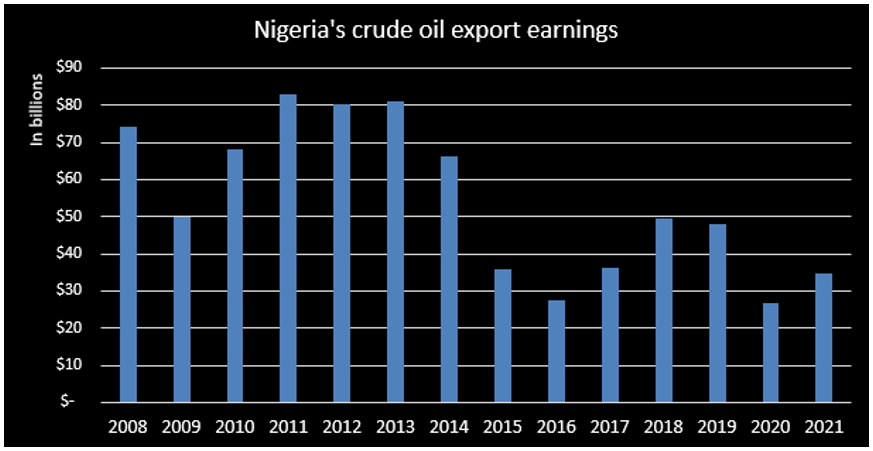

Nigeria earned $195bn in crude oil exports from 2017 – 2021, it could have been more

Data from the Central Bank of Nigeria (CBN) showed that Nigeria made a sum of $195 billion from the export of crude oil between 2017 and 2021.

While $195 billion seems like a fortune for a country whose real GDP is estimated at $174.02 billion (N72.39 trillion: 2021), it is worth noting that Nigeria could have earned significantly more.

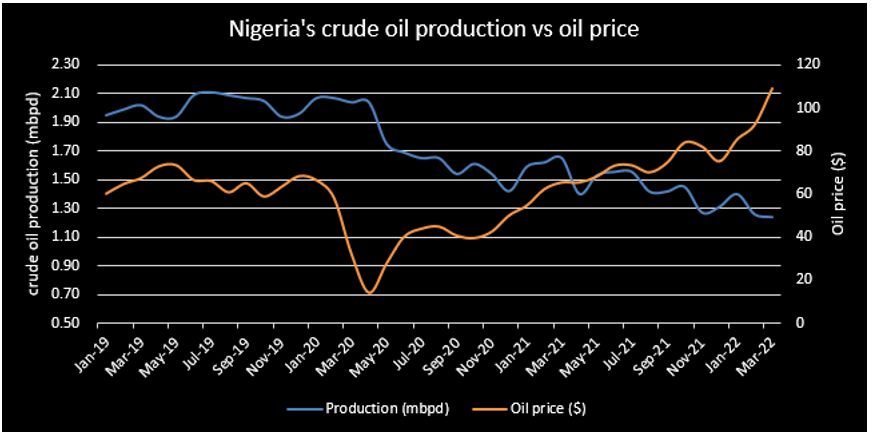

Specifically, looking through available data over the past two decades (2000 to 2020), Nigeria’s daily crude oil production has continued to dwindle.

- For the 10-year period 2000 to 2010, average daily crude oil production was 2.085 million barrels per day

- The decade 2011 to 2020 showed average daily volumes dropped to 1.732 million bpd (I.e. 17% decline)

- For 2021, Nigeria’s daily crude production averaged 1.48mpd (a further 15% decline from prior year).

Consequently, the trailing 5-year average daily volumes of 1.7million bpd is approximately 20% lower than the 2.085 million bpd observed between 2000 and 2010.

- This 20% production drop reflects a potential $40billion revenue loss over 5 years or approximately $8billion per annum

Even more alarming is that for 2022, recent estimates suggest daily volumes have dropped even further to below 1.3 million bpd. Thus, more missed revenue opportunities.

Some reasons for production decline

Industry watchers have attributed some of the oil production decline to significant divestments, as well as, lower capital expenditure in recent times, which has hindered the recovery of the sector.

Read: Stock market inch up by 3.70 points as SIC, Access and Société Generale post gains

However, in addition to divestments and lower CapEx, allegations are now being made that there is a proliferation of oil theft and pipeline vandalism ravaging the development of the sector.

What has been said

In the past few weeks, billionaire business mogul, Tony Elumelu tweeted that Nigeria loses over 95% of its oil production to thieves. Citing that Bonny Terminal, which is supposed to receive over 200,000 barrels of crude oil daily, receives barely 3,000 barrels causing Shell to divest its operations from Nigeria.

Additionally, Austin Avuru, the former MD/CEO of Seplat Energy and Executive Chairman of AA Holdings also opined in the same direction that Nigeria’s oil production has reached an emergency critical state, stating that oil production wells don’t get to receive 80% of production making it to the terminals due to oil theft.

Whilst these are anecdotal bits of information, their views cannot be simply brushed aside especially as these are prominent leaders within the sector.

Thus, to avoid continued missed revenue opportunities, it is important that the plethora of reasons driving our persistent production decline be remedied as a matter of urgency.

Emerging Opportunities in an evolving world

The ongoing push by the west to pivot away from Russia presents an opportunity for commodities rich nations to take advantage of new demand channels. There is no reason why Nigeria should not position itself to benefit.

Furthermore, a recent report noted that Nigeria only received $3.5billion of the over $70 billion worth of foreign investments which was deployed in Africa between 2012 and 2022. This is a paltry 5% of total despite being a major player in the oil and gas industry.

These investments evading the African giant are finding their way into other countries on the African continent.

- Notably, a breakdown of the $70billion revealed that Tanzania attracted about $30 billion worth of gas investments in the period, Mozambique received $4.7 billion, while in Djibouti received $4 billion in the review period.

What the government is doing

Thus far, following the reports of oil theft and pipeline vandalism, from a Federal Government perspective, President Mohammadu Buhari, tasked the Minister of State for Petroleum Resources, the MD of the Nigerian National Petroleum Company Limited (NNPC), Mele Kyari and the Chief of Defence Staff, General Lucky Irabor to stop the worsening state of crude oil theft in the country.

The Federal Government has also threatened to clamp down on perpetrators of oil theft and oil bunkering in the country as Timipre Sylva stated they have identified three elements as solutions to the current menace.

“There are three elements to the solution of this problem. The communities must be involved because the people who are engaged in these illegal activities are not ghosts. They are from communities. So, the communities have to be involved,” the minister said.

“You the security also must be involved because you are the law enforcement arm of government. And, of course, we as part of the government must be involved. And then the third arm is the operating companies.”

He also added that, “all the elements are complete now, we are here as government, the operating companies are here and, of course, we are going to the communities. So, I believe that finally this problem will be resolved.”

Why this matters

Nigeria is in dire need of FX inflows as the external reserve continues to strain from the constant intervention of the CBN in the official forex market.

As noted previously, the ongoing push by the west to pivot away from Russia presents an opportunity for commodities rich nations to take advantage of new demand channels. There is no reason why Nigeria should not position itself to benefit.

Plugging oil production decline and increasing investments to push output back towards the 2million bpd will definitely yield benefits.

Specifically, getting production back to the levels such that the country is able to recoup the estimated $8billion of missed earnings will go a long way to ease pressure on the Naira.