Republic Bank MD urge government to help renewable energy firms tap into $200m green financing fund

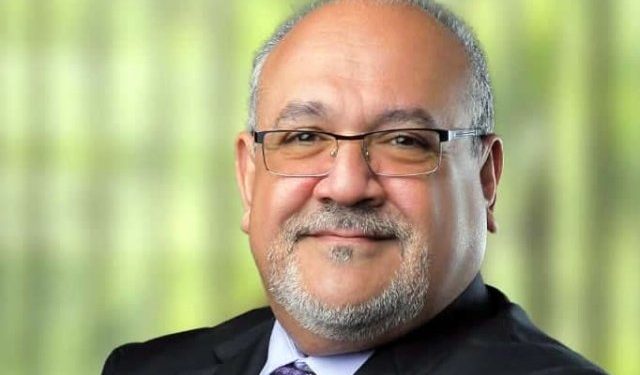

Managing Director for Republic Bank Ghana, Farid Antar, has called on government to put in place a regulatory framework that will allow renewable energy companies in Ghana take advantage of a $200 million fund set up by the Republic Bank Group.

According to Mr Antar, the fund set up by the Republic Bank Group, forms part of the Group’s commitment to green financing and broadly climate change action.

Speaking to norvanreports in an exclusive interview, Mr Antar noted that countries such as Barbados have put in place regulations that allow renewable energy companies to produce energy to be sold to the national grid and be financed by banks of which the Republic Bank is one, further pointing out that, that is not the case in Ghana.

“The group has set aside $200 million, which we are going to use to finance green projects, in Barbados for instance the Group inaugurated an innovative solar and alternative energy generating project which can sell the power it generates to the national grid and that was made possible because there are certain regulations in the country that allows for that.

“With Ghana, already the IPPs are allowed to sell to the grid which is good because in such an environment then anyone with clean energy can sell to the grid, but credit to these companies might not be readily available [sic],” he stated.

Adding that the Bank in view of the challenge is engaged in discussions with relevant authorities to make it easier to lend to renewable energy companies in the country.

Investments into the country’s renewable energy sector particularly in solar energy projects over the last decade according to the Ghana Investment Promotion Centre (GIPC) has reached $2 billion.

According to the Head of Research and Business Unit at the Ghana Investment Promotion Centre (GIPC), Eugenia Okyere, these investments are in only 29 renewable energy projects spread across the country with some of the projects yet to commence.

Ghana’s renewable energy sector was in 2018 ranked 72nd in terms of total energy production globally, the first in West Africa and fifth in Africa for the ability to provide sustainable energy.

With regards to where to invest on the African Continent in renewable energy, Ghana presently ranks first in West Africa, 12th in Africa and 88th globally.

Read: Nigeria needs $1.5 trillion to close Infrastructure deficit in ten years – Buhari

Meanwhile, the Energy Commission is said to have suspended the licenses of members of the Association of Ghana Solar Industries (AGSI).

The suspension of licenses by the Commission, the Association notes in a petition to the Commission, has negatively impacted the operations of its members, adding the decision is retrogressive to gains made by the country in promoting renewable energy.

In a letter to the Executive Secretary of the Energy Commission, the Association following the suspension of licenses for its members requested for the immediate intervention of the Commission to revert the decision which threatens the growth of the industry.

“We are hereby humbly calling on your outfit as a matter of urgency to revert this decision and restore our industry back to the path of growth,” read parts of the petition.

Information reaching norvanreports indicate that the suspension of the licenses of the members of the AGSI is due to the fact that some Electricity Distribution Companies “are not happy with the way Bulk customers are taken away from them hence denying them the anticipated revenue.”

Also, the Electricity Company of Ghana (ECG) in particular feels that the operation of solar companies is a threat to their business in general and in particular inimical to the renegotiation of Power Purchase Agreements which has resulted in some excess capacities in the system.