Gov’t reportedly achieves 80% target in debt exchange programme

Government has reportedly achieved more than 80% of the target needed for its Domestic Debt Exchange Programme (DDEP), according to sources close to the team working on the programme.

The DDEP is a requirement for Ghana to secure an economic bailout of about $3 billion from the International Monetary Fund (IMF).

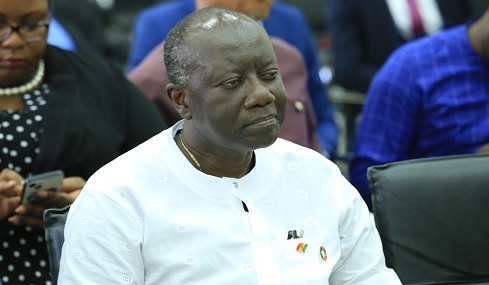

Finance Minister Ken Ofori-Atta is expected to make an official announcement on the success of the programme later this week.

Despite the exclusion of Pension Funds from the programme, the target was achieved thanks to significant participation from institutional bondholders such as major banks, insurance firms, and securities industry players.

Despite objections from the Individual Bondholders Forum, some individual bondholders also voluntarily participated in the programme. The settlement of the exchange is scheduled for February 14th, 2023, and if successful, it will pave the way for the external debt restructuring process.

Under the improved offer, individual bondholders below the age of 59 years (Category A) are being offered instruments with a maximum maturity of five years and a 10% coupon rate, while all retirees (including those retiring in 2023 and in Category B) are being offered instruments with a maximum maturity of five years and a 15% coupon rate.

The objective of the DDEP is to ensure that individuals, especially retirees, who invested their savings in the domestic market are not left in hardship as a result of the programme.

The deadline for the DDEP was extended several times due to technical challenges faced by some bondholders in completing the online tender process.

The Finance Ministry stated that the extension was necessary to complete administrative work and that the window ended on February 10th, 2023.