Why Africa’s Largest Untapped Oil Field Has Yet to Flow

TotalEnergies’ Venus project in Namibia’s Orange Basin is the kind of discovery that makes oil executives’ eyes light up and governments dream of windfalls. The discovery – made in February 2022 – was immediately recognized as one of the African continent’s largest in decades, with an estimated 1.5 billion barrels of light crude at 45 degrees API and 4.8 Tcf of natural gas. Expectations are high: peak output is projected at around 150,000 barrels a day and the field could remain productive for 30-40 years. The ownership structure reflects a mix of global capital and local participation, with TotalEnergies holding 45.25%, QatarEnergy 35.25%, Namibia’s state oil company Namcor 10%, and UK-based Impact Oil & Gas 9.5%. For Namibia, which had no prior large-scale oil production, Venus represents a massive turning point. By 2030, it could increase the country’s GDP by as much as 20%.

Yet the promise of Venus is inseparable from its challenges. The field is situated in ultra-deep water, 3,000 meters below the surface and 300 kilometres from shore. This alone places it among the most technically demanding offshore projects in the world. The associated gas adds another layer of complexity, becoming a major point of disagreement that stalls the negotiation process. Namibia wants Venus’ gas production to be shipped onshore to boost power generation across the country, whilst TotalEnergies’ development concept is to reinject the gas into the reservoir to maintain pressure, given the low permeability of rocks. For Windhoek, this is about more than energy – it is about securing long-term revenues and establishing a foundation for domestic power generation. For TotalEnergies, it raises costs and risks in a project already on the edge of commercial viability.

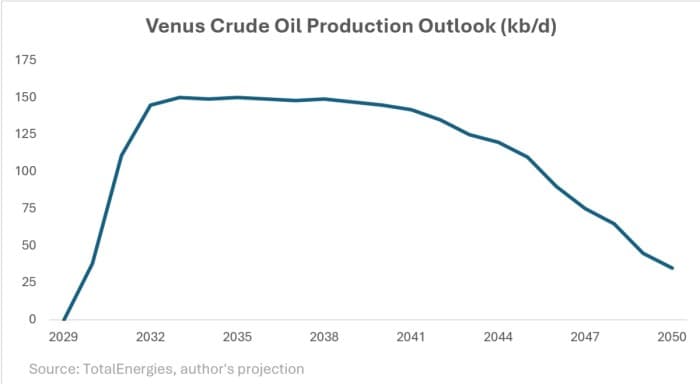

TotalEnergies has already adjusted its production profile to reflect Namibian realities. The company initially proposed a more aggressive development strategy with peak output of 200,000 barrels a day, but it has since revised that figure downward to 150,000 b/d. This reassessment is likely tied to the company’s broader strategy of prioritizing value over volume, aiming to sustain the production plateau for seven to eight years rather than pursuing rapid early gains (see chart). It also reflects an understanding of the strategic context: following Shell’s withdrawal, TotalEnergies is effectively the only major operator left in Namibia. Any future infrastructure – whether a potential LNG terminal on the coast, pipelines, or other facilities – will fall largely on its shoulders. Extending the production lifetime therefore helps ensure that such capital-intensive investments can generate returns over a longer period.

This tension defines the negotiations now underway. Namibia’s new president Netumbo Nandi-Ndaitwah has placed the issue directly under her control, creating a petroleum unit in the presidency to oversee talks. The concern is clear: the country does not want to replicate Guyana’s experience, where ExxonMobil’s 1999 production-sharing contract left the government with a royalty rate of just 2%, a deal exemplifying the downsides of nascent oil producers seeking to lure Western majors to develop their prospective resources. Namibia is determined to avoid what it views as an alarming precedent, and TotalEnergies faces a less agreeable counterpart at the negotiating table. CEO Patrick Pouyanné has said that the 2029 target for first oil can only be met if a final investment decision is reached by the end of this year. With negotiations still unresolved, that timetable already looks difficult to achieve.

Project economics are another source of debate. TotalEnergies has indicated a breakeven price of $20 per barrel, but this appears more a negotiation tactic than a realistic cost assessment. Comparable deepwater projects mostly trend around $35 per barrel. ExxonMobil’s operations in Guyana, at water depths of around 1,700 meters, and Petrobras’ Brazilian pre-salt fields, around 2,000 meters, illustrate this rule. Venus, at water depths surpassing 3,000 meters (and total depth of 6,300 meters) also happens to wield a high gas-to-oil ratio, rendering its development even more difficult. Without precise data on the gas content of Venus’ productive reservoir, it is difficult to design reinjection and processing capacity, making cost projections uncertain. Analysts warn that if gas proves more abundant than expected, reinjection could reduce net returns significantly.

The cautionary example of Shell demonstrates these risks. In early 2025, Shell announced a $400 million write-down on its PEL 39 license offshore Namibia, relinquishing its Jonker, Graff and Enigma prospects. The London-based energy major concluded that poor reservoir quality and high gas content made the finds sub-commercial. Shell’s exit illustrates that not all discoveries in the Orange Basin can be developed at scale, and Venus, despite its huge promise, is not immune to the same geological and economic constraints.

Even so, Namibia is positioning itself as a new energy hub. Beyond oil, the government has advanced a $10 billion green hydrogen project with German investors, due to begin production in 2027–28. The African nation’s concurrent pivot into non-fossil energies highlights its strategy of diversification, with Venus as the anchor but not the sole pillar.

For TotalEnergies, Venus reflects both the scale and the risks of its African strategy. Africa now accounts for half of the company’s operated production and commands the largest share of its exploration budget. Growth targets are centered on LNG and offshore oil in Namibia, Angola, and Gabon. But the Namibian project illustrates the uncertainties that come with frontier exploration. The company’s withdrawal from South Africa in 2025, after its offshore license off the Cape coast was rescinded amid political and environmental challenges, demonstrates how fragile (and erratic) operating conditions can be in the region.

Geopolitics adds yet another dimension. China has already established itself as Namibia’s largest foreign investor in uranium mining and is active in renewables and infrastructure. The African Energy Chamber recently opened a Shanghai office to facilitate Chinese participation in energy projects, signaling a deliberate pivot for the entirety of the continent. For TotalEnergies, this introduces a strategic risk: delays and disagreements with respective governments could give competitors a chance to expand their footprint, diluting the French company’s long-term position in Africa.

Venus therefore, stands as both an extraordinary opportunity and a profound test. On paper, it could deliver considerable growth to TotalEnergies’ cash flow by 2030 and redefine Namibia’s economic trajectory. In practice, the project must overcome extreme technical challenges, negotiate fiscal terms that balance investor returns with national expectations, and navigate a shifting geopolitical environment. If agreements on gas, revenues, and infrastructure can be struck soon, Venus could emerge as one of the defining oil projects of the decade. If not, it risks becoming another example of how frontier energy opportunities, no matter how vast, can stall under the weight of cost, politics, and competition.