The Republic Bank Ghana, is offering salaried employees as well as Small and Medium-sized Enterprises (SMEs) in the country, loans bearing interest rates of 19 per cent in its Christmas Loan Sale Campaign for this year.

Salaried workers as well as owners of SMEs who apply for the Christmas loan, aside having the loan approved for them on the same day will also enjoy three months loan moratorium – that is applicants will begin repayment of loans after three months.

SMEs through the Christmas Loan Sale Campaign can apply for a loan amount of up to Ghs 1 million. The loan amount the bank says, is to help owners of SMEs seeking to expand their businesses during the Christmas season and beyond.

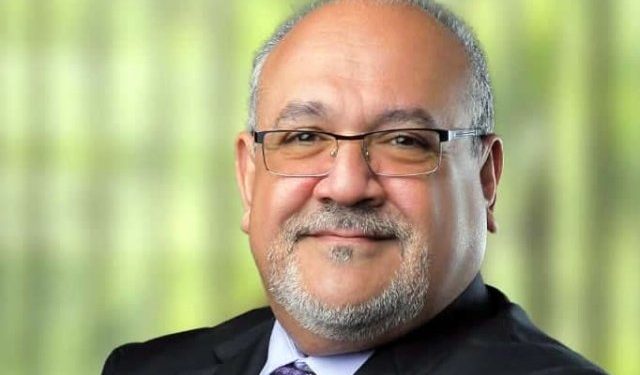

Managing Director of Republic Bank Ghana, Farid Antar, speaking at the launch of the campaign which begins this October and ends January 2021, noted this year’s Christmas Loan Sale forms part of Republic Bank’s Covid-19 reliefs to Ghanaians.

Republic Bank promised to weather the storm with Customers during the prefatory stage of the Covid-19 pandemic in Ghana. We did this by being the first Bank in Ghana to announce a Moratorium and other Covid-19 relief packages. As we adjust to living in a post-covid-19 era, there is a need for us to prove even further that we are the one for our Customers and Ghanaians as a whole. That is why this year, despite market volatility, we will run the Christmas Loan Sale Campaign from October to January 2021,

Farid Antar, MD, Republic Bank

The Republic Christmas Loan is an annual loan sale campaign run by Republic Bank. This is the third year since the launch of the campaign in Ghana.

The Loan is available to all qualified Ghanaians, customers and non-customers of Republic Bank and can be accessed from any of the 41 Republic Bank Branches nationwide or from the Bank’s website www.republicghana.com