Oil prices continued their decline in the afternoon hours on Monday, with WTI crude falling sharply to $66.33 per barrel.

The price of a WTI barrel was down 7.63% on the day—a slide that began following the Sunday OPEC meeting, which only grew worse as Delta variant fears crept into the markets.

The price drop is despite the forecast for an ever-tightening supply situation in the oil market.

Poor timing

OPEC’s timing could be seen as rather unfortunate. The group was handed a favor in the IEA’s prediction that the market shortfall was somewhere in the 1.5 million bpd range.

With that outlook, oil prices would surely be resilient even as OPEC+ agreed on Sunday to ramp up production to the tune of 400,000 bpd starting in August and every month thereafter, until the production cut agreement had been entirely wound down.

But now, increases in the presence of the Covid-19’s Delta variant has the market nervous that it will once again stall the U.S. economy and slow the oil demand recovery that had just started to take hold.

The Dow was down sharply on Monday, too, with airline stocks hit particularly hard, along with energy stocks such as Chevron and Exxon.

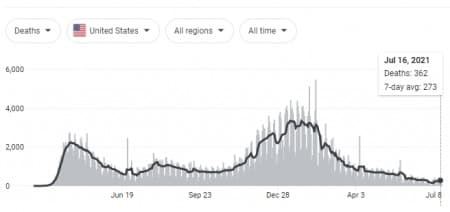

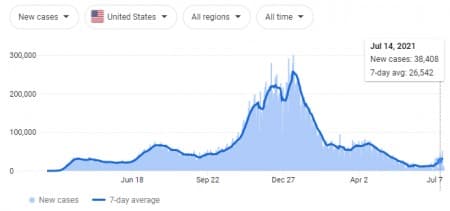

The FDA’s panic meter redlined on Monday, as the average number of daily new coronavirus cases over the past week increased 66% from the previous week.

In LA County, as just one example, the rate of new cases ticked up 300% since July 4, according to LA County’s health department.

Of course, new cases don’t necessarily mean hospitalizations or severe illness.

The FDA’s Dr. Scott Gottlieb said that most unvaccinated Americans will likely contract the Delta variant, CNN said, “And for most people who get this Delta variant, it’s going to be the most serious virus that they get in their lifetime in terms of the risk of putting them in the hospital,” Gottlieb said on Sunday’s Face the Nation.

Those fears also helped to send Brent crude down 6.71% on Monday to $68.65 at 4:30 p.m. EDT.