Resource nationalism on the rise in top mining countries — Report

The last year has seen a rise in resource nationalism — or the risk of thereof —in an extensive and fast-rising number of countries, including top mining countries, market analyst Fitch Solutions finds in its latest industry report.

While resource nationalism had been relatively contained geographically speaking in the past to Sub Saharan Africa, and localised countries such as Indonesia, it is spreading across the world and is now noticeable in SSA (the DRC, Mali, Zimbabwe, South Africa, Guinea), Latin America (Mexico, Peru, Chile), North America (the US), Europe (Russia) and Asia (Indonesia, Mongolia), Fitch reports.

The analyst has long argued that resource nationalism in the mining sector was going to remain a key feature of the sector. In the wake of covid-19, Fitch raised the probability of a rise in resource nationalism on a global basis.

Over the past 12 months, resource nationalism in top mining players has flared up around the world, mostly in emerging markets. Fitch expects this trend to continue over the coming few years, as underlying drivers of resource nationalism and government intervention will remain in play.

Resource nationalism can take several forms, including renegotiation of existing mining contracts to get better terms (currently witnessed in the DRC and Mongolia), increase in taxes or royalties on the mining sector (Chile, Peru, Russia), asset nationalization (forced equity transfers) or the threat of (Zambia, Mexico, Zimbabwe), in- country beneficiation (Indonesia), or export restrictions.

Drivers of resource nationalism remain in play in 2022

A number of factors will incentivise governments to consider intervening in the mining sector and tightening mining regulations, Fitch says, noting that several of those drivers have been clearly accentuated in recent quarters, mostly by the covid-19 pandemic.

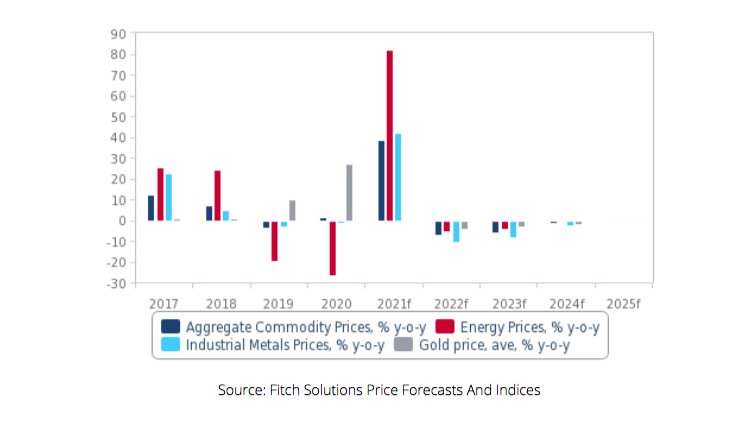

The rally in mineral and metal prices in 2020-2021 has revived the interest in the mining and metals sector and boosted potential tax and royalty returns for governments. Fitch forecasts prices to remain elevated in 2022.

Read Also: Longer delivery times reflect supply chain disruptions

Improved prospects for the Green Energy Transition minerals such as copper, nickel, lithium, cobalt, among others, amidst the ongoing acceleration in decarbonisation efforts at multiple levels.

This is leading to a sharp rise in investment in new projects towards these materials, prompting governments to make sure their countries benefit from these trends, Fitch says.

Increased economic/fiscal hardships and rising social inequality in the wake of covid-19 are providing strong incentives for a rise in government intervention in the mining sector.

Another key driver of resource nationalism is political risk linked to elections, Fitch notes.

The recent election of left/ social-leaning governments, in the US and Peru for example is a factor behind potential changes to mining regulations in these countries. Sudden changes in governments, which have happened in some countries recently, also usually increase risks of a change in regulation. Mali for example, saw two coups in 2020-2021.

Finally, contested campaigns also increase nationalism rhetoric ahead of the elections in order to gain support, Fitch forecasts.

This happened in Zambia in 2020-2021 for example, when former President Lundu used a nationalistic rhetoric ahead of the August 2021 elections.

While elections happen on a regular basis, their convergence with economic hardships and social tensions over rising inequalities pose an increased risk of resource nationalism, the analyst asserts.