Proposed changes to Chile’s mining royalty regime will not have a drastic impact on the country’s production landscape in the near-term. However, analysis from global consultancy Wood Mackenzie, indicates there is clear risk the amendments could compromise continued appetite to make large-scale, long-term investments in Chile’s copper sector.

“It is unhelpfully alarmist to place primary focus on the proposed amendments on producers’ value loss under current spot prices, which are at record highs,” said William Tankard, a senior analyst with Wood Mackenzie’s copper research team.

“That said, without careful consideration around implementation, a proposal of this scale could jeopardise future investments.”

A motion to reform Chile’s royalty regime for copper and lithium mining has been on the table since September 2018.

Originally, Bill 12093-08 proposed a production-based 3% royalty on the total value (ad valorem) of production for companies producing in excess of 12 ktpa copper.

A controversial amendment passed by the Chamber of Deputies, Congress’ lower house, in May 2021, included a sliding scale component to the royalty, WoodMac points out.

This would trigger higher payments when the LME copper price trades above $2.00/lb ($4,400/tonne) on an annual average basis, up to a marginal ceiling of 75% of contained value at prices above $4.00 ($8,800/t).

The amendment has yet to be debated by the Senate or signed into law.

“Discussion of the amendments has tended to focus on a scenario of 75% marginal royalty payments coming into play,” Tankard said.

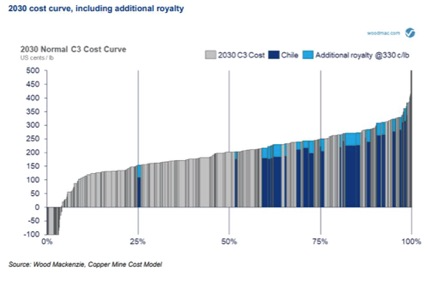

To offer contrast to that headline number, our analysis suggests that at the $4.00/lb copper price level where a marginal 75% rate is proposed, the effective royalty rate would be an additional charge equating to 22% of gross revenue for a mine producing concentrate.”

Concessionary relief has been proposed for upgraded production with the thresholds for four copper product categories —concentrate, blister, anode and cathode.

Wood Mackenzie considered the net refining cost of Chile’s three electro-refineries, Chuquicamata, Potrerillos and Ventanas, which average 10 USc/lb Cu, as the basis for the level of cathode royalty relief.

“As part of Chile’s national mining company, Codelco, these three refiners’ concessions would be academic, since Codelco’s revenues report directly to the state,” Tankard said. “However, we have also used that cost as the assumed level of relief that would apply to Chile’s leach-SxEw mines.”

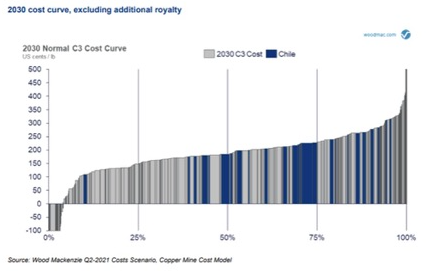

“Evaluating material flows from each mine, we assigned the set of measures to Chile’s cost base, at the copper price forecasts used in 2025 and 2030 in WoodMac’s Copper Mine Cost Summary.

“This corresponds to forecasts of 275 and 330 USc/lb respectively, both values sitting some way below the 400 USc/lb trigger price for the proposed top rate marginal royalty charge of 75% for concentrate producers,” Tankard said.

Generally, the impact to C3 Total Cost (C1 cash cost plus depreciation, royalties, corporate overhead, extraordinary costs and interest charges) for Chilean operations would be to push a given operation up the cost curve by 10 to 20 centiles.

“However, many of Chile’s mines are already relatively high cost and this, for example, would tend to push a third quartile producer into the fourth quartile,” Tankard added.

“For the 2025 scenario at 275 USc/lb, about 1.4 Mt of costed production of a Chilean total of 6.1 Mt would be pushed into a pre-tax loss-making position on a C3 basis, up from 0.9 Mt without the imposition of the royalty.”

Wood Mackenzie’s analysis stressed that it is not yet clear how the proposed sliding-scale royalties would be implemented within the existing fiscal framework.

Under the Specific Mining Tax, a quasi royalty implemented in 2010, operations producing more than 50 ktpa copper are subject to a progressive tax on profits at rates between 5% and 14%.

“A key element for potential investors would be confirmation that a proposed royalty would replace the Specific Mining Tax in an orderly way, rather than being levied in addition to existing tax structures,” Tankard said.

“As well as the implications for higher costs arising from the proposed royalty, the uncertainty created by the pace and scale of amendments drafted have the potential to undermine confidence in future, not-yet-committed, project investments.”

Chile has unparalleled copper resource endowment, although as higher-grade ore is progressively depleted, increasingly these huge resources are low-grade.

“Although the royalty as proposed would not drastically change the production landscape in the near-term, there is clear risk it could compromise continued appetite to make the large-scale, long-term investments Chile has benefited from over the past 30 years, in favour of projects in other jurisdictions that offer faster or more assured returns,” Tankard said.