Riskiest junk bonds shunned in Europe on rising risk of default

The junkiest corporate debt is becoming increasingly hazardous for investors amid mounting signs that a default cycle is picking up steam.

The holding company of Thames Water Ltd. this week failed to make payments that had come due on a £400 million bond ($504 million). It follows a plunge in the bond prices of Altice France last month after management told investors they would have to participate in “discounted transactions” to help the firm slash its debt.

As a result, investors are penalizing CCC rated debt even as wider bond spreads narrow to benchmarks. In the last two weeks, the extra yield on the riskiest European debt reached the highest levels since Covid-19 shuttered entire industries and the euro region debt crisis was raging more than a decade ago. In the US, the widening is less dramatic, but nonetheless happening.

For years, asset managers bought the lowest band of bonds to boost returns because cheap money from central banks made it less likely that corporates would default. After the fastest interest rate hikes in decades, some companies are beginning to struggle when they have to refinance their borrowings at a significantly more expensive level. The threat of haircuts for debt investors looms large as a result.

“There is going to be some pain ahead,” said Raphael Thuin, head of capital market strategies at Tikehau Capital. “Perceived wisdom is that it takes 18 to 24 months for rate hikes to take effect. We are in that period now.”

With central banks disappointing market hopes for a slew of interest rate cuts this year, the Bank of England warned last week that the risk of a widening in credit spreads has grown since the final quarter of last year and that “finance for riskier corporates could be particularly vulnerable to a significant deterioration in investor risk sentiment.”

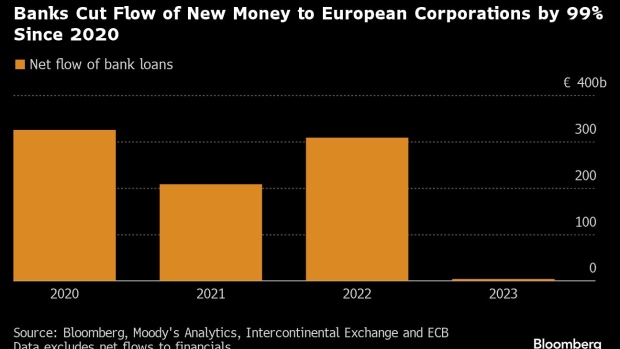

That’s a potential problem for borrowers given banks, the other traditional source of lending in Europe, significantly reduced the rate of growth in their corporate loan books last year. Fitch Ratings sees the default rate on high-yield bonds climbing to 4% in the region this year from 1.7% in 2023, driven by leverage, debt maturities and declining performance.

One of the notable features of the CCC blowout in Europe and the US is the fact the spread between better-rated categories of high-yield debt remains relatively tight, as investors pile into junk, but steer clear of the riskiest category.

“CCC’s have been the huge underperformer,” Steven Fawn, head of global credit at Amundi Asset Management, said on the Bloomberg Intelligence Credit Edge podcast this week.

To be sure, debt rated CCC or below constitutes just 8% of Europe’s junk index, according to Bloomberg Intelligence, suggesting the problems will not become widespread.

“Our worst case scenario where all credits with a CCC- rating and below names default, the junk index default rate still won’t cross 2.4%,” said Heema Patel, a credit strategist from Bloomberg Intelligence. “So it does look like the CCC index is a bit oversold.”

Recent Downgrades

Still, Altice France SA and landlord Samhallsbyggnadsbolaget i Norden AB have been downgraded into the CCC bucket in recent weeks, while the rating of Kemble Water Finance Ltd., the owner of Thames Water, has been cut deeper.

“After a decade of free money and negative rates, some capital structures are unsustainable,” said Nicolas Jullien, a high yield portfolio manager at Candriam SA.