates and Foreign Exchange restrictions on import of some items by the CBN, Emefiele reiterated that that Nigeria already has peculiar economic situations that may not allow it comply with some of those recommendations by the Bretton Woods institutions.

He said : “At our various meeting at the IMF and World Bank, the resolutions have always been that authorities should go back to their different countries and find home grown solutions.

“Nigeria’s situation is very peculiar and that is why we have continued to engage the them to show understanding in our local problems.

“Yes they want us to free the exchange rate and you do know that this has some impact on the exchange rate itself in the sense that when you allow that to happen, you will have some uncontrollable spiral effect in our exchange rate.

“And we want to ensure that through the managed float, we have some interventions put in place to really control how the exchange rate spirals.”

He acknowledged that today, the demand for foreign exchange in Nigeria outstrips supply, which would continue to be a challenge, but that the government is doing everything possible to restructure the base of the economy through some of the demand management policies that have been put in place which the IMF and World Bank may not like, but are critical to the survival of Nigeria’s economy.

“We hope that these policies we have adopted will be released at some point, but for now, we want to ensure that we have been able to deepen the production of those goods in Nigeria before we release them.

“We will continue to make them understand the peculiar situations that Nigeria face and how we can tackle that to see the progress of the economy,” he emphasised.

Emefiele reassured of the apex bank commitment to continuously explore possibilities of improving non-oil exports and earn proceeds that would strengthen the country’s reserves, which stands at about $40bn today.

“I am happy that other people outside Nigeria are seeing our effort to drive non-oil exports,” he stated.