76% of global investors look set to grow their African investments – New study reveals

Global investors are set to see a significant increase in their African investments, with 76% either studying the markets, preparing for entry or readying to deploy additional investments into the continent.

This is according to the “World to Africa” report, an industry-wide study conducted by Standard Bank Group and the ValueExchange, in cooperation with the Bank of New York Mellon, Africa Venture Capital Association (AVCA), South African Venture Capital Association (SAVCA), Global Custodian and MiDA.

Investing in Africa is already a core activity for almost half of all global investors, particularly those in Europe. A further 36% of global investors are readying themselves to enter African markets – either through planned market entries or account activation in the region – highlighting the growing appeal of African markets to overseas investors.

The fact that this development is driven mostly by long-term, institutional investors is evidence that this growth is strategic more than opportunistic.

Although volumes of Africa-bound investments are yet to return to pre-pandemic levels, the study reveals that 34% of investors plan to increase their investments into Africa in 2022 – creating a major injection of liquidity into key markets.

Read: Cedi now among Africa’s worst performing currencies

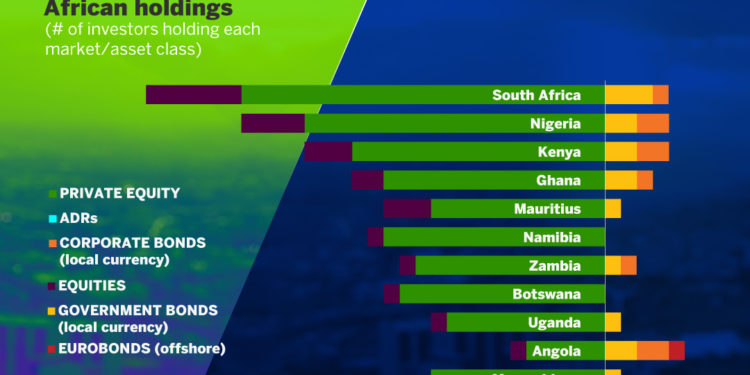

Whilst the majority of investors are focusing on South Africa, Nigeria and Kenya for these increased flows, sub-Saharan markets such as Botswana, Zambia and Namibia look set to benefit from growing investor confidence.

ESG and Fintech seen as major drivers

Projected investment returns from African markets is the key driver for foreign investment flows, but the appeal of Africa as an ESG-friendly destination is also driving increased interest. European investors and those from the Asia-Pacific region, who see ESG as the second-most important driver of Africa flows today, lead the way in this trend.

“This survey draws on views from over 220 institutions to give a uniquely comprehensive view of the drivers, challenges and triggers that Global Portfolio Investors face when looking at African markets. Ghana’s capital market is steadily developing and increasingly playing a pivotal role in attracting long-term capital for financing economic activities,” said William Sowah, Head, Investor Services, Stanbic Bank Ghana.

He added that, “To continue on the upward trajectory, stakeholders from the industry need to collaborate to discover new horizons that will deliver prospects for Ghana’s Capital Market. The survey findings awaken our market to the need to focus on removing liquidity impediments and hasten the pace of reforms.”

These investments are being directed into Africa’s rapidly growing technology and fintech sectors. Whilst portfolio investors are focused on govt bonds and a basket of technology, infrastructure and natural resource stocks, the appeal of fintech as the main target for all profiles of investment is clear – particularly for large North American investors seeking global diversification.

FX liquidity a core challenge

Despite the increased attention on Africa, not all global investors are ready to turn to the continent, 41% of new investors to Africa (and 27% of existing Africa-investors) see the current state of the continent’s foreign exchange regimes as being a core obstacle to investing. The research is clear that global investors will be strongly drawn toward countries that take action to drive local market reforms to increase and stabilise liquidity in the near future.

“The results of this research proves that the continent is full of investment opportunities that will drive Africa’s growth, and the global investment community has recognised this and is ready to realise Africa’s potential,” says Chaitanya.

The key findings from the World to Africa research campaign are available for download at www.thevx.io

About Standard Bank Group

Standard Bank Group is the largest African bank by assets, operating in 20 African countries and 5 global financial centres. Headquartered in Johannesburg, South Africa, we are listed on the Johannesburg Stock Exchange, with share code SBK, and the Namibian Stock Exchange, share code SNB.

Standard Bank has a 158-year history in South Africa and started building a franchise outside southern Africa in the early 1990s.

Our strategic position, which enables us to connect Africa to other select emerging markets as well as pools of capital in developed markets, and our balanced portfolio of businesses, provide significant opportunities for growth.

The group has over 50 000 employees, more than 1100 branches and over 6500 ATMs on the African continent, which enable it to deliver a complete range of services across personal and business banking, corporate and investment banking and wealth management.

Headline earnings for 2020 were R15.9 billion and total assets were R2.5 trillion (about USD170 billion). Standard Bank’s market capitalisation as of 31 December 2020 was R209.4 billion (USD14 billion).

The group’s largest shareholder is the Industrial and Commercial Bank of China (ICBC), the world’s largest bank, with a 20.1% shareholding. In addition, Standard Bank Group and ICBC share a strategic partnership that facilitates trade and deal flow between Africa, China and select emerging markets.

About the ValueExchange

The ValueExchange is an international market research and benchmarking company, focused on the global capital markets. Leveraging over 20 years of direct involvement in the securities industry, ValueExchange provides industry participants with unique, actionable insights that make the case for transformation.