Nigeria’s naira devaluation lures foreigners back into nation’s stocks

Last month’s currency devaluation in Nigeria is bringing foreign investors back to the nation’s stock market.

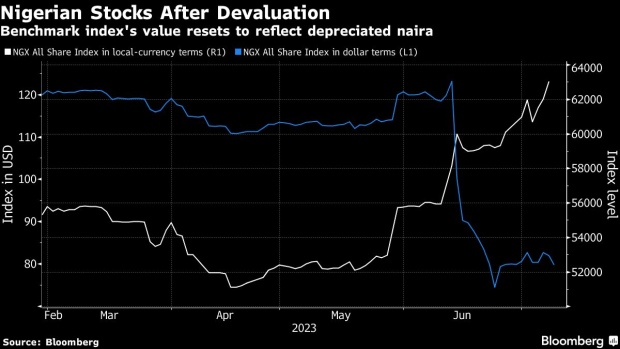

Overseas investment flows have jumped over the past month after incoming President Bola Tinubu’s administration allowed the naira to weaken 40%, according to data from the Nigerian Exchange in Lagos. While the devaluation initially reset the foreign-currency price of the benchmark index lower, stock gains fueled by the flows have mitigated that impact — leading to a 7.5% rebound over the past two weeks.

Investors will take heart from history that shows currency devaluations, while causing short-term pain, boost stock values and investment flows over the long term. The world’s best-performing stock market over the past year is Argentina’s, up 101% in dollar terms on the back of a 51% decline in the peso. Not far behind is Turkey, up 74% off a 34% slump in the lira. The stocks gauge of Lebanon, which has seen the world’s worst currency losses, is up 20% in dollar terms over the period. In Egypt, stocks are up 20% after the currency fell 39%.

“Foreign investors are coming now because they believe they are taking a position on the future,” said Adetilewa Adebajo, chief executive of Lagos-based CFG Advisory. “If the government comes out with a good budget, oil prices stabilize, crude production goes up, foreign exchange becomes more available, those will be good signals for foreign-investor participation and the positive market movement will be sustained.”

Nigerian stocks are already one of the world’s best performers in local-currency terms. Though Tinubu wasn’t the markets’ most favorite candidate at the February hustings, his administration has surprised investors with the intent and execution of a range of economic reforms. He wound down expensive fuel subsidies, brought changes to the management of the central bank and pledged to move to a flexible foreign-exchange rate.

The World Bank is forecasting the West African nation will almost double its growth rate to 4% from 2024 onward compared with an average of 2.1% since 2015 if it implements reforms to increase non-oil revenue and cut inflation. Bank of America Sub-Saharan Africa economist Tatonga Rusike expects the central bank to intensify its fight against consumer-price growth, potentially hiking interest rates by 700 basis points by the end of the year.

The NGX All Share Index has risen 6% this month in naira terms, its third monthly gain. That translates to a 3% advance in dollars. The post-election rally has helped the gauge to reduce its valuation discount to its emerging-market peers. It now trades 31% below the forward price-earnings ratio of the MSCI Emerging Markets, compared with 40% in April.

Meanwhile, foreign-investor participation has increased to 12% of transactions from 4% before the devaluation, according to the exchange. For the flows to continue and deepen, however, they would need assurances the reforms will continue. They will also monitor other variables including foreign-exchange volatility and inflation before committing more funds, said Samuel Sule, director of the financing group at Renaissance Capital Africa.

The naira erased a decline Monday to trade 1.2% higher at 760.12 per dollar.