Over One Trillion Securities Traded on GFIM Since Inception, Says GSE MD

Volume of securities traded on the Ghana Fixed Income Market (GFIM) since its inception in 2025 till date, has hit over one trillion, according to the Managing Director of the Ghana Stock Exchange (GSE), Abena Amoah.

Speaking at the media launch of the GFIM’s 10th Anniversary Celebration on Wednesday, November 5, 2025, Ms Amoah described the fixed-income market’s growth trajectory as phenomenal.

According to the MD, the Ghana Fixed Income Market (GFIM) has surpassed GH¢200 billion in trading volumes between January and October 2025, signaling a strong rebound toward pre–Domestic Debt Exchange Programme (DDEP) levels.

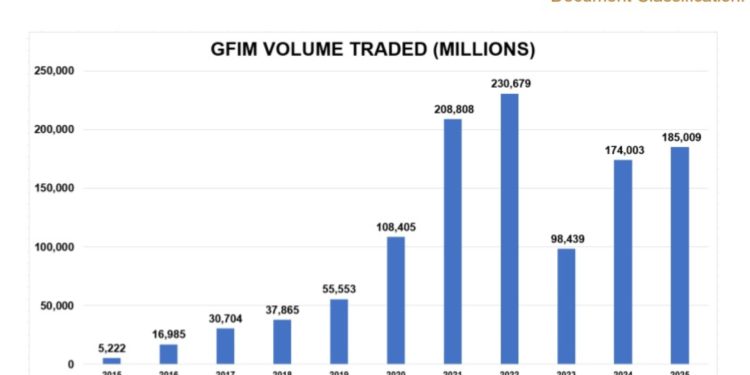

“From its humble beginnings in 2015, when 5.2 billion securities traded from August to December, the market enjoyed a positive growth trajectory peaking at 230 billion in volume traded in 2022,” she stated.

She added that the GFIM’s first major setback came in 2023, following the implementation of the DDEP, when trading volumes plunged to GH¢98 billion, down from GH¢230 billion the previous year.

“GSE’s markets can be a good barometer for what’s happening in the economy,” she said, noting that trading volumes rebounded by 76% in 2024 to reach GH¢174 billion, as market confidence began to recover under Ghana’s IMF-supported programme.

Corporate Capital Mobilisation and Economic Impact

Ms Amoah revealed that corporate issuers have raised more than GH¢24 billion on the GFIM to date, with tenors ranging from 150-day commercial papers to 10-year corporate bonds.

“The funding raised has contributed to growth in the real sectors of the economy — from providing loans to households and SMEs, supporting cocoa farmers, and enabling the production of fast-moving consumer goods Ghanaians love,” she noted.

Challenges and Future Outlook

Despite the progress, she acknowledged several hurdles constraining the market’s depth, including macroeconomic volatility, limited corporate issuance, and market concentration around government debt instruments.

Operational and settlement risks also remain, highlighting the need for continuous system upgrades and alignment with global standards.

Looking ahead, Mrs Amoah said the next decade of the GFIM will be defined by four key priorities:

- Deeper corporate market development to encourage more private-sector participation.

- Expansion of sustainable finance instruments such as green and social bonds.

- Regional financial integration under the AfCFTA framework.

- Adoption of fintech, blockchain, and data analytics to deepen transparency and efficiency.

Vision for the Next Decade

Outlining the Exchange’s vision for the coming ten years, Ms Amoah stated, “We want to see 10 million Ghanaians — up from the current 2 million — opening securities accounts and actively trading on the GFIM through technology and digital tools. We aim to grow the number of listed companies from 7 to 100, and encourage government to issue infrastructure bonds to fund key projects in roads, energy, schools and hospitals.”

She added that the GSE’s long-term goal is to build a vibrant, trusted, and inclusive fixed-income market capable of financing Ghana’s development needs in partnership with both public and private stakeholders.