Rising Rates May Trigger Financial Instability, Complicating Fight Against Inflation

Before the pandemic, investors worried about how persistently low inflation and interest rates would crimp bank profits. Paradoxically, they also worried about bank profitability when post-COVID reopening sent inflation and central bank interest rates soaring. The failure of Silicon Valley Bank and other US lenders in early 2023 appeared to validate these fears.

Our new research on the relationship between inflation and bank profitability helps us make sense of these concerns. Most banks are largely insulated from shifts in inflation—the exposure of income and expenses tend to offset each other. Yet some have significant inflation exposures, which may lead to financial instability if concentrated losses lead to wider panics in the banking sector. As several major central banks are reassessing their monetary policy frameworks in the aftermath of the post-pandemic inflation surge, a deeper understanding of the links between inflation and bank profitability can help design better monetary policy frameworks.

Our findings imply that central banks may need to consider financial stability when setting their policy stance to combat inflation.

Inflation matters

Does inflation matter for bank profitability? This question has received surprisingly little attention. We answer it by combining balance sheet and income data for more than 6,600 banks in advanced and emerging economies with nearly three decades of IMF economic data.

Most lenders appear largely hedged against inflation with both bank income and expenses rising with inflation to similar degrees. Income and expenses tied to borrowing and lending are exposed indirectly to inflation, because they primarily react to policy rates that fluctuate in response to inflation. In contrast, other income and expenses—revenues from non-traditional banking activities, services, salaries, and rent—are exposed directly to price changes.

At the country level, the impact of inflation on bank income and expenses individually varies widely across banking systems. Shifts in inflation are reflected in income and expenses much more rapidly in some countries than in others. But, again, since both income and expenses rise with inflation to similar degrees in most countries, most banking systems appear largely hedged to inflation.

Concentrated exposures

So, can inflation be a cause for concern?

Our research identifies specific vulnerabilities: some banks are particularly susceptible to inflation due to different risk management and business models. Outliers in both advanced and emerging market and developing economies stand to see large losses when inflation and interest rates spike.

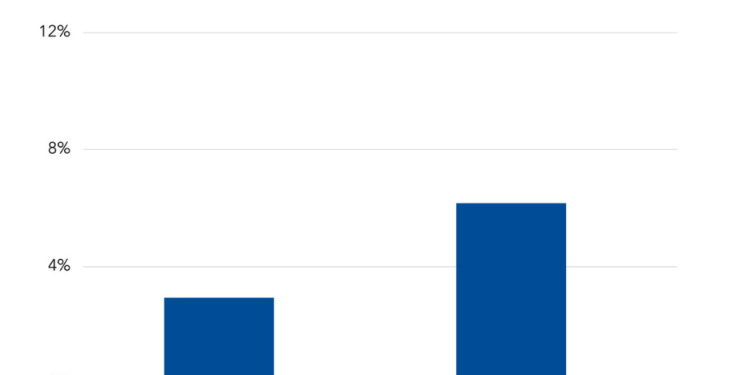

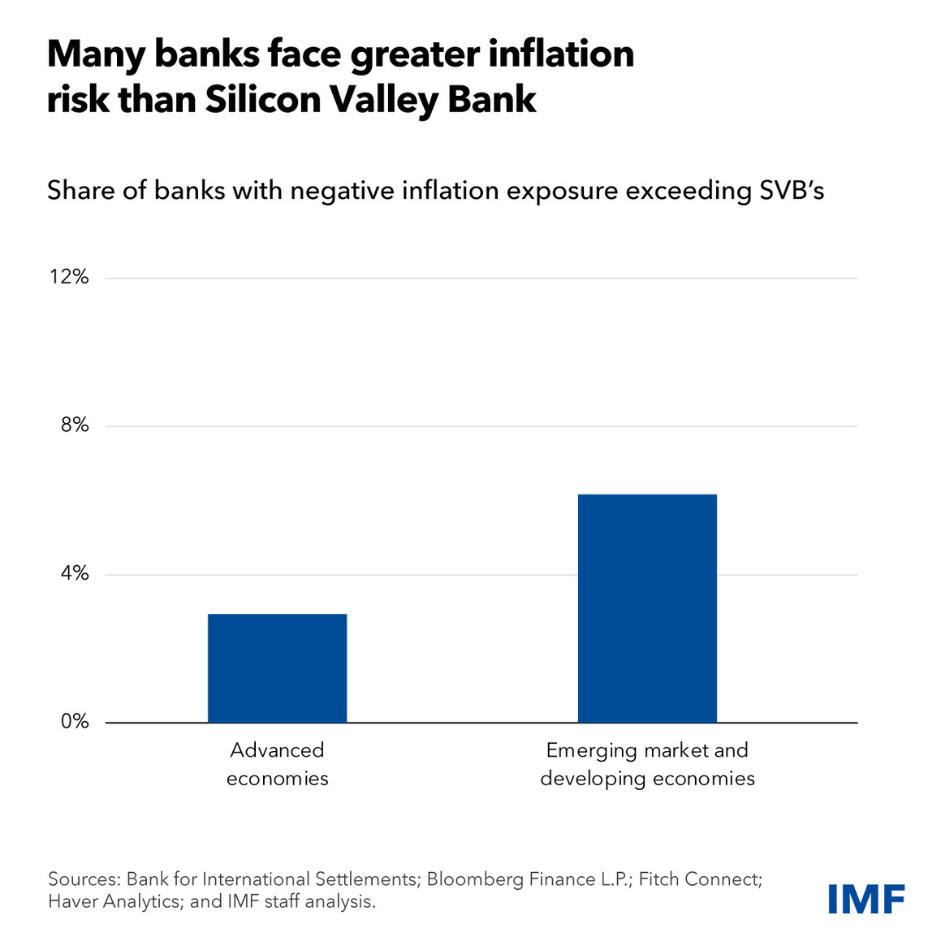

Strikingly, 3 percent of banks in advanced economies and 6 percent of banks in emerging economies are at least as exposed to elevated interest rates as Silicon Valley Bank at the onset of its failure. Banks in emerging economies also appear more exposed to inflation directly, possibly due to more widespread price indexation.

Policy implications

Amid high inflation, tightening monetary policy, while necessary, could lead to meaningful losses for banks with large exposures. Customers and investors may then reassess risks across all banks, which could lead to panics and financial instability.

Strengthening prudential regulation and supervision, heightening required risk management at banks, improving transparency, and using granular risk assessments accounting for key factors our research highlights for a broad set of banks would all help to systematically contain inflation exposures.

Despite these improvements, if losses at individual banks leave room for wider contagion, central banks may need to balance raising rates to contain inflation against the potential for financial instability.