Bright Simons Writes: KATANOMICS is Why Ghanaian Professionals Won’t Help GoldBod to Succeed

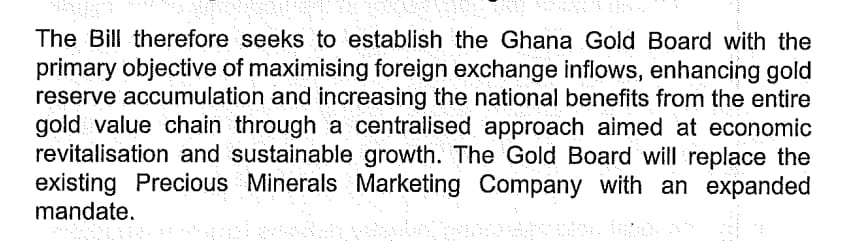

1. I recently wrote that Ghana’s new super-agency, the Gold Board (GoldBod), is a strange mishmash of commercial and regulatory entities rolled into one.

Here is that piece: https://brightsimons.com/2025/03/all-that-glitters-is-not-gold-initial-comments-on-ghanas-gold-board/

2. While conceding that the efforts made by the new government and the CEO-presumptive of the GoldBod to consult widely in their design of the GoldBod were a refreshing departure from what has been the case in recent years, I had other criticisms.

3. A. The 60-day timeline set by the govt for creating this complex entity was, in my view, rushed and arbitrary.

B. The lack of any serious policy document explaining how exactly the GoldBod will manage clear risks and achieve its objectives made it difficult for some of us in the policy community to participate in the consultation process despite sincere and earnest outreach by the govt to many stakeholders.

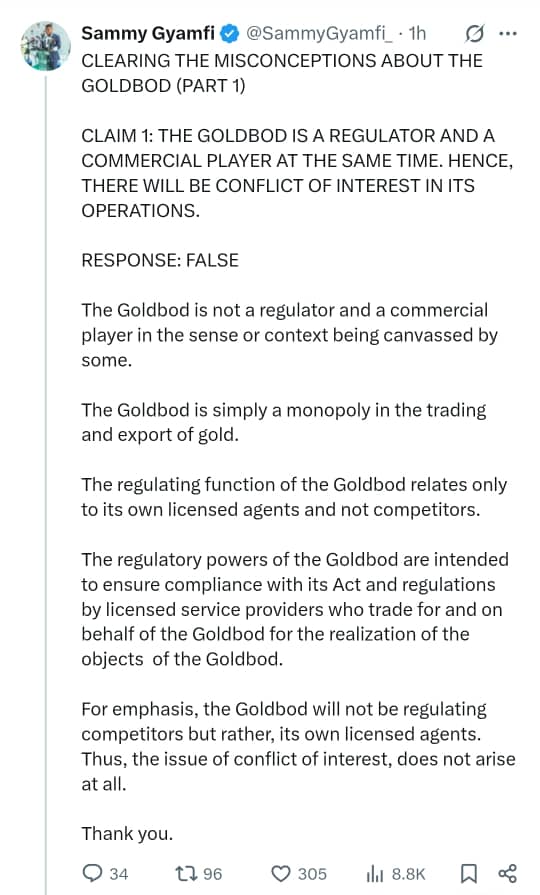

4. The CEO-presumptive of the GoldBod has written publicly to dispute my claims (see attached) that the GoldBod has a regulatory mandate. A respected technical advisor at the Finance Ministry has also shared his view privately, which is to the effect that the GoldBod is not commercial in nature. Rather, it has a policy function: to support the domestic currency through gold reserves accumulation.

5. In a country where politics flow from policies and policies flow from politics (i.e. in a SYNCHRONOMIC society), an explosive debate would have ensued given the sheer enormity of the GoldBod’s mandate and the criticality of its failure or success. The media, political actors, academia, and professional groups in related industries would all have jumped in.

6. The situation in Ghana is however one that can best be explained by the term “KATANOMICS”, as explained in my previous articles. Thus, a policy issue such as the actual character and goals of a major super-agency allocated ~1.8 BILLION GHS of Ghana’s scarce public funds and endowed with an expansive mandate to prevent another fiscal crisis won’t get the attention it deserves from informed citizens. Policy is NEVER high-stakes enough in Ghana because there is virtually no osmosis between it and politics, where, as in most societies, the high-stakes allocation of resources and power happen.

7. Despite this sad situation, some of us are condemned to keep trying to elevate policy and force its content into the political cycle and structure. For that reason, I am replying Ghana’s upcoming Gold Boss (GoldBossu) and his esteemed advisors. 😊

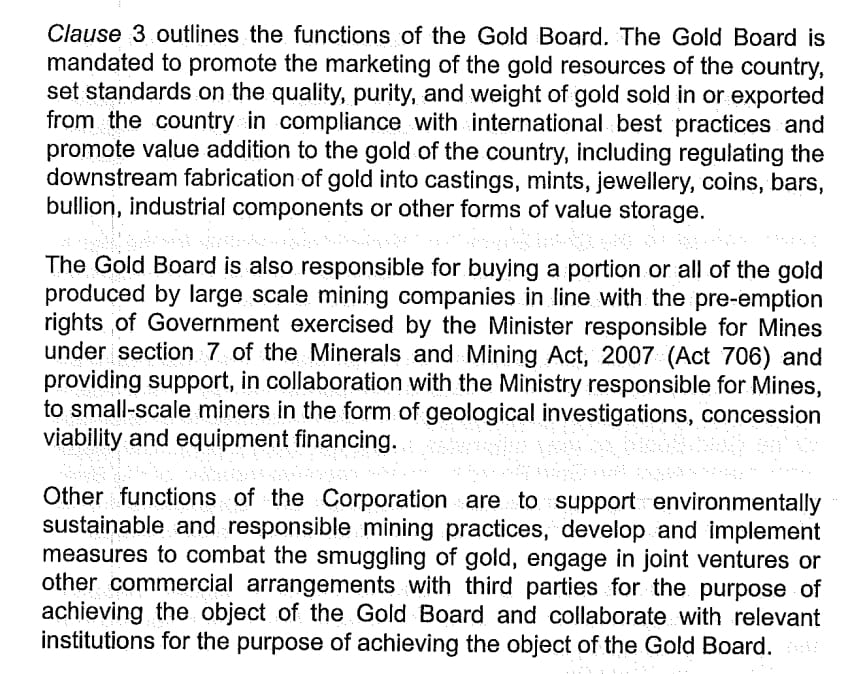

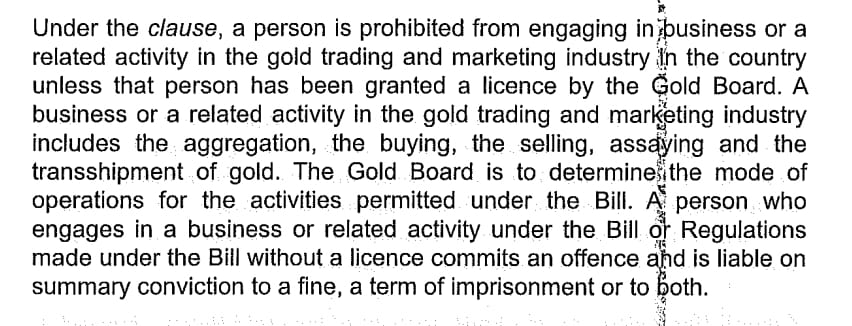

8. GoldBod is a regulator because it is described as such in the memorandum to the draft law as sent to Parliament. It is expected to regulate all industrial applications of gold in Ghana, set standards, assess quality, apprehend offenders, monitor compliance, and sanction deviations. These are all classic regulatory functions.

9. GoldBod regulates the same entities with which it does business: the various licensees, ranging from aggregators to processors. It sets prices, negotiates delivery terms, contract on logistics, loan money to the licensees and small-scale mines, charge interest or gain equity on its active financial investments, etc. Then the same GoldBod turns around to REGULATE these same counterparties.

10. GoldBod’s CEO’s claim that the sprawling entity is NOT a regulatory body is thus clearly NOT supported by the Finance Minister’s memorandum to Parliament and the plain text of the DRAFT law. If there have been any last-minute changes, then we need to know.

11. Having such broad powers to enforce laws, regulations, and standards on industry; and to apply sanctions against offenders and deviants are all classic regulatory domains.

12. After licensing companies to buy, aggregate, move & process gold, GoldBod also enters into trading, lending, and logistical transactions with them. Then it monitors their compliance with regulations and standards, some of which it has set. If there are disputes, its own set of rules and adjudicators steps in. Huge moral hazards are clearly possible as, for example, when a company that buys a lot of gold for GoldBod also happens to be reckless in not conforming with high standards. In fact, a company may actually be very efficient as an aggregator precisely because it dispenses with inconvenient regulations (like auditing it’s supply chain more rigorously to screen out galamsey gold.) Will GoldBod have the moral courage to clamp down on such a company?

13. Imagine being a company in the gold business, trading with or borrowing money from the GoldBod. Woe betides you if you fall out with it! Say, some crooked staff of the GoldBod lies about the weight, content, or purity of a delivery. Or you refuse to grease some inspector’s palms. Or anything at all. You will be fighting with the only entity that exports small-mine gold, issues licenses, and also monitors compliance! What chance do you stand?

14. As for GoldBod’s commercial character it is too obvious for debate. It can’t lose money on the gold it buys to export. It can’t lose money on the loans it makes to aggregators to mobilise gold on its behalf. It can’t lose money on investments it makes into mines. If you spend money that you need to recover at all cost and even grow it, then you are in a commercial line of business.

15. Furthermore, GoldBod needs powerful commercial instincts to buy and export gold without making massive losses.

16. Gold has high price volatility. Timing is everything. Which means you can’t trade at fixed volumes & intervals like the Finance Minister supposes. Gold is now in a bull phase but a bearish downturn is possible at any moment. Without a strong and competent commercial strategy, one can lose massive amounts of money.

17. We are told that the main goal of GoldBod is to amass gold to support the Cedi against the Dollar. Gold prices are inversely correlated with the Dollar. So, when the Dollar is strong, gold prices tend to be lower. But it is that time that the Cedi needs the most support. It takes serious commercial skill to navigate this conundrum.

18. Gold prices are also usually inversely correlated with US interest rates. However, when US interest rates go up, the Cedi tends to get hit. Yet, that is when gold sometimes also gets into trouble. Hence, it takes serious commercial savvy to get the timings right. It is not surprising that two Ghanaian agencies that have dabbled in gold trading in recent times, MIIF and the Bank of Ghana, strenuously refuse to publish their trading book and results.

In short, a non-commercial entity would struggle to do what GoldBod is meant to do.

Very sad, then, that Katanomics prevents serious debate in Ghana about so critical a policy.

Bright Simone’s behavior as if he is the only learned and intelligent person in Ghana He always find issues with government policies.. this time we are going to give him the Goldbod to manage so we see how he can use his intellect to make this policy beneficial to Ghana. wisdom is different from book knowledge he must understand this .. There is any single policy of that he has not had a problem with always try it down play it and punch holes ..having control over the English language does mean you know everything.how far with his healthcare organization and iman Ghana. He should give us a break.. we are going to try if we fail so be it if we succeed.. Amen..