Nigeria Risks Missing Out On The Trump Tariff Opportunity

After all has been said and done about how African countries can capitalise on Trump’s return to reciprocal tariffs, the sad reality is that Nigeria may still not be prepared to seize the opportunity, even as the U.S. grants a 90-day pause on the new tariffs for most countries, excluding China.

This temporary window gives African economies some breathing room to reposition themselves. Yet, while others are taking steps to align their exports with U.S. demand, Nigeria remains unprepared mainly — lacking the infrastructure, coordination, and manufacturing base needed to turn a trade opportunity into real economic gain.

With Donald Trump signalling a return to high tariffs—especially on Asian clothing and textile exporters—some African countries are responding with urgency. Nigeria is not among them.

Trump’s proposed tariff hike, which could raise duties on goods, including clothing and cars from countries like Bangladesh, China and Vietnam, to as much as 47 percent, is already shifting global trade conversations. In 2023 alone, over 97 percent of clothing sold in the United States was imported, mostly from Asia.

This leaves a gaping opportunity for African exporters operating under the African Growth and Opportunity Act (AGOA), which grants qualifying African countries preferential access to the U.S. market. While Asian firms could soon be paying steep tariffs, African manufacturers in Ethiopia, Kenya, and elsewhere are looking at rates as low as 10 percent—or none at all. However, economists like Kingsley Moghalu, former Deputy Governor of the Central Bank of Nigeria, have expressed concern that AGOA may not be renewed under Trump’s current administration — raising questions about how long this trade advantage will last.

Ethiopia moves, Nigeria stalls.

Ethiopia is already responding. Zemedeneh Negatu, a prominent Ethiopian investment strategist, said the country is positioning itself as a competitive clothing exporter to the U.S. by building on its strong textile infrastructure, which already serves European and Middle Eastern markets. “We currently manufacture world-class, high-quality clothing in Ethiopia for the European and other markets. With President Trump’s new tariffs, we could very competitively export to the U.S. with a big price benefit for Americans,” Negatu said. With the right logistics and investment in place, Ethiopia sees this tariff shift as a rare geopolitical tailwind.

Meanwhile, Nigeria lags. The conversation in local circles is not about how to export more but about whom to blame for what we didn’t prepare for. In a recent public discussion, Kalu Aja, a financial analyst based in the US, voiced a frustration that many share. He noted that countries like Morocco, Tunisia, and Ethiopia have invested in infrastructure, including export clusters, to facilitate global trade. “No railway from East to West. No power supply. No industrial clusters. And now we’re blaming Trump?” Aja lamented.

“The foresight of Lagos State to build a deep seaport is what’s making it the number one destination for deep-sea cargo in West Africa,” Aja noted. “Why hasn’t the federal government replicated that nationally? Why aren’t we part of global supply chains like Morocco or Ethiopia?”

What AGOA data tells us

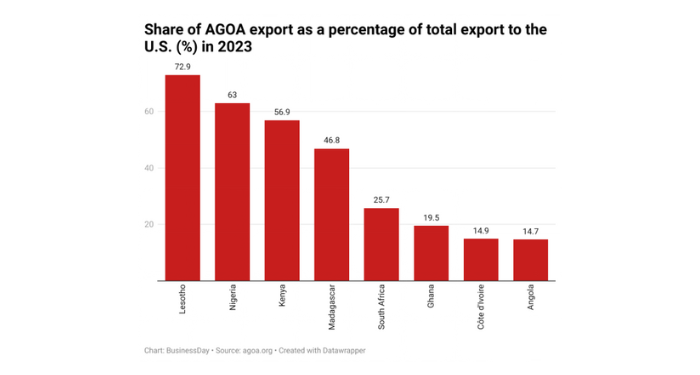

Despite being one of Africa’s largest economies, Nigeria has not leveraged AGOA with the same strategic intent seen in smaller nations. While AGOA accounted for nearly 63 per cent of Nigeria’s exports to the United States in 2023, the number saw a significant fall in 2024 to a mere $5.68 million. The bulk of that value comes from crude oil—a low-value-added commodity whose global prices are volatile and increasingly pressured by green transitions.

Contrast that with countries like Lesotho, where over 72 percent of total exports to the U.S. are under AGOA, driven by the apparel sector. Even Kenya, with more diversified export streams, still sees nearly 57 percent of its U.S. exports benefiting from AGOA preferences — primarily from textiles and apparel. Ethiopia is not on the chart due to its suspension from AGOA in 2022 over human rights concerns.

This reveals more than trade patterns; it speaks to economic intent. Countries like Ethiopia and Kenya, both slammed with a 10 percent tariff each, have a competitive advantage in the U.S. market over other countries with tariffs of over 40 per cent.

Nigeria, by comparison, has missed this wave, in part due to its weakened manufacturing base and lack of integrated infrastructure. That oil and gas dominate its AGOA profile is not surprising, but it’s also not sustainable.

Morocco’s long game

In North Africa, Morocco has attracted global automakers like Renault, Peugeot, and Stellantis, with growing reports that BMW may soon build or expand a factory there. In 2024, BusinessDay reported that Morocco became Africa’s largest car exporter after investment in railways and other infrastructure. With just 10 percent, Morocco could take advantage and expand their markets.

“Tunisia and Morocco are exporting cars to the EU,” said Aja. “Now, those same cars are going to be exported to the U.S. because BMW is going to expand in Morocco, build their cars in Morocco, and export them to the U.S. They have built their economy over time. Nigeria did nothing.”

Morocco exported over $14 billion worth of automotive goods in 2023—an amount larger than Nigeria’s entire non-oil export base. These investments didn’t happen overnight. They were built through long-term planning, consistent infrastructure development, and industrial coordination—everything Nigeria has consistently failed to do.

The missed potential at home

Moreover, the potential within Nigeria’s local market is clear. A documentary on industrial activities in Aba market, Abia State, Nigeria, highlighted the thriving local production of clothing and footwear. Despite facing infrastructure challenges, manufacturers in Aba are already attracting buyers from Italy, Cotonou, and Cameroon, who purchase locally made shoes and clothes in bulk. These products are often repackaged, rebranded, and sent back to Nigeria, highlighting the untapped potential within the country’s manufacturing sector. With the right infrastructure—such as efficient transport networks, stable electricity and export processing zones—Nigeria could easily position itself as a key player in global manufacturing, capturing much more of the value in these industries.

Nigeria’s opportunity cost grows higher every day. The U.S. tariff realignment is not simply about trade; it is about who gets to step into the supply chains of the future. With Asia being penalised with high tariffs, Africa has the chance to step up. But without steady power, efficient transport, and export-ready zones, Nigeria may watch from the sidelines again.

The Trump tariff moment may seem like a niche trade debate in faraway Washington, but its consequences are real and immediate. If Nigeria fails to take this window seriously—if policymakers continue to speak without action and if investment does not follow clear industrial intent—then this may be yet another story of how Africa’s largest economy got left behind while others seized the moment.

Nigeria can’t keep standing still and expect the world to wait.