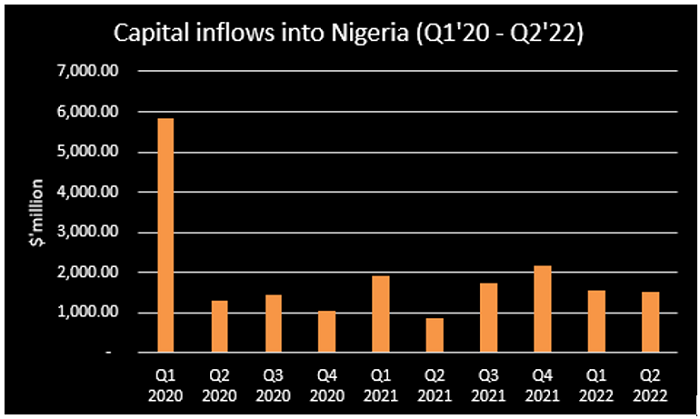

Nigeria’s capital inflow surges by 75% to $1.54 billion in Q2 2022, FDI remains low

Nigeria attracted a sum of $1.54 billion as capital inflows in the second quarter of 2022, an increase of 75.34% compared to $875.62 million recorded in the corresponding period of 2021. This is, however, 2.4% lower than the $1.57 billion received in the preceding quarter.

This is according to the recently released capital importation report by the National Bureau of Statistics (NBS).

The breakdown of the report showed that the largest amount was received through portfolio investment at $757.32 million, which accounted for 49.33% of the total inflows, followed by other investments with $630.87 million, representing 41.09%, while foreign direct investment accounted for 9.58% ($147.16 million).

Highlights

- Foreign direct investment (FDI) into Nigeria increased by 82.3% year-on-year from $77.97 million recorded in Q2 2021 to $147.16 million in the review quarter. On the flip side, it declined marginally by 8.26% from the previous quarter ($154.97 million).

- In the same manner, foreign portfolio investments (FPI) recorded a 37.4% year-on-year increase to $757.32 million in Q2 2022 but declined by 20.9% on a quarter-on-quarter basis from $957.58 million recorded in the preceding quarter.

- Other investments, which include trade credits, loans, currency deposits, and other claims stood at $630.87 million in the review period, a 156.2% year-on-year increase from $246.3 million recorded in the corresponding period of 2021,

Foreign inflows into Nigeria have remained low post-covid, attracting a total of $6.7 billion in foreign capital in 2021, as against $9.66 billion and $23.99 billion recorded in 2020 and 2019 respectively. Cumulatively, a total of $3.11 billion has been recorded as imported capital in the first half of the year.

Disaggregated by Sectors, capital importation into banking had the highest inflow of $646.36 million amounting to 42.10% of total capital imported in the second quarter of 2022. This was followed by capital imported into the production sector, valued at $233.99 million (15.24%), and the financing sector with $197.31 million (12.85%).

Capital Importation by Country of Origin reveals that the United Kingdom ranked top as the source of capital imported into Nigeria in the second quarter of 2022 with a value of $781.05 million, accounting for 50.87%. This was followed by Singapore and the Republic of South Africa valued at $138.58 million (9.03%) and $122.26 million (7.96%) respectively.

In terms of destination of investments, Lagos state remained the top destination in Q2 2022 with $1.05 billion, accounting for 68.66% of total capital investment into Nigeria. Abuja followed with $453.95 million in investments, accounting for 29.57% of the total value. Notably, apart from Anambra, Ekiti, and Kogi States, all other states recorded no inflows in the period under review.

According to the NBS, Citibank Nigeria Limited ranked highest in Q2 2022 with $450.94 million (29.37%), in terms of categorization by banks. This was followed by Standard Chartered Bank Nigeria Limited with $323.24 million (21.05%) and Stanbic IBTC Bank Plc with $163.92 (10.68%).

Why this matters

Despite the increase in the amount of capital inflows into the largest African economy, the inflows have remained low and is having a significant impact on the supply of forex in the economy. Capital importation is one of the major areas by which the economy has access to foreign exchange, which is currently in high demand in the country.

However, the ripple effect from the covid-19 pandemic and continuous economic headwinds have discouraged foreign investors from bringing their monies into the economy.

By implication, if inflows remain low, amidst low export earnings as well as the continuous dwindling state of the country’s crude oil earnings, this could cause a further FX supply gap, which would pile more pressure on the local currency.