Sustainable finance in emerging markets is enjoying rapid growth, but may bring risks

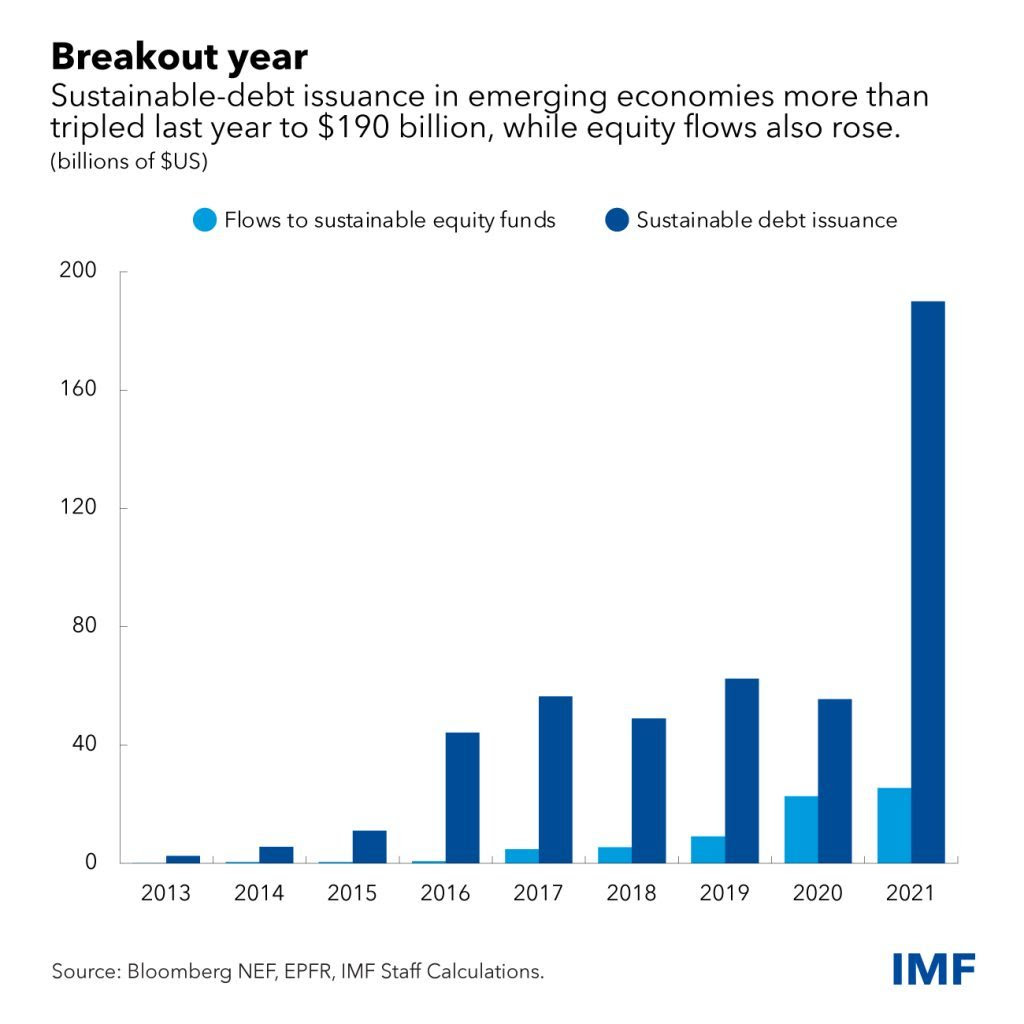

Most of the activity in the rapidly growing world of sustainable finance has been previously concentrated in advanced economies, but emerging markets, while still a small share of the total, saw a surge last year.

As a result, their market share has increased for the first time since 2016, underscoring the growing investor appetite for environmental, social, and governance (ESG) products, but this growing opportunity also poses new risks.

ESG’s rising prominence

Sustainable finance incorporates ESG principles into business decisions and investment strategies, covering issues from climate change to labor practices. It has become more mainstream in emerging markets in part because of pandemic-related financing needs, such as healthcare, as well as Latin America’s surge in climate-related borrowing.

ESG-linked debt issuance more than tripled last year to $190 billion. Sustainability-related equity fund flows also rose, to $25 billion, bringing total assets under management to nearly $150 billion.

ESG investments now make up almost 18 percent of foreign financing for emerging markets excluding China, quadruple the average for recent years. This raises questions about possible financial stability risks.

Expanding across dimensions

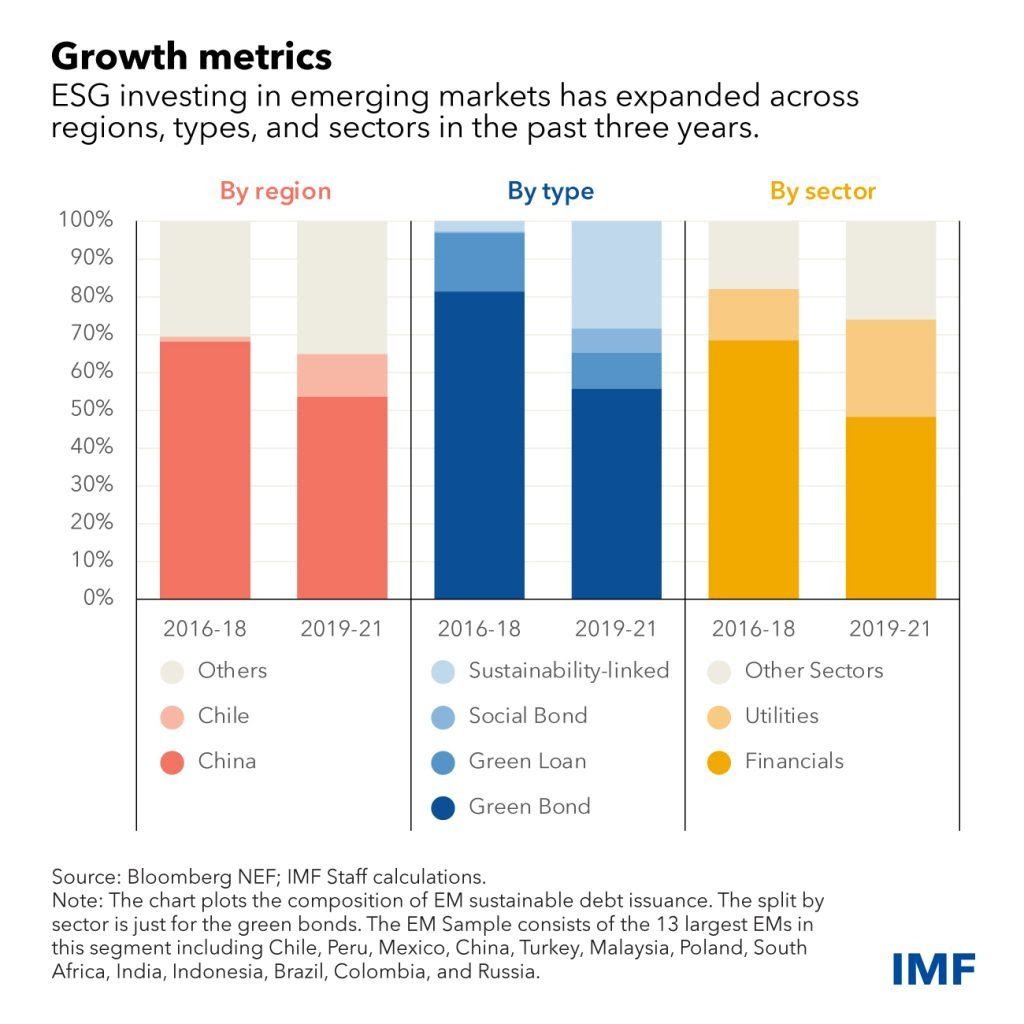

The ESG ecosystem in emerging markets has grown not only in size but also broadened across other dimensions. Green bonds remain a core part of this ecosystem, with volumes growing at an average rate of 20 percent.

Read: RMB helps raise $1.2bn for Afreximbank in boost to African trade

However, social and other sustainability-linked instruments are becoming more important, reaching almost half of total issuance in 2019-21, up from about a fifth in 2016-18.

This expansion of sustainable finance is also evident in the more active green bond issuance by non-financial firms and government related sectors, a subject we will detail in a forthcoming IMF staff paper.

One key dynamic of the emerging-market ESG world is growth outside of China. Issuance excluding China made up almost half of the total in 2019-21, compared to only about a third during the preceding three years.

Other increasingly important players in the sustainability market are Chile, where ESG issuance has reached nearly 12 percent of gross domestic product over the last five years, as well as Peru and Mexico. Some low-income countries, like Benin and Togo also issued ESG-linked debt in 2021.

Private finance role

Recent gains in ESG markets may be an important opportunity for emerging markets to access more stable funding sources and develop a broader and more mature sustainable finance ecosystem. With many of these nations highly exposed to climate hazards and already facing related transition challenges, private finance will play a crucial role in mitigating these risks and strengthening the financial sector.

But there are also risks that emerging-market policymakers must monitor and challenges they need to address.

- Financial stability risks include the different investor base relative to more traditional investors and a potentially higher sensitivity to global financial conditions, given the technology-heavy composition of many ESG indices. That’s an important consideration in the current policy environment, with central banks in advanced economies raising interest rates and reducing policy accommodation put in place during the pandemic—a development that is starting to tighten financial conditions around the world.

- Policymakers should strengthen the climate information architecture to incentivize efficient pricing of such risks and avoid greenwashing, the use of green labels or strategies that are often unverified or deceptive about environmental soundness. Policies should aim at improving the quality, consistency, and comparability of climate data, develop classifications that align investments with climate goals, and enhance global disclosure standards.

While some of these issues are also common in advanced economies, emerging market economies face additional challenges, particularly with respect to the transition to a green economy and to the availability and quality of climate data.

To avoid fragmentation of markets and regulatory approaches, international coordination and the adoption of global standards remain paramount.