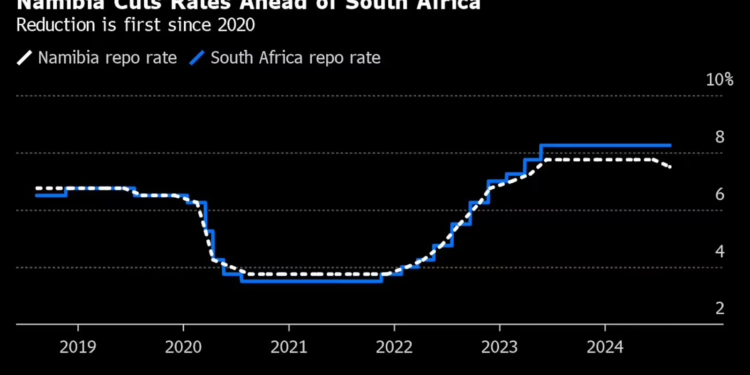

Namibia Splits From South African Rates For First Time In More Than A Year

The Bank of Namibia diverged from South Africa’s monetary policy for the first time in more than a year to bolster its economy and as it sees inflation moderating further.

The monetary policy committee cut the key rate by 25 basis points to 7.5%, Governor Johannes !Gawaxab told reporters on Wednesday. That’s in contrast to South Africa, which is yet to ease monetary policy.

Namibia’s monetary policy often tracks that of its neighbor because of its currency’s peg to the rand, but they have deviated when their inflation trajectories differ such as in April last year. The divergence means Namibia’s interest rate is now 75 basis points lower than South Africa’s.

The MPC expects the gap to be temporary. “As the monetary policy easing cycle progresses, the margin between the repo rates of the Bank of Namibia and the South African Reserve Bank will again narrow,” !Gawaxab said.

The median estimate of 11 economists in a Bloomberg survey is for South Africa to cuts rates in September.

Namibia’s central bank expects inflation to average 4.7% in 2024 and 4.4% next year, down from an earlier forecast of 4.9% and 4.5% respectively.

The rate cut should help support economic activity, said !Gawaxab. The central bank projects growth to decelerate to 3.1% in 2024 from 4.2% last year because of a slowdown in the primary industry and prevailing drought conditions.

International reserves increased to 60.8 billion Namibian dollars ($3.4 billion) by the end of July, from 55.6 billion Namibian dollars in May, enough to cover 4.1 months of imports and sustain the peg between the Namibian Dollar and the rand, Gawaxab said.