Robust metals price outlook softens in 2022 – Reports

The global metals and mining industry outlook has changed from ‘positive’ to ‘stable’, with a new Moody’s Investors Service report finding that despite most metals prices exceeding historical marks, that doesn’t mean they will improve from current levels.

The high current price levels are expected to fade despite expected high overall demand for metals and mining throughout the period. Moody’s sees most base metals prices showing signs of steadying in 2022 after reaching historical peaks this year.

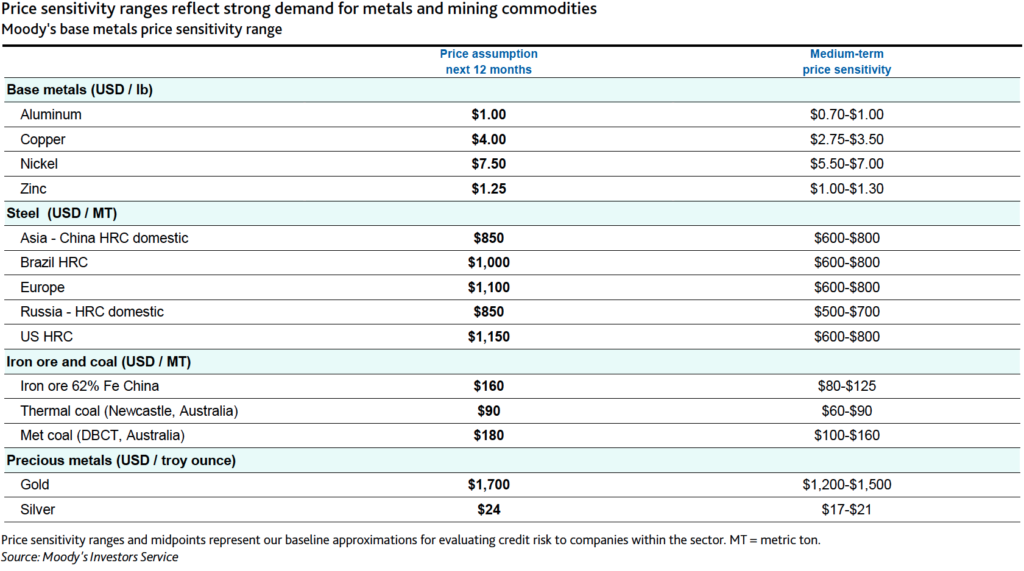

In its report covering the medium-term outlook for iron ore, steel, coal, aluminum, gold, silver, nickel, copper and zinc, Moody’s expects most prices would exceed historical marks.

“We expect industry’s earnings before interest, taxes, depreciation and amortization to increase by about 8% through mid-2022 based on economic recovery supporting demand for base metals, iron ore, steel and coal,” says Moody’s senior VP Barbara Mattos in a statement sent to MINING.COM.

Among the primary base metals, aluminum prices are expected to remain elevated through at least mid-2022. Aluminum prices will remain elevated through early 2022, having exceeded $2,600 per tonne, or $1.18 per pound, in mid-2021 – their highest level in a decade.

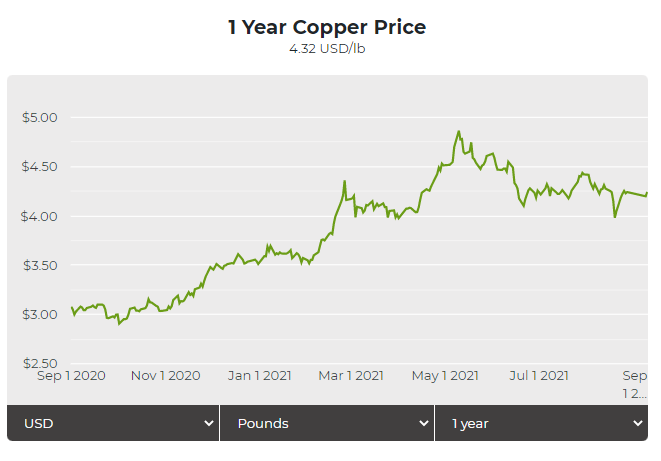

Copper prices are also expected to remain strong through at least late 2022 compared with historical averages, and for the longer term, a structural deficit will keep copper prices high. The carbon-transition efforts of governments and industries ultimately benefit copper production, and copper supplies have been struggling to keep up with demand in certain regions, including Chile.

Strong copper and nickel outlook

Copper prices have remained above $4.00 per pound since February, with the substantial recovery of demand, briefly peaking at nearly $5.00 per pound in early May before retreating amid China’s risk from the covid-19 Delta variant, which slowed China’s manufacturing activities and therefore its copper imports.

Moody’s sees copper prices in the third quarter still well above the $2.50 to $3.00 per pound range in the years before the pandemic locked down many of the world’s economies in March 2020.

Click here for an interactive chart of copper prices

Global industrial activity remains strong, with manufacturing purchasing managers indexes above 60 in the US and Europe and around 50 in China.

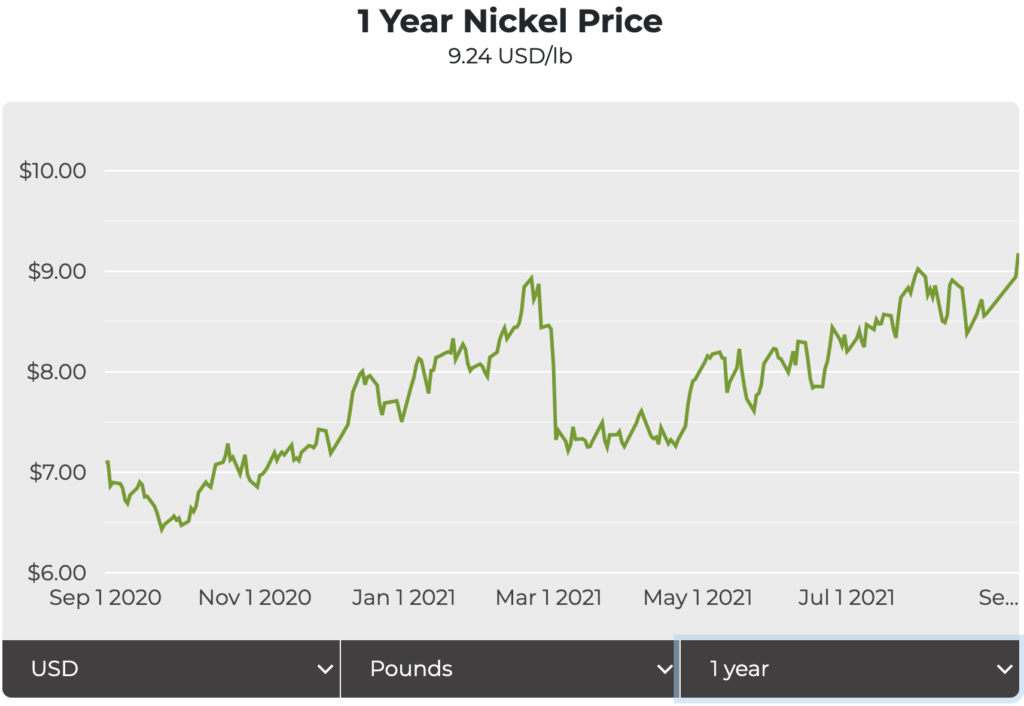

Moody’s expects the high nickel prices of the first half of 2021 to be unsustainable in 2022 but will likely remain high at least into the start of the year.

Production has fully recovered to pre-pandemic levels, and nickel will be in ample supply. In August, prices of about $19,000 per tonne, or $8.62 per pound, were up nearly 40% from their $13,784 tonne ($6.25 per pound) average in 2020 amid recovering economic activity, the lifting of Covid-19 restrictions and expectations of high demand for batteries.

However, analysts flagged increasing supplies of nickel pig iron (NPI), a low-grade ferronickel and a cheaper alternative to pure nickel in stainless steel production, will keep rising as additional facilities ramp up activity in Indonesia.

Click here for an interactive chart of nickel prices

The increase in Indonesian NPI is expected to offset decreasing production in China, which faces reduced availability of ore and rising ore prices.

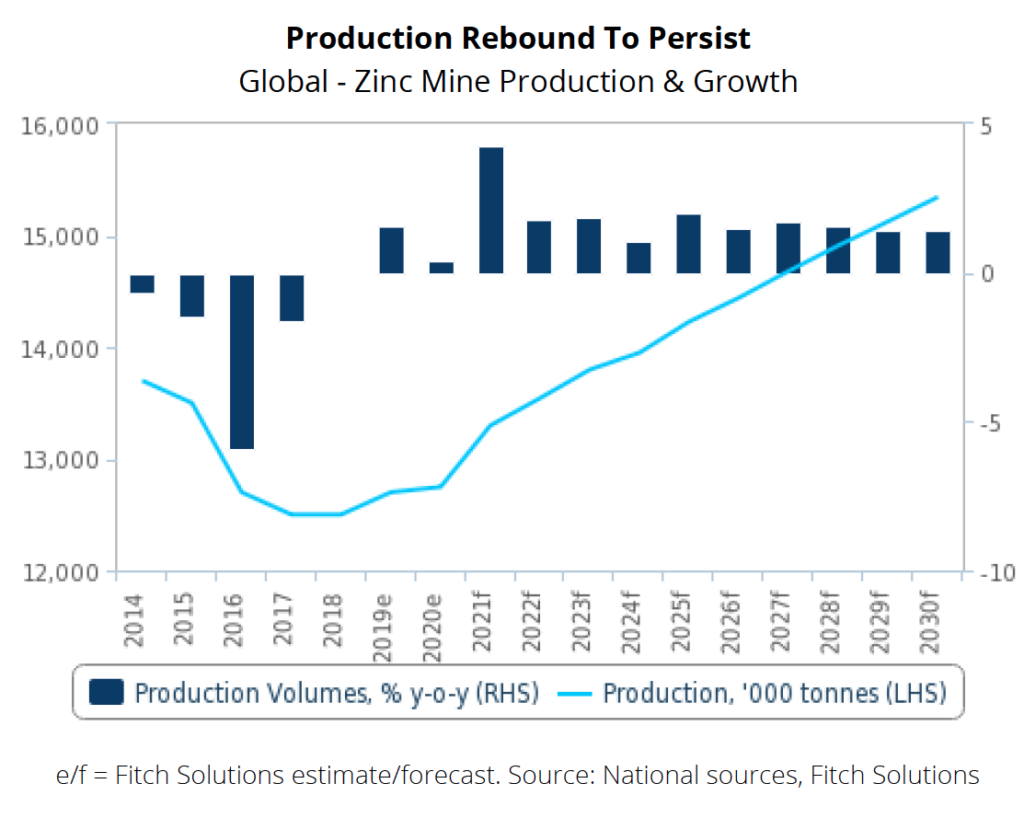

While zinc prices showed some strength in mid-2021, the longer-term prices will fall to the lower end of our price range as long-term production growth outstrips low demand growth. Prices will remain elevated through the second half of 2021 amid strong demand from the steel sector and reduced zinc production in China.

The world zinc market is now shifting from a deficit to a surplus, with production recovering at the large zinc mines of Peru, Mexico and Bolivia, among other countries.

This prompted Fitch Solutions Country Risk and Industry Research to issue a report declaring global mined zinc production will probably grow at the fastest pace, 4.3%, since 2012 in 2021 as disruptions caused by the covid-19 outbreak wane.

Beyond 2021, the rebound in mine output that began in 2019 after five consecutive years of contraction will persist, Fitch says. “However, lower zinc prices will limit the scale of growth in new projects, expansions and restarts in the coming years as the economic attractiveness of projects begins to wane. We forecast global mine production to grow at an annual average rate of 1.9% over 2021-2030.”

Bulks

Iron-ore prices will move gradually toward their $70 to $80 per tonne average levels of 2016 to 2019 beyond 2022.

Read This: Falling trend of non-performing loans indicate increasing banking sector resilience – MPC

Tight iron-ore supplies will keep prices above their historical norms through 2022. Still, prices have retreated sharply from their peaks earlier this year as supplies have increased and demand growth decelerates, according to Moody’s.

Coal prices are expected to remain relatively high but will taper as supply problems, and geopolitical disputes ease.

Meanwhile, the worldwide supply-demand imbalance for steel will return through 2022, with prices gradually declining toward their historical averages from the unusual highs of this year, Moody’s forecasts.

Precious metals

Meanwhile, Moody’s expects market uncertainty, low real interest rates, and inflation will keep gold prices above historical levels through 2022, but predicts prices will ease from around $1,800 per ounce in the third quarter of 2022 amid a continuing economic recovery, a stronger US dollar, and a gradual increase in yields.

“Some economic indicators suggest that inflation will rise beyond central bank expectations, and the US Federal Reserve is unlikely to budge on its accommodative stance anytime soon. Gains in silver prices support continued high levels in 2022, reflecting the same factors as for gold, as well as an ongoing recovery in industrial demand,” Moody’s says.