Countries Are Pledging Money They Don’t Control at COP29

Over the next two weeks, nearly 200 countries participating in United Nations climate talks in Azerbaijan will negotiate a new, possibly multi-trillion-dollar annual finance goal to help the world’s poorest economies decarbonize and adapt to rising temperatures. But even though nations are doing the talking, much of the money isn’t going to be coming from governments.

Developed countries, feeling cash-strapped these days, are already telegraphing at the start of the COP29 summit that a large part of any finance promised through these negotiations will need to come from sources out of their direct control. That includes the private sector through loans and other “innovative” finance structures.

The complicated and costly proposal to deploy more private finance is already being opposed by highly indebted developing nations, which are pushing for a narrower goal that places emphasis on delivering publicly financed grants. The strategy also raises a fundamental question: How can nations commit third parties, which aren’t a part of the UN process, to mobilize hundreds of billions of dollars? The answer will be crucial in determining the credibility of any new pledge made in Baku this year.

In the diplomatic jargon of COP29, the main focus for the summit is to agree on a New Collective Quantified Goal on climate finance, which will replace a previous goal that promised $100 billion per year from rich nations to the developing world by 2020. Already there is distrust in the process. Developed countries came through two years late on their initial commitment, and some dispute whether the $100 billion per year milestone has in fact been met. Countries at this summit will be negotiating a much larger goal — currently placed at up to roughly $2 trillion per year.

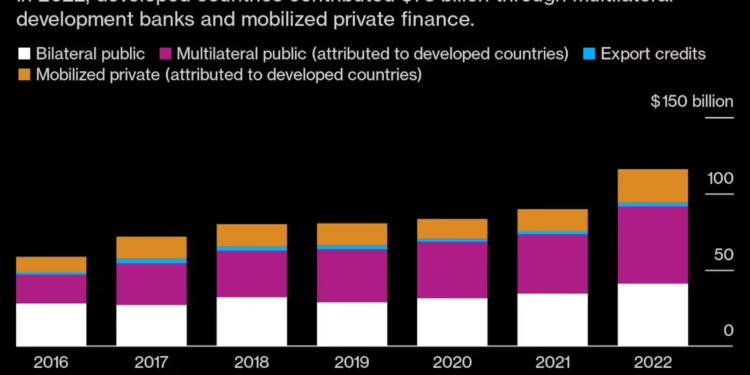

On the table is a greater role for private financial institutions and multilateral development banks such as the World Bank. In fact, even the last goal heavily relied on these parties. Of the $116 billion developed countries contributed in 2022, 63% came through through multilaterals and mobilized private finance, according to estimates from the OECD. Current proposals are for that to be scaled up dramatically, even as developing countries insist they cannot afford more loans. Some are already spending more on servicing their debt than on education or health.

Another glaring problem is that MDBs, banks and investors are not negotiating parties at UN climate talks. Nor are they under the COP’s direct control.

“It often seems to be the case that the UN system would like to tell the MDBs what to do, but it has very little leverage to make it happen,” said Chris Humphrey, senior research associate at think tank ODI Global and an adviser to the G20 on boosting MDB investing capacity. “That’s a long-standing tension.”

Countries can, to varying degrees, influence MDBs through their respective shareholdings. Rich nations could, for instance, commit to pay more into them. But MDBs are subject to their own governance structures and have other financing priorities too beyond climate change, such as alleviating poverty. A group of the world’s largest MDBs on Tuesday pledged $120 billion in annual climate finance by 2030, but stressed the capital restrictions they face for going further.

There’s also an enormous potential stumbling block created by former President Donald Trump’s return to the White House. The US is the largest shareholder in most non-European MDBs, including the World Bank, and future commitments to such funding activity under the Trump administration are in serious doubt.

The COP process has even less control over the funding flows of private financial institutions. Much of Wall Street has spent the past year rolling back its green commitments or betting against clean energy and climate tech. Bankers and investors have repeatedly made clear they will only put money where there’s profit.

Further complicating matters, there’s no universally agreed system in place for tracking public climate finance, meaning countries can already dispute when or if funding targets have been met. Adding more private finance to the mix, particularly if it’s not tied to public funds used to de-risk investments, will further obscure the picture. Green finance figures are often wildly inflated among banks and asset managers.

Still, providing funding through various layers of public and private finance — what’s been dubbed an “onion” approach — may be the only way to assemble large tranches of cash given strained national budgets. “If you consider concentric circles of influence and importance, where resources are being raised today is in the MDBs,” said Vera Songwe, co-chair of the Independent High Level Expert Group on Climate Finance. “It represents a way to get the kind of quantum we’re expecting.”

André Corrêa do Lago, secretary for climate, energy, and environment at the Brazilian Ministry of Foreign Affairs, is more skeptical. It’s “obvious” the private sector and development banks have a role to play in climate finance, Corrêa do Lago says, but their contributions need to stay out of the debate. He would prefer for countries to focus on what they can bring to the table, instead of trying to prove they can mobilize money from sources outside their own pockets.

“It cannot be about substituting the developed countries’ [contribution] with these development banks and new donors, it has to be additional,” he said. “Unfortunately, the way they are presenting it is not very convincing.”