Nigeria: Miners’ debt to banks rises 296% in Q3 2023 amidst states’ bans

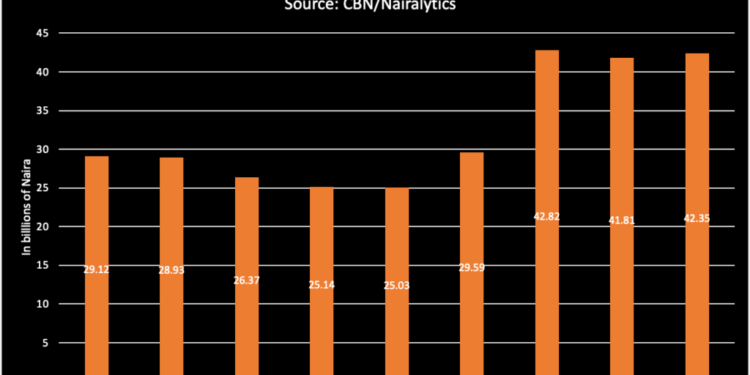

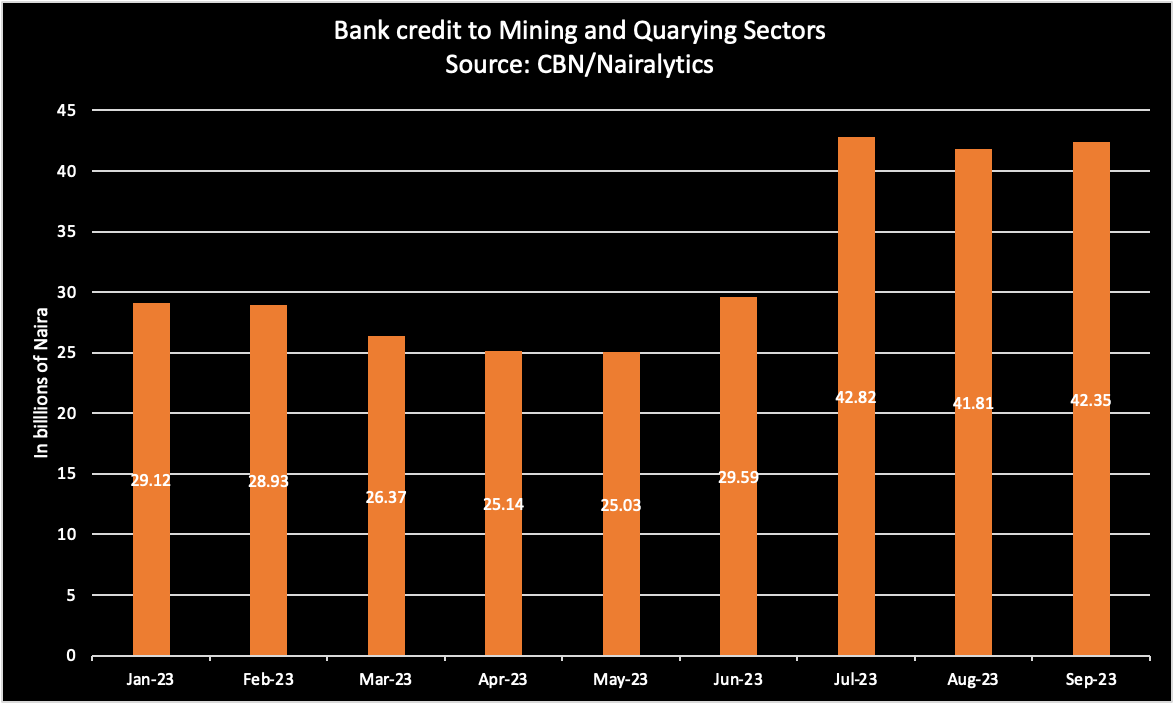

The mining and quarrying sector witnessed a substantial influx of bank loans in the third quarter of 2023, with borrowing surging to approximately N12.76 billion, as detailed in the Central Bank of Nigeria’s (CBN) latest quarterly statistical bulletin.

This leap represents a staggering 296% increase from the N3.22 billion recorded in the preceding quarter, underscoring a robust appetite for capital despite broader economic challenges.

By the close of September 2023, the cumulative debt burden shouldered by firms within this sector had escalated by a notable 43% to N42.35 billion, up from N29.59 billion at the end of June 2023.

This financial trajectory is particularly noteworthy against the backdrop of regulatory headwinds, as some Nigerian states imposed bans on mining activities during the same period.

States’ Ban on Mining Activities

The landscape of Nigeria’s mining sector underwent significant regulatory shifts between June and September 2023, marked by a series of bans on mining activities across various states.

This period saw no fewer than five states—Taraba, Niger, Zamfara, Kebbi, and Enugu—impose restrictions, primarily targeting illegal mining operations, amid concerns over environmental degradation and insecurity.

In June 2023, Taraba State Governor Agbu Kefas enacted Executive Order No. 3 to halt all mining activities effective June 23, 2023. By August, Niger State, under the directive of Governor Mohammed Umaru Bago, suspended all forms of mining. The following month, similar actions were taken in Zamfara, Kebbi, and Enugu, all aiming to address the resurgence of insecurity linked to mining activities.

These state-level interventions coincide with broader national security concerns. Previously, in 2022, the former Minister of Justice, Abubakar Malami, floated the idea of a nationwide mining ban as a strategy to undercut the financial pipelines fueling terrorist activities.

However, these measures have not been without controversy. The Miners Association of Nigeria (MAN) has criticised the state-imposed bans, arguing that such actions infringe on federal jurisdiction over mining and mineral resources.

The association’s grievances point to a contentious legal and regulatory landscape, which may further heighten the risk tendency of the mining sector.

The state bans, while aimed at curbing illegal mining and its associated security risks, also raise questions about the impact on legitimate enterprises and the broader economic implications for regions reliant on mining for revenue and employment.

FG’s Response to Ban

The federal government, through Dele Alake, the Minister of Solid Minerals Development, clarified the legal landscape surrounding mining regulation, firmly stating that state governments lack the authority to regulate mining activities within their territories.

This declaration comes in the wake of a series of unilateral bans on mining activities by various state governments aimed at curtailing illegal mining operations and addressing associated security challenges. According to Alake, such state-level interventions are deemed illegal and contravene the provisions of the Nigerian constitution.

The minister emphasised the centralised nature of mining regulation, noting that any state interested in participating in mining activities must adhere to established legal processes, including applying for a licence through the appropriate federal channels.

This stance underscores the federal government’s intent to maintain a unified regulatory framework for the mining sector, which is critical to ensuring national security, environmental protection, and economic development.

Also, Alake recently highlighted the strategic importance of solid minerals as a potential major revenue earner for the nation, urging sub-national governments to align with the federal government’s vision.

He advocated for states to position themselves as contributors to the national agenda by leveraging the mineral resources within their jurisdictions, albeit through legally mandated federal licencing and regulatory mechanisms.

More Insights

- The Solid Minerals Development Fund (SMDF), under the guidance of Executive Secretary and CEO Fatima Shinkafi, is placing a strategic emphasis on greenfield exploration, targeting the critical gap in data availability that hinders investment attraction in Nigeria’s mining sector.

- Shinkafi recently spoke about the inherent challenges of exploration, notably its cost-intensive and risky nature, which historically has deterred banks, known for their risk-averse lending practices, from financing ventures within the sector.

- Despite these challenges, a noticeable shift in the financial landscape is attributed to recent reforms spearheaded by the current Minister of Solid Minerals Development, Dele Alake.

- These reforms seem to have incrementally opened the doors to increased financing from the banking sector, signalling a departure from the traditional reluctance to engage with the mining industry due to its speculative nature.

- This shift is part of a broader strategy by the Federal Government, through initiatives like the SMDF, aimed at de-risking the mining sector to make it a more attractive investment proposition.

- Nigeria’s mining and quarrying sector is navigating a transformative era, buoyed by governmental efforts to mitigate risk and foster a conducive environment for investment.

- The concerted push to fill the data void through greenfield exploration is particularly significant, as it directly addresses one of the most substantial barriers to entry for potential investors.

- Moreover, the willingness of banks to reconsider their stance on lending to the sector reflects a broader re-evaluation of the mining industry’s potential as a viable and lucrative investment destination.