Iron ore price poised to hit $150 in 2024 on Chinese stimulus, analysts say

Seaborne iron ore prices are set to climb to as much as $150 per ton in the first half of 2024, according to analysts who have lifted their estimates on expectations of increased demand in China after recent stimulus measures.

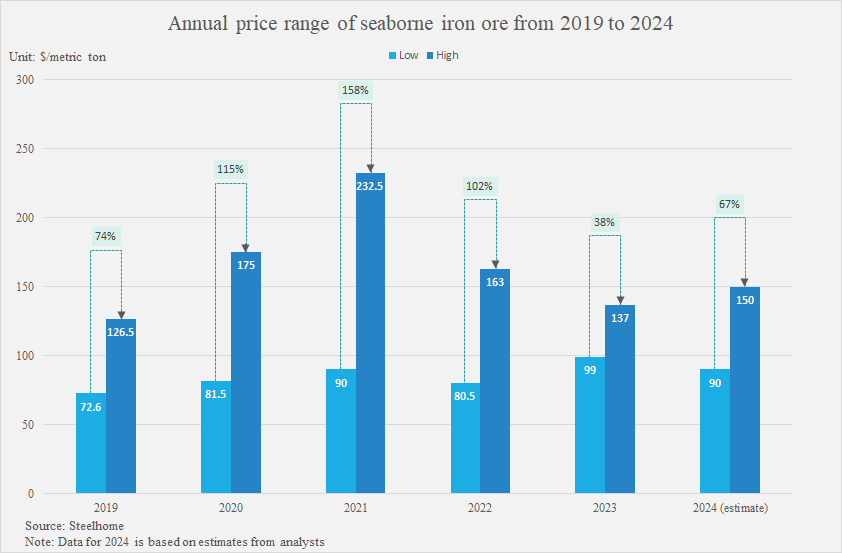

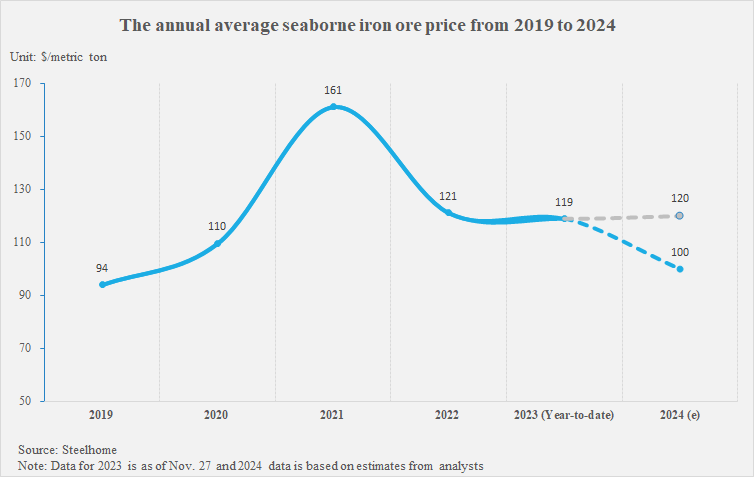

The price outlook compares with earlier estimates of $130 per ton, and Monday’s level of $135 per ton. It is, however, still far below the record $232.5 a ton reached in May 2021, according to data from consultancy Steelhome.

Iron ore has rallied in recent weeks after China’s central government unveiled a series of measures to revive its flagging economy, in particular the ailing property market, a key steel consumer.

China buys more than two-thirds of the world’s iron ore and its demand dictates global prices and production plans by leading miners such as BHP and Vale.

Prices have already defied expectations in 2023 due to stronger-than-expected Chinese steel exports and growing demand from the infrastructure and manufacturing sectors which has partly offset decline from the property sector.

“Price resilience will continue from positive sentiment over Mainland Chinese stimulus hopes, falling port inventories and strong demand from the country’s non-property sectors including machinery, shipping, autos and infrastructure,” BMI research wrote in a note.

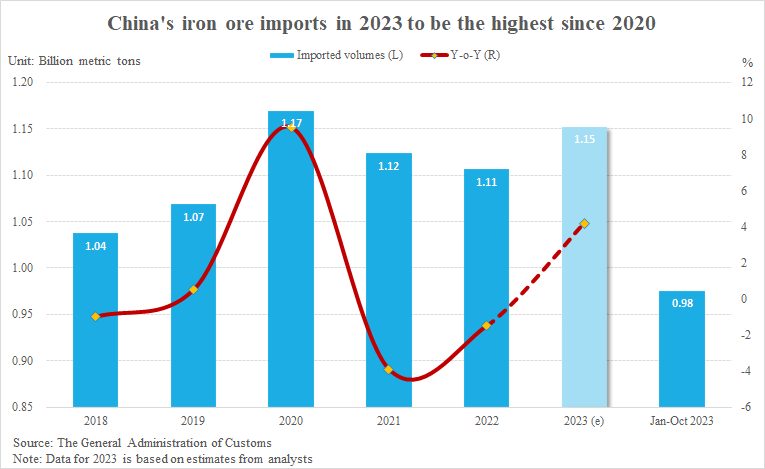

China’s 2023 iron ore imports might hit a record high, according to some analysts while others think it could be the second-highest level since 2020, when steel output peaked at 1.065 billion tons.

Prices will also be supported by relatively tight supply next year.

Global seaborne ore supply could grow by up to 3.8%, according to a CICC research note. But analysts add that demand outside China is also rising, leading to competition for shipments.

“Outside China, iron ore demand in 2024 is expected to improve, driven by robust Indian demand and some recovery of ground lost in the last two years in Europe,” said David Cachot, research director at Wood Mackenzie.

China is also likely to see only a small increase in steel scrap supply next year, said Pei Hao, an analyst at international brokerage FIS. He noted that Chinese mills don’t have much policy support to buy more than they do from abroad.

Scrap is the main feedstock in electric arc furnace (EAF)-based steelmaking and is used in the blast furnace-basic oxygen furnace (BF-BOF)-based steelmaking.

Analysts predict prices will decline in the second half of 2024 when shipments are expected to increase and especially if Beijing chooses to cap steel output.

Beijing curbed steel production in 2021 and 2022 to slow carbon emissions, but has not implemented the policy so far this year amid worries over the economy.

BMI has lifted its average price outlook for next year by 20% to $120, while Goldman Sachs has boosted its estimate by 22% to $110. Wood Mackenzie’s prediction is 8% higher at $108.

That compares with an average of $119 this year so far.

However, analysts predict a wider range of between $90 and $150 a ton for next year, partly due to uncertainty over the steel cap and potential government intervention. Prices have ranged from $99 to $137 a ton thus far in 2023.