Over 25% of Global Copper Supply Trapped by ESG Roadblocks — Study

About 6.4 million tonnes of copper production capacity, equal to more than 25% of global mine output, is stalled or suspended due to environmental, social, and governance (ESG) issues, a new study shows.![]()

These bottlenecks, unlike geological or technical barriers, stem from conflicts that could be resolved through stronger governance, deeper community engagement, and more sustainable practices, according to analysts at GEM Mining Consulting. The findings come as demand for copper continues to surge, driven by electrification, renewable energy growth, and the digital economy.

Countries including Chile, Peru and the United States hold some of the largest copper reserves now off the market. Unlocking even a fraction of these projects could ease looming supply shortages during the energy transition, Patricio Faúndez, head of economics at GEM, says.

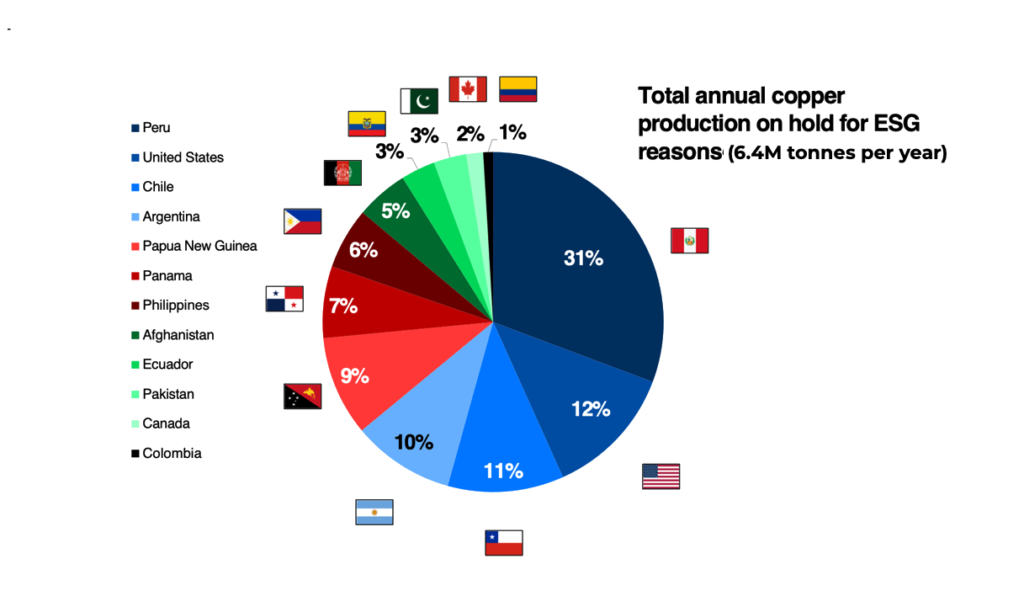

Peru accounts for the largest share of untapped copper, roughly 31% or 1.8 million tonnes annually, followed by the US with 0.8 million tonnes, Chile with 0.7 million tonnes, and Argentina and Papua New Guinea (PNG) with about 0.6 million tonnes each.

Peru’s halted output nearly matches its current annual production. If released, the country could reclaim its position as the world’s second-largest copper producer, surpassing the Democratic Republic of Congo with more than 4 million tonnes per year, the study notes.

In the US, restarting suspended projects could narrow the gap between domestic production and rising consumption, strengthening supply security and reducing import dependence.

In Chile, the stalled copper could finally break a decades-long production ceiling of around 5.5 million tonnes per year, pushing output beyond 6 million tonnes and reinforcing the country’s leadership in global supply.

Three telling cases

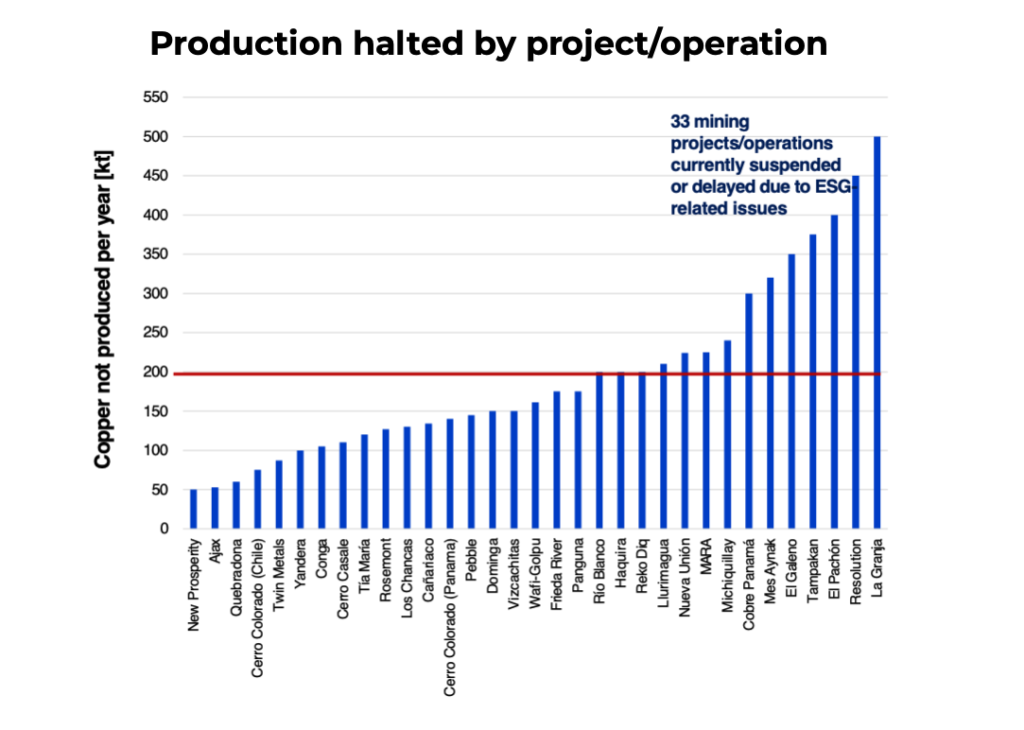

Among the 33 projects paralyzed by ESG factors, three stand out: La Granja in Peru, Resolution Copper in the US, and El Pachón in Argentina.

La Granja, owned by Rio Tinto (ASX: RIO) and First Quantum Minerals (TSX: FM), has faced some headwinds over alleged contamination and land use since 2006. Despite regulatory approvals, the project — ranked as the world’s fifth-largest copper deposit — remains blocked by public distrust.

In Arizona, Rio Tinto’s Resolution Copper project has been stalled for more than two decades due to Indigenous and environmental opposition over the sacred Oak Flat site, located on federally owned land.

El Pachón in Argentina, held by Glencore (LON: GLEN), has been delayed by glacier-protection rules and permitting hurdles, though new incentives under President Javier Milei’s RIGI regime may revive development.

GEM’s report does not mention an iconic copper mine that has remained idled since November 2023: First Quantum’s Cobre Panamá. Before Panama’s Supreme Court declared the mine’s operating contract unconstitutional and forced it to shut down, it ranked among the world’s largest copper producers, yielding 350,000 tonnes in 2022, its final full year of operations. The mine contributed about 5% of Panama’s GDP, and First Quantum estimates the suspension has cost the country up to $1.7 billion in lost economic activity.

Perfect storm

Panguna in Papua New Guinea stands as a stark reminder of how ESG concerns, such as water use, biodiversity loss, Indigenous rights, consultation failures and local protests can collide.

Once one of the world’s largest copper-gold mines, the mine operated by Rio Tinto’s unit by Bougainville Copper, closed in 1989 after a violent civil conflict over environmental destruction and inequitable profit sharing. More than three decades later, redevelopment remains uncertain.

While some projects may eventually progress, Faúndez warns that many remain frozen for years, out of sync with surging demand. Rebuilding trust, enforcing higher environmental standards, and stabilizing governance, he said, will be crucial to unlocking the copper needed for the global energy transition.