Nigeria’s mixed messages on interest rates are causing a problem

Nigeria is sending mixed signals on interest rates even as investors wait to hear from the central bank, which has not held a monetary policy meeting since July.

The central bank is offering short-term paper in auctions of its so-called OMOs — which refers to open market operations and are supposed to be for managing market liquidity — at far higher yields than government debt with similar tenor.

This week it sold 365-day OMOs, which it issues to banks and offshore investors, at 17.5%. It also sold government Treasury bills of the same tenor at 8.39%. The government bills, despite their lower yield, are bought heavily by domestic pension funds who are limited in their investment options.

“From the central bank side, they want rates to go up,” said Sunmbo Olatunji, group head of treasury at Access Bank Plc. Speaking at an investor conference Wednesday in Lagos, she also said that the regulator has removed the cap on interbank borrowing rates which was previously in place.

Now the interbank rate can go as high as 22-23%, she said, “so the central bank is basically allowing the forces of supply and demand to dictate and determine where rates could be.”

At the monetary policy committee in July, the central bank raised the benchmark rate to 18.75%. Since then, inflation has accelerated to a 27-year high of 28.9%. The uptick has in part been fanned by reforms introduced by President Bola Tinubu, who abolished fuel subsidies and eased the country’s exchange-rate regime after taking office in May.

Surging inflation has raised expectations that the West African nation will hike rates aggressively.

While it has yet to schedule the next meeting of the MPC — which by law only has to meet four times a year – the central bank has hinted that rates will have to go up.

But some government officials are publicly voicing their doubts.

Raising interest rates will lead to a “significant increase in debt service and a growth in the fiscal deficit, without the commensurate pump in savings,” Ben Akabueze, director general of the budget office, told an event in Lagos. “While the monetary authority is arguing that way, we on the fiscal side say no, we don’t see that this is the likely impact,” Akabueze said.

Nigeria has a debt servicing problem, which consumed almost all of the government budget last year, and Tinubu promised to lower rates while he campaigned for the presidency.

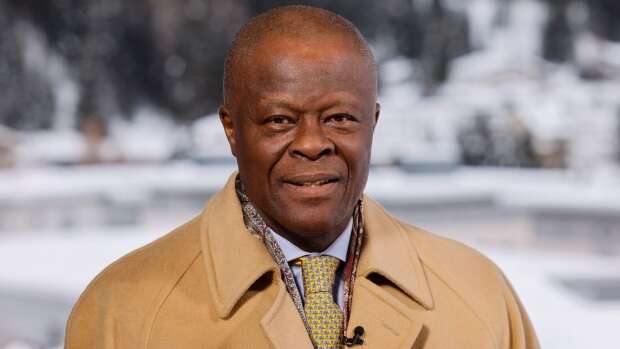

Finance Minister Wale Edun, speaking to Bloomberg Television Wednesday in Davos, offered a more nuanced explanation.

“We have an autonomous central bank, so the instruments of monetary policy – interest rates, money supply – are controlled by them,” he said. “But of course, it is one government and the objectives of the government, whether fiscal or monetary policy, are set by the government itself.”

He said that the need to stabilize the naira and attract foreign investment means “the direction of interest rates, in the short term, naturally is upwards.”

He also said the central bank’s policy committee has typically met every two months “so I’m sure one is imminent. And I’m sure it will be very rich in what it tells investors.”

Still, monetary policy isn’t very effective in Nigeria, a challenge shared by other nations in the region where the share of the population with access to credit is small, muting the impact of policy changes.

“Nigerian is not a credit economy; there are no mortgages, credit cards that will change your behavior when the interest rate goes up,” said Taiwo Oyedele, chairman of the Presidential Fiscal Policy and Tax Reforms Committee.

Steadying the naira means boosting foreign investment to ease a local shortage of dollars, which has contributed to its 46% decline against the US currency since exchange rules were eased in June.

But that means narrowing the gap between inflation and the central bank’s policy rate, which currently stands at more than 10 percentage points. That makes Nigeria’s real, or inflation-adjusted interest rate, deeply negative, discouraging investment.

“There needs to be some level of harmonization between monetary and fiscal,” said Ayodeji Dawodu, //director of fixed income for Central and Eastern Europe, Middle East and Africa// at BancTrust & Co. Investment. “The lack of clarity on policy is a concern.”

Inconsistency between the central bank’s OMO auctions, and the much lower yields offered on government debt auction, is compounding that problem, said Razia Khan, chief economist for Africa and the Middle East at Standard Chartered Bank.

She said that until there is better signalling of monetary policy intent, which an MPC meeting would help, Nigeria is taking the pain of currency liberalization, with the naira weakening to record levels, without the benefits of attracting capital inflows.

“Meaningful monetary tightening is a pre-requisite to the ultimate success of FX liberalization, with all of its long-term economic benefit,” she said. “An MPC meeting would be helpful.”