Pandemic tests resilience and credibility of fiscal rules

Since 1990, a growing number of countries have adopted fiscal rules to strengthen budgetary discipline and enhance the credibility of public finances. These numerical limits on spending, deficits, or debt signal a government’s commitment to prudence. At the same time, fiscal councils are becoming more common to provide independent oversight and monitor the compliance of rules.

What happens when a country must respond to a large shock such as the pandemic? Governments must strike the right balance between the imperative of emergency support and the credibility of the rules-based fiscal framework.

Our new research shows how countries navigate this challenge—particularly during the pandemic. As the crisis wears on, high deficit and debt levels will further challenge the credibility of fiscal policy frameworks anchored by rules.

Large deviations

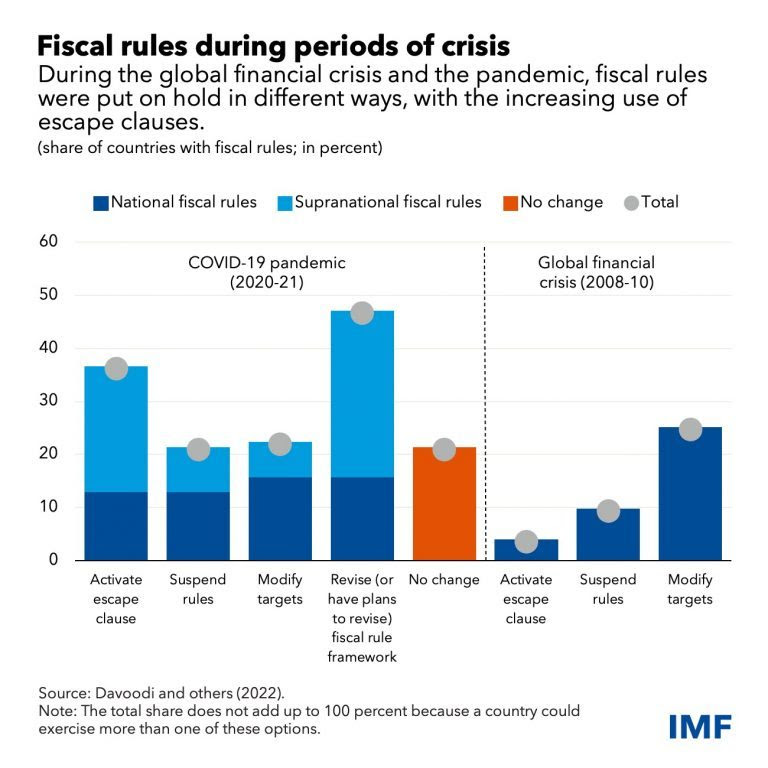

Governments have used all the flexibility of the rules to appropriately respond to the health crisis. Nearly 40 percent of economies with fiscal rules activated escape clauses during the pandemic, including the European Union, Jamaica, Paraguay and the United Kingdom. That compares with 5 percent during the global financial crisis, when these clauses were often not part of the framework.

These clauses permit a deviation from the numerical rules within the limits defined by the framework. Without such clauses, countries must resort to ad hoc suspensions or modifications of the rules.

Fiscal councils also played an important role by assessing the crisis-related policy responses and the appropriate use of escape clauses. These councils are independent, non-partisan agencies that provide fiscal oversight, including costing policy measures, assessing budgetary forecasts, and monitoring rules. Their role is key to ensuring the transparency and credibility of the framework. In some cases, they gave advice on the size and type of fiscal support and stressed the need for greater transparency of COVID-19 fiscal measures.

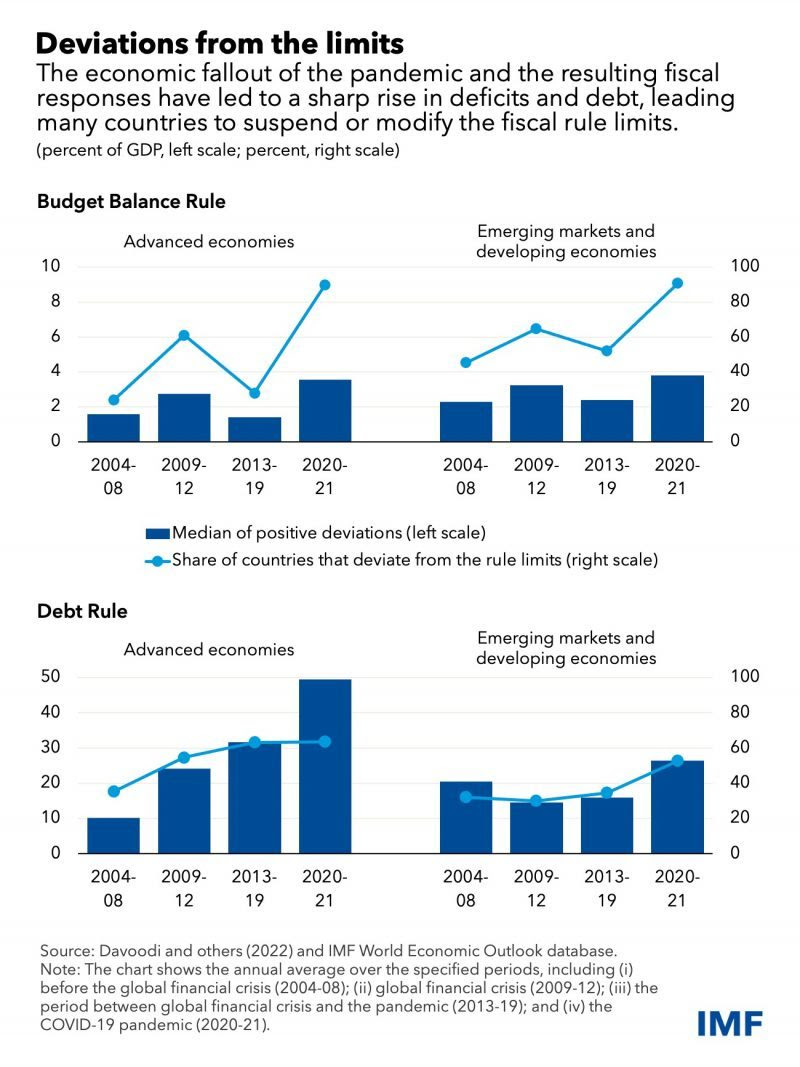

Read: Low real interest rates support asset prices, but risks are rising

The unprecedented rise of deficits and debts during the pandemic has led to large deviations from fiscal rules. In 2020, about 90 percent of countries had deficits larger than the rule limits—by about 4 percent of gross domestic product, on average—while public debt exceeded the limit for over half of the countries with rules in place. Public debt surpassed the limits by about 50 percent of GDP on average in advanced economies and by about 25 percent in emerging markets, adding to already large pre-crisis deviations.

The return to fiscal rules

A key challenge for many countries will be whether and how to modify the rules-based framework after major deviations.

Deviations from the rules—especially debt limits or anchors—are difficult to reverse. In the aftermath of the global financial crisis, for example, advanced economies slowly returned to pre-crisis deficit rule limits, but their debts remained elevated. In emerging markets and developing economies, deficits first declined toward the limits but then widened again after 2014 when commodities prices fell.

Governments face difficult choices in the post-pandemic environment. Regardless of the paths to reinstate or revise the rules, robust fiscal institutions and medium-term frameworks will be important to preserve the credibility of policies in the transition period. Empirical evidence suggests that deviations from deficit limits are associated with higher financing costs. A credible transition helps to limit the costs of public finance.

Countries could use this opportunity to further strengthen fiscal rules. While frameworks have been flexible during crises, they have failed to prevent a large and persistent buildup of public debt, even if debt service costs were contained, reflecting the trend declines in inflation and real interest rates.

Each country will have to choose its own path. But in all cases, effective rules-based frameworks require strong political commitment, including a good record of compliance, the right incentives to build buffers during good times, and well-designed escape clauses to manage large adverse shocks. Strengthening fiscal councils’ ability to operate independently and fulfill their mandates would also improve the credibility and accountability of policies.

New datasets

The IMF has just released updates of two global datasets on fiscal rules and fiscal councils.

Both are becoming a more common feature of policy frameworks globally. As of end-2021, about 105 countries had rules, an increase from fewer than 10 in 1990. The number of countries with fiscal councils has also risen from 19 in 2010 to 49 today.

The first dataset provides information on national and supranational fiscal rules in 106 countries from 1985 to 2021. It also presents details on the types and characteristics of rules, such as their legal basis, coverage, escape clauses, as well as enforcement procedures, and takes stock of key supporting features in place, including monitoring bodies and fiscal responsibility laws.

The second describes key features of fiscal councils as of December across the IMF’s membership. The dataset includes the main features of the council’s remit, their tasks, and channels of influence; and key institutional characteristics such as independence, accountability, and human resources.

These resources aim to help policymakers strengthen their fiscal governance on the basis of the best available international evidence.