Republic Bank Ghana Posts Strong Q1 Profit Amid Tight Credit Environment

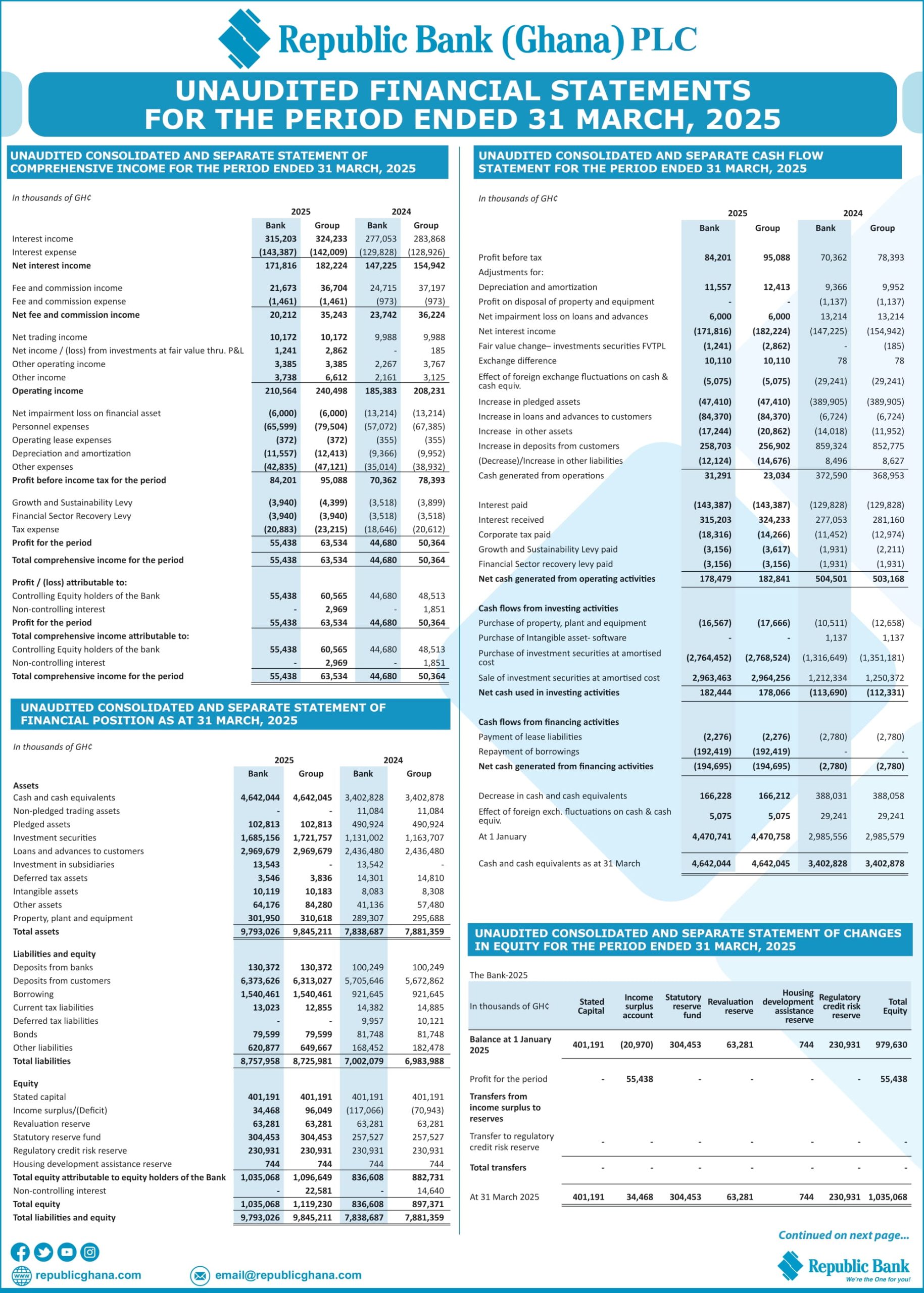

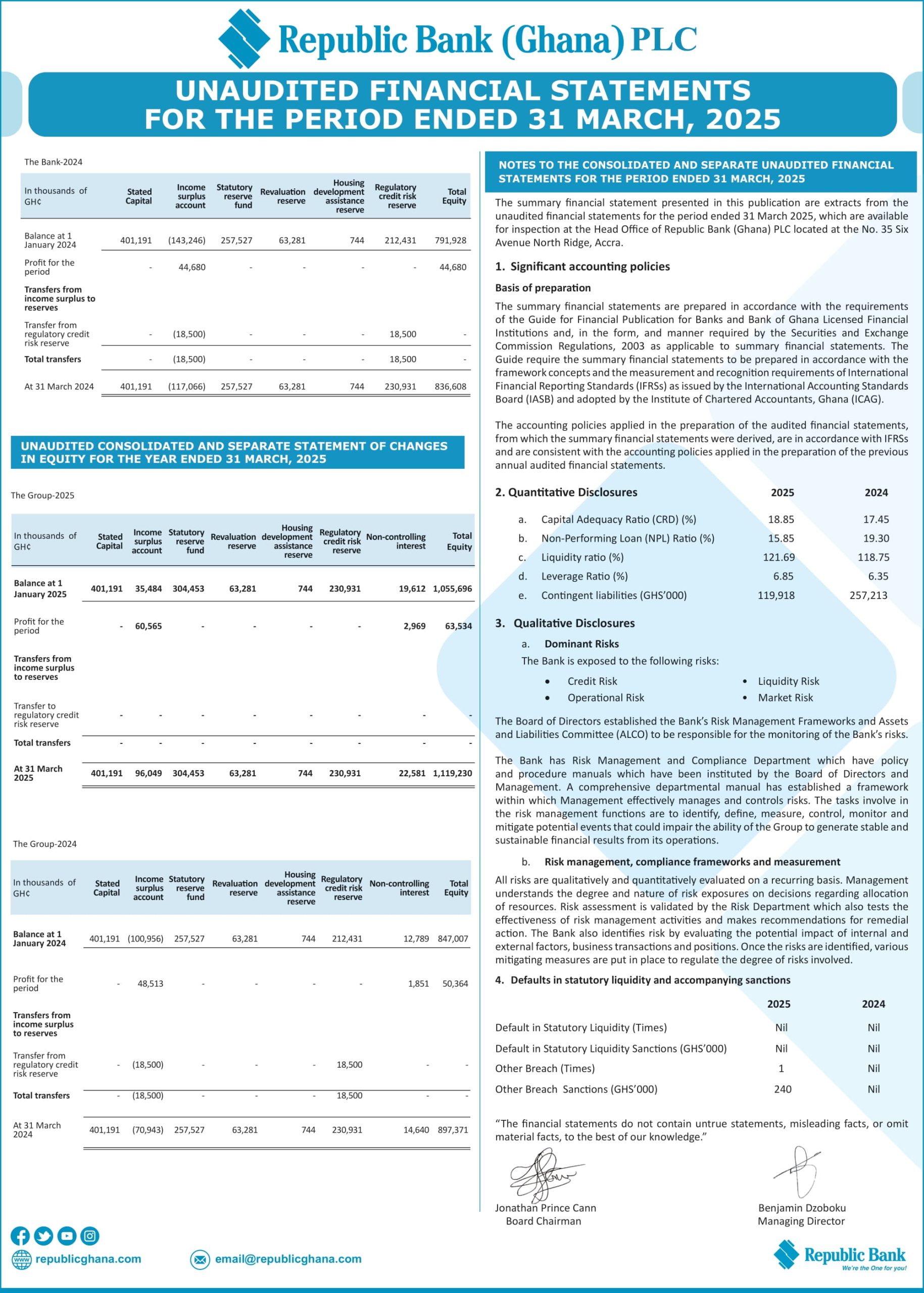

Republic Bank Ghana PLC has reported a solid first-quarter performance for the financial year 2025, recording a 63.5 million Ghana cedis profit at the group level, a 26.1% increase compared to the 50.4 million cedis posted in the same period in 2024. The achievement comes despite a challenging macroeconomic backdrop and tight credit conditions.

The bank’s net interest income rose 17.6% year-on-year to GH¢182.2 million, up from GH¢154.9 million, supported by higher interest rates and increased lending activity. Total interest income stood at GH¢324.2 million, driven by a surge in loans and advances to customers, which grew from GH¢2.4 billion to GH¢3.0 billion, representing a robust 21.9% year-on-year expansion.

“We are pleased with the resilience of our core operations,” said Managing Director Benjamin Dzoboku, highlighting the bank’s improved cost efficiency and asset quality. “Our performance reflects disciplined risk management and a strong deposit mobilization drive.”

Fee Income Rebounds; Impairments Narrow

Net fee and commission income slightly declined at the bank level but remained strong at the group level, totaling GH¢35.2 million, nearly flat from GH¢36.2 million in Q1 2024. Trading income held steady at GH¢10.2 million, while investment-related income rebounded sharply to GH¢2.9 million, driven by gains on fair-value-through-profit-and-loss (FVTPL) securities.

Crucially, impairment losses on financial assets dropped by more than 54%, down to GH¢6 million from GH¢13.2 million, underscoring improving asset quality. The bank’s non-performing loan (NPL) ratio improved significantly to 15.85% from 19.30% a year earlier, even as total loans expanded.

Cost Discipline and Regulatory Resilience

Total operating expenses for the group rose to GH¢139.4 million, compared to GH¢120.6 million last year, due largely to increased personnel costs and depreciation charges. Nonetheless, the bank maintained profitability, reporting a pre-tax profit of GH¢95.1 million, up 21.3% year-on-year.

Republic Bank’s capital adequacy ratio (CAR) stood at 18.85%, well above the regulatory minimum, while its liquidity ratio reached 121.69%, reflecting a strong buffer in the face of financial volatility.

Despite the bank maintaining regulatory compliance on all fronts, it disclosed a single breach unrelated to statutory liquidity, which incurred a modest GH¢240,000 sanction.

Deposits, Liquidity, and Investment Activity

Customer deposits rose by 11.3% year-on-year to GH¢6.31 billion, reflecting continued customer confidence. Borrowings, however, saw a significant increase to GH¢1.54 billion from GH¢921.6 million, likely due to funding for expanding lending operations.

Investment securities increased to GH¢1.72 billion, and cash and equivalents rose sharply to GH¢4.64 billion from GH¢3.4 billion, indicating ample liquidity. The bank also recorded strong positive cash flow from operations, totaling GH¢182.8 million.

On the investment side, the bank was aggressive, with GH¢2.96 billion worth of securities sold and GH¢2.77 billion purchased, suggesting proactive portfolio reshuffling amid fluctuating market yields.

Forward Outlook

Analysts believe the bank is strategically positioned to capitalize on Ghana’s anticipated economic rebound in H2 2025, especially if inflation and lending rates stabilize.

However, managing asset quality will remain a key concern, especially as sector-wide restructuring efforts and currency depreciation pressures continue to affect loan recoveries.

Board Chairman Jonathan Prince Cann reaffirmed the board’s commitment to sustainable growth and strong governance, adding that Republic Bank’s forward strategy will emphasize “resilience, digital transformation, and inclusive banking.”