Recession fears set to split stocks and bonds after summer rally

It’s been a summer season of affection for each shares and firm bonds. But with fall nearing, equities are set to fade whereas bonds strengthen as central financial institution tightening and recession fears take maintain as soon as once more.

After a brutal first half, each markets had been primed for a rebound. The spark was lit by resilient earnings and hopes {that a} slight cooling in rampant inflation would get the Federal Reserve to gradual the tempo of its fee hikes in time to avert an financial contraction.

A close to 12% advance in July and August has put US shares on the right track for one in every of their finest summers on file. And corporations’ bonds have gained 4.6% within the US and 3.4% globally since bottoming out in mid-June. Having moved in tandem, the two are actually set to diverge, with bonds trying higher positioned to lengthen the rally because the sprint to security in an financial downturn will offset an increase in danger premiums.

The financial outlook is as soon as once more cloudy as Fed officers have indicated they’re not eager to cease tightening till they’re positive that inflation received flare up once more, even at the price of some financial “pain,” in accordance to Wei Li, international chief funding strategist at BlackRock Inc.

For authorities bonds, which means a possible flight-to-safety that will additionally profit debt from funding grade companies. But for shares, it’s a danger to earnings that many buyers could also be unwilling to bear.

“What we’ve seen at this juncture is a bear market rally and we don’t want to chase it,” Li stated, referring to equities. “I don’t think we’re out of the woods with one month of inflation cooling. Bets of a dovish Fed pivot are premature and earnings don’t reflect the real risk of a US recession next year.”

The second-quarter earnings season did a lot to restore religion within the well being of company America and Europe as corporations largely proved demand was sturdy sufficient for them to go on increased prices. And broad financial indicators — such because the US labor market — have held up strongly.

But economists forecast a slowdown in enterprise exercise from right here on, whereas strategists say corporations will battle to hold elevating costs to defend margins, threatening earnings within the second half. In Europe, Citigroup Inc. strategist Beata Manthey sees earnings falling 2% this yr and 5% in 2023.

And whereas buyers in Bank of America Corp.’s newest international fund supervisor survey have turned much less pessimistic about international progress, sentiment remains to be bearish. Inflows to shares and bonds recommend “very few fear” the Fed, in accordance to strategist Michael Hartnett. But he reckons the central financial institution is “nowhere near done” on tightening. Investors can be scouring for clues on that entrance on the Fed’s annual Jackson Hole gathering this week.

Hartnett recommends taking earnings ought to the S&P 500 climb above 4,328 factors, he wrote in a current observe. That’s about 2% increased than present ranges.

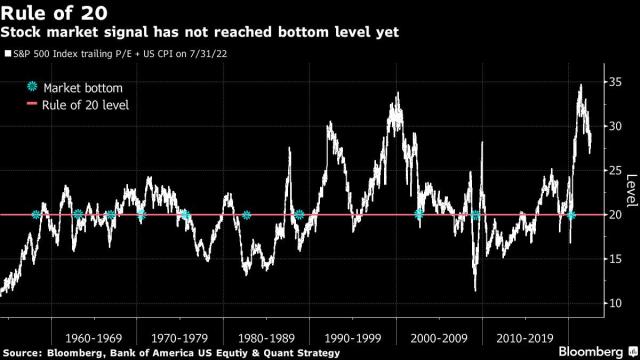

Some technical indicators additionally present the US shares will resume declines. A measure from Bank of America that mixes the S&P 500’s trailing price-to-earnings ratio with inflation has fallen beneath 20 earlier than every market trough because the Fifties. But throughout the waves of promoting this yr, it solely acquired as little as 27.

There’s one commerce that might provide an enormous help to equities. The so-called progress shares together with expertise behemoths Apple Inc. and Amazon.com Inc. have been seen as a relative haven. The group has led the current inventory rally, and strategists at JPMorgan Chase & Co. count on it to hold climbing.

In the bond world, the layers that make up an organization’s borrowing prices look set to play into buyers’ arms. Corporate yields comprise the speed paid on related authorities debt and a premium to compensate for threats like a borrower going bust.

When the economic system falters, these constructing blocks have a tendency to transfer in reverse instructions. While a recession will elevate considerations about companies’ capability to repay their debt and widen the unfold over secure bonds, the flight-to-quality in such a state of affairs will cushion the blow.

“The potential damage to investment grade seems limited,” stated Christian Hantel, a portfolio supervisor at Vontobel Asset Management. “In a risk-off scenario government bond yields will go lower and lessen the effect of wider spreads,” stated Hantel, who helps oversee 144 billion Swiss francs ($151 billion).

This profit from falling authorities yields in case of a downturn notably impacts high-grade bonds, that are longer-dated and provide thinner spreads than junk-rated counterparts.

“There is a lot of risk around and it feels like the list is getting longer and longer but, on the other hand, if you are underweight and even out of the asset class, there is nothing more you can do,” stated Hantel. “We have been getting more questions about investment-grade, which signals that at some point we should get more inflows.”

To ensure, the summer season rebound has made entry factors in company bonds much less interesting for these courageous sufficient to dive again in. George Bory, head of fastened revenue technique at $476 billion cash supervisor Allspring Global Investments and a bond evangelist in current months, has considerably tempered his enthusiasm relating to credit score and rate-sensitive bonds as valuations not look notably low cost.

Still, he holds on to the bullish views he first expressed earlier this summer season after the bond selloff despatched yields flying to ranges that might even beat inflation.

“The world was becoming a more bond-friendly place and that should continue in the second half of the year,” he stated.